Why Atmos Energy (ATO) Is Up 5.4% After Raising Earnings Outlook and Boosting Dividend

- Atmos Energy reported strong third-quarter 2025 results, with sales rising to US$838.77 million and net income reaching US$186.43 million, and the company raised its full-year earnings guidance while announcing an 8.1% increase to its quarterly dividend.

- An interesting aspect is Atmos Energy’s emphasis on system safety, reliability, and ongoing capital investments to support customer growth and operational improvements in its gas distribution and pipeline segments.

- With the dividend increase and higher earnings outlook, we'll explore how these developments may influence expectations for Atmos Energy’s future revenue stability and growth.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Atmos Energy Investment Narrative Recap

To be an Atmos Energy shareholder, you need to believe in the company's consistent ability to drive revenue through system modernization, customer growth, and dependable gas distribution, tempered by the challenge of funding these capital investments effectively. The latest strong quarterly results and increased earnings guidance reinforce revenue stability and reflect ongoing demand, but the most important near-term catalyst remains successful rate recovery on new investments, while a key risk is persistent regulatory uncertainty that could affect revenue recovery. The recent earnings news does not materially alter the biggest risk, which remains linked to regulatory factors.

The 8.1% increase to Atmos Energy’s quarterly dividend, announced alongside its raised earnings guidance, directly highlights management’s confidence in future cash flows and the sustainability of returns to shareholders. This continued focus on shareholder distributions coincides with the company’s large capital expenditure plans, an area that both underpins future growth and contributes to financial risk if not balanced carefully with cash generation and regulatory outcomes.

Yet, investors should also be aware that, in contrast to rising earnings and dividends, unresolved regulatory risk could...

Read the full narrative on Atmos Energy (it's free!)

Atmos Energy's outlook projects $5.9 billion in revenue and $1.5 billion in earnings by 2028. This scenario assumes annual revenue growth of 9.8% and a $0.4 billion earnings increase from current earnings of $1.1 billion.

Uncover how Atmos Energy's forecasts yield a $164.45 fair value, in line with its current price.

Exploring Other Perspectives

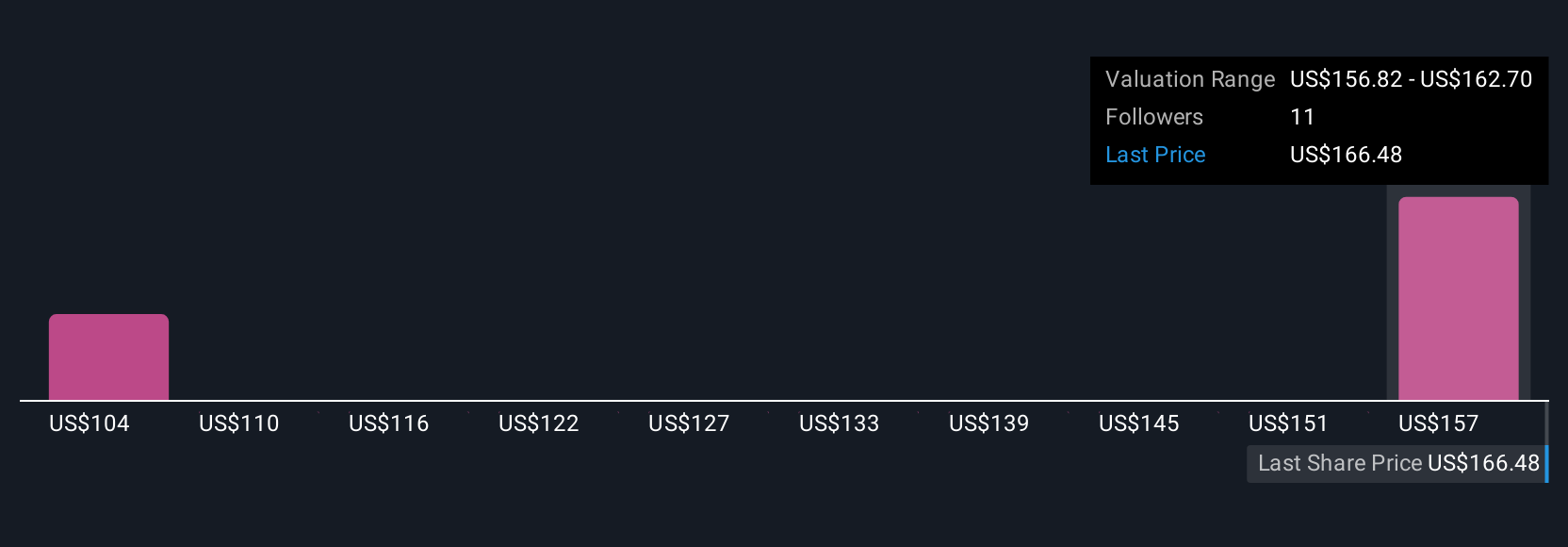

Simply Wall St Community members offered two fair value estimates for Atmos Energy, stretching from US$105.32 to US$164.45. With regulatory uncertainties potentially impacting future returns, your view on risk and reward can differ sharply from others, take a look at the range of opinions before deciding where you stand.

Explore 2 other fair value estimates on Atmos Energy - why the stock might be worth 36% less than the current price!

Build Your Own Atmos Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Atmos Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Atmos Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Atmos Energy's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal