Investors Still Aren't Entirely Convinced By Global Industrial Company's (NYSE:GIC) Earnings Despite 25% Price Jump

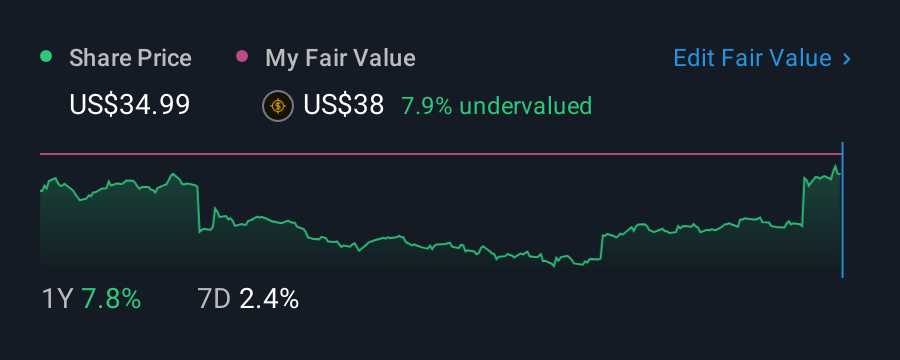

The Global Industrial Company (NYSE:GIC) share price has done very well over the last month, posting an excellent gain of 25%. Notwithstanding the latest gain, the annual share price return of 9.8% isn't as impressive.

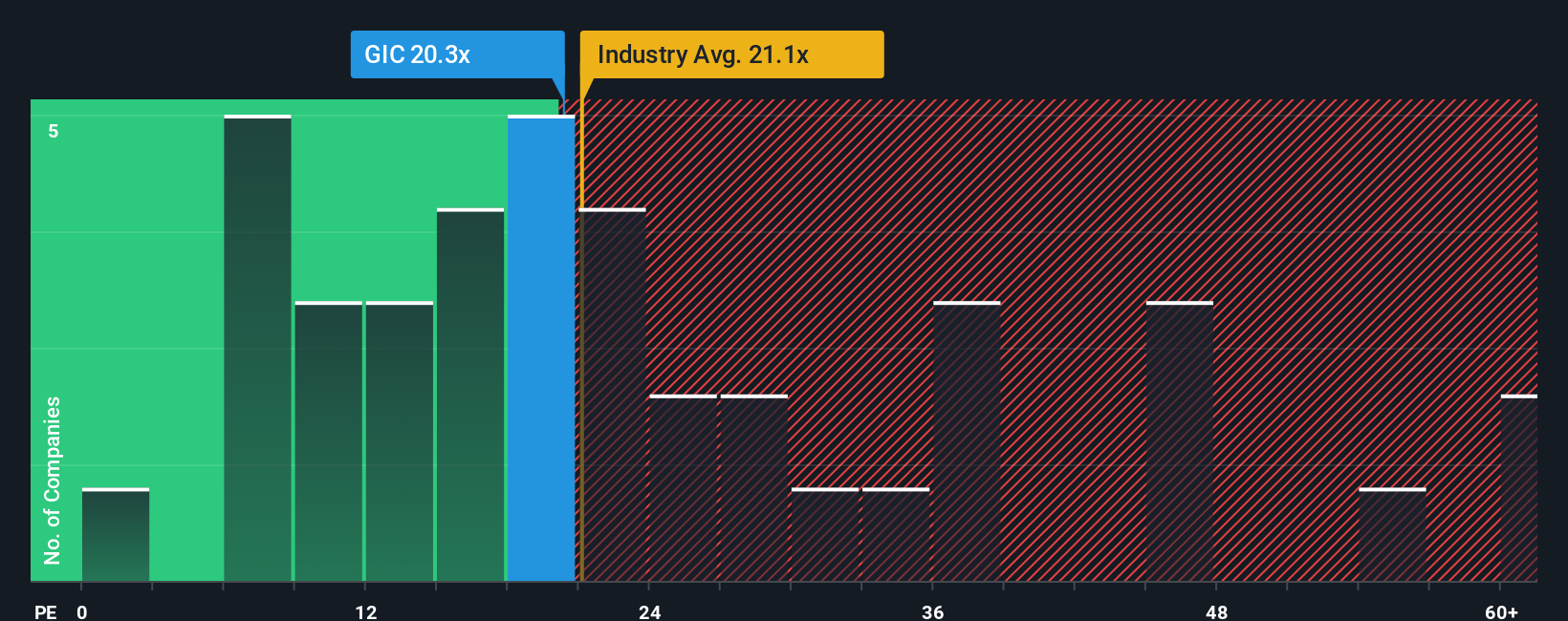

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Global Industrial's P/E ratio of 20.3x, since the median price-to-earnings (or "P/E") ratio in the United States is also close to 19x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Global Industrial could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Global Industrial

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Global Industrial's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 5.6% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 26% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 19% over the next year. With the market only predicted to deliver 14%, the company is positioned for a stronger earnings result.

With this information, we find it interesting that Global Industrial is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Its shares have lifted substantially and now Global Industrial's P/E is also back up to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Global Industrial currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Global Industrial with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might also be able to find a better stock than Global Industrial. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal