Will Best Buy's (BBY) IKEA Partnership Reshape Its Multichannel Strategy and Competitive Position?

- Best Buy and IKEA U.S. recently announced a partnership to pilot in-store planning and shopping experiences, combining Best Buy’s major appliances with IKEA’s home furnishings in ten Florida and Texas locations.

- This marks the first time IKEA’s products and services are available within another U.S. retailer, signaling a unique collaboration aimed at creating a seamless home planning solution for customers.

- We'll explore how the rollout of IKEA shop-in-shops could impact Best Buy's multichannel strategy and future growth projections.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Best Buy Investment Narrative Recap

To be a Best Buy shareholder, you likely need confidence in the company's ability to attract and retain customers amid fierce competition and economic uncertainty. The recent IKEA partnership could provide a short-term boost to in-store traffic and enhance Best Buy’s omnichannel approach, although its impact on major risks, like margin pressures from tariffs and soft appliance sales, remains to be seen and may not be material for now. The most critical short-term catalyst continues to be how effectively Best Buy responds to shifting consumer behavior and pricing pressures. Among recent company developments, the appointment of Neal Sample as Chief Digital and Technology Officer is especially relevant. This leadership change brings fresh focus to technology and reinforces Best Buy’s push to optimize its digital capabilities, which may play an important role in supporting the IKEA partnership and other omnichannel efforts as the retail sector evolves. On the other hand, investors should not overlook the persistent risk of shrinking margins if competition forces deeper discounts or tariffs drive up costs...

Read the full narrative on Best Buy (it's free!)

Best Buy's outlook anticipates $43.8 billion in revenue and $1.5 billion in earnings by 2028. This reflects a 1.8% annual revenue growth rate and a roughly $617 million increase in earnings from the current $883 million.

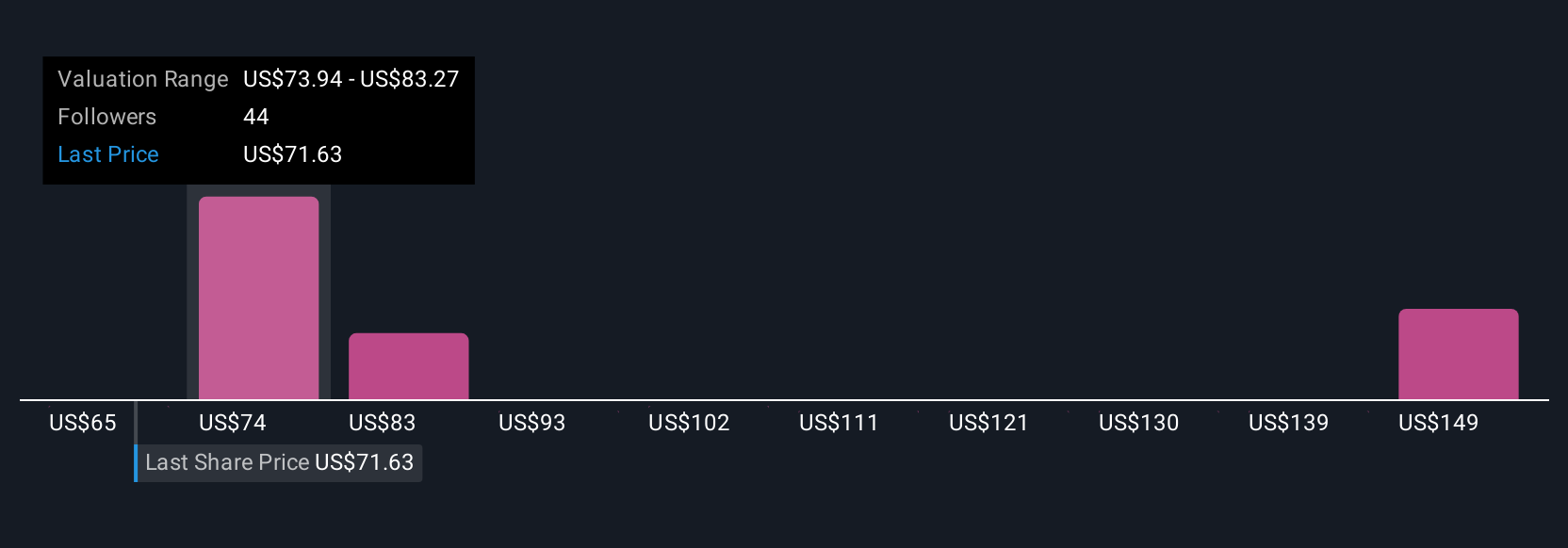

Uncover how Best Buy's forecasts yield a $78.52 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community estimate Best Buy’s fair value from as low as US$64.62 to as high as US$156.66. With such differing views, consider how tariff pressures could weigh on overall profitability and why investors may want to compare a range of forecasts.

Explore 6 other fair value estimates on Best Buy - why the stock might be worth 6% less than the current price!

Build Your Own Best Buy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Best Buy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Best Buy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Best Buy's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal