Should Planet Fitness' (PLNT) Strong Q2 Results and Club Expansion Prompt Investor Action?

- Planet Fitness, Inc. recently announced strong second quarter 2025 results, surpassing expectations with system-wide revenue of US$340.88 million, net income of US$58.02 million, and an 8.2% rise in same club sales, along with 23 new club openings that lifted its global total to 2,762 locations.

- The company also introduced a streamlined online membership cancellation process and expanded its higher-margin Black Card offering, both of which are contributing to shifts in member engagement and retention.

- We'll explore how Planet Fitness's robust revenue growth and club expansion reinforce its investment narrative and future growth potential.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Planet Fitness Investment Narrative Recap

To be a Planet Fitness shareholder, you need to believe that the company’s steady club expansion, brand loyalty, and recurring membership revenue can continue driving profitable growth while managing competitive threats and evolving consumer preferences. The recent Q2 results, which topped expectations on revenue and earnings, further highlight strong demand, but the most important short-term catalyst, continued robust membership growth, remains closely linked to ongoing churn from the new online cancellation policy. For now, the impact of this rollout on long-term growth appears manageable. The most relevant announcement is the introduction of streamlined online membership cancellation. While this convenience has led to a temporary increase in member attrition, management expects attrition rates to normalize, which could be crucial for maintaining predictable recurring revenue and supporting the company’s ambitious expansion plans. But in contrast to club growth, the risk of persistent higher member churn after click-to-cancel is something every investor needs to be aware of if...

Read the full narrative on Planet Fitness (it's free!)

Planet Fitness is projected to reach $1.6 billion in revenue and $309.5 million in earnings by 2028. This outlook is based on an annual revenue growth rate of 11.6% and a $120.5 million increase in earnings from the current $189.0 million.

Uncover how Planet Fitness' forecasts yield a $119.81 fair value, a 12% upside to its current price.

Exploring Other Perspectives

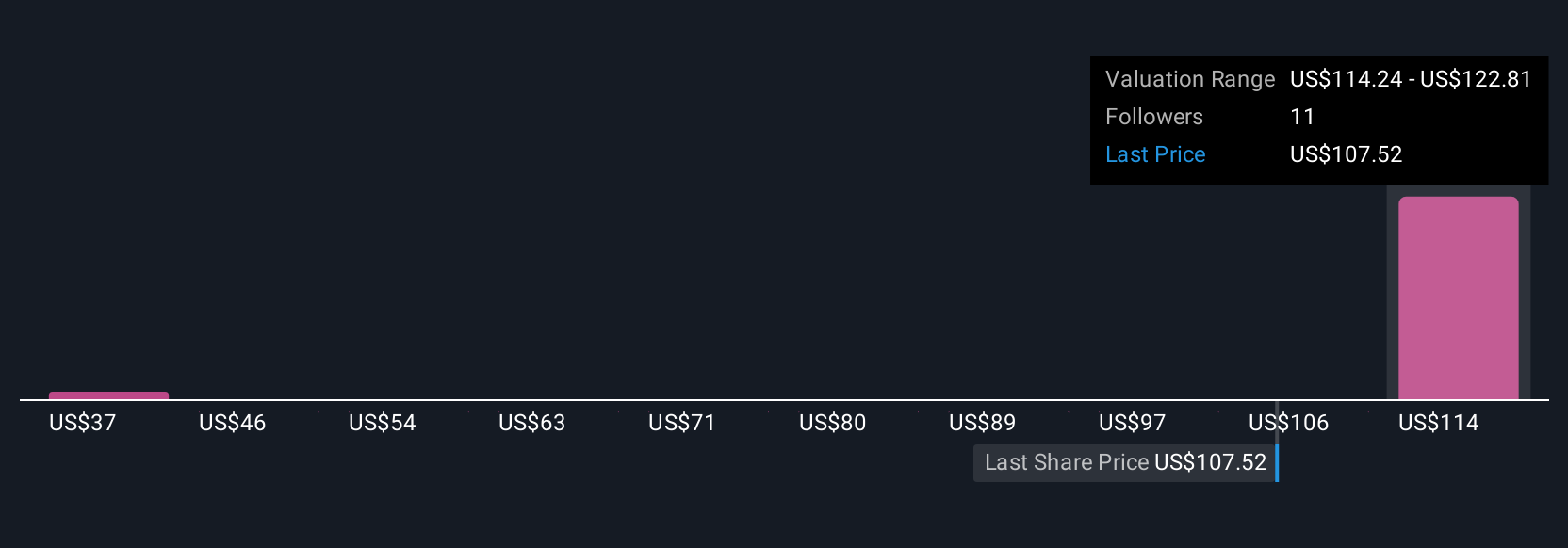

Simply Wall St Community members provided two fair value estimates for Planet Fitness, ranging from US$119.81 to US$121.47. While opinions differ, the ongoing risk from elevated member attrition could weigh on the consistent earnings trajectory investors expect, be sure to review other opinions on what these signals may mean for the business.

Explore 2 other fair value estimates on Planet Fitness - why the stock might be worth as much as 14% more than the current price!

Build Your Own Planet Fitness Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Planet Fitness research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Planet Fitness research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Planet Fitness' overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal