How Heather Dixon’s Appointment and Strong Q2 Results Could Shape Addus HomeCare’s (ADUS) Trajectory

- Addus HomeCare Corporation recently reported strong second quarter 2025 results, exceeding analyst expectations on both revenue and earnings, and announced the appointment of Heather Dixon as President and Chief Operating Officer, effective mid-September.

- Dixon brings extensive executive experience from her roles at Acadia Healthcare, Everside Health, Walgreens Boots Alliance, Aetna, and service as an independent director at Addus and Signify Health.

- We'll explore how Heather Dixon's appointment as President and COO could influence Addus HomeCare's investment narrative and future opportunities.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Addus HomeCare Investment Narrative Recap

To be a shareholder in Addus HomeCare, you need confidence in the expansion opportunities of home-based care, strong execution in personal care and hospice, and the management team’s ability to respond to regulatory and reimbursement pressures. The recent appointment of Heather Dixon as President and COO highlights renewal at the executive level, but the key near-term catalyst remains Medicaid and Medicare rate changes in large states, while heavy reimbursement concentration continues to be the biggest risk. Dixon’s arrival is likely to have limited immediate impact on these factors, but may strengthen long-term operational leadership.

Among the recent announcements, Addus’s robust second quarter 2025 earnings, featuring strong year-over-year growth in both net income and adjusted EBITDA, stand out as most pertinent in the context of executive changes. Sustained organic growth across personal care and hospice, plus the Gentiva and Helping Hands acquisitions, directly link to current catalysts such as service expansion and rate increases, while highlighting the persistent risk of reimbursement volatility.

In contrast, ongoing uncertainty around future Medicare payment rates, especially the proposed 2026 reduction, remains information investors should be aware of if they are...

Read the full narrative on Addus HomeCare (it's free!)

Addus HomeCare's narrative projects $1.7 billion revenue and $136.5 million earnings by 2028. This requires 10.1% yearly revenue growth and a $53.5 million earnings increase from $83.0 million today.

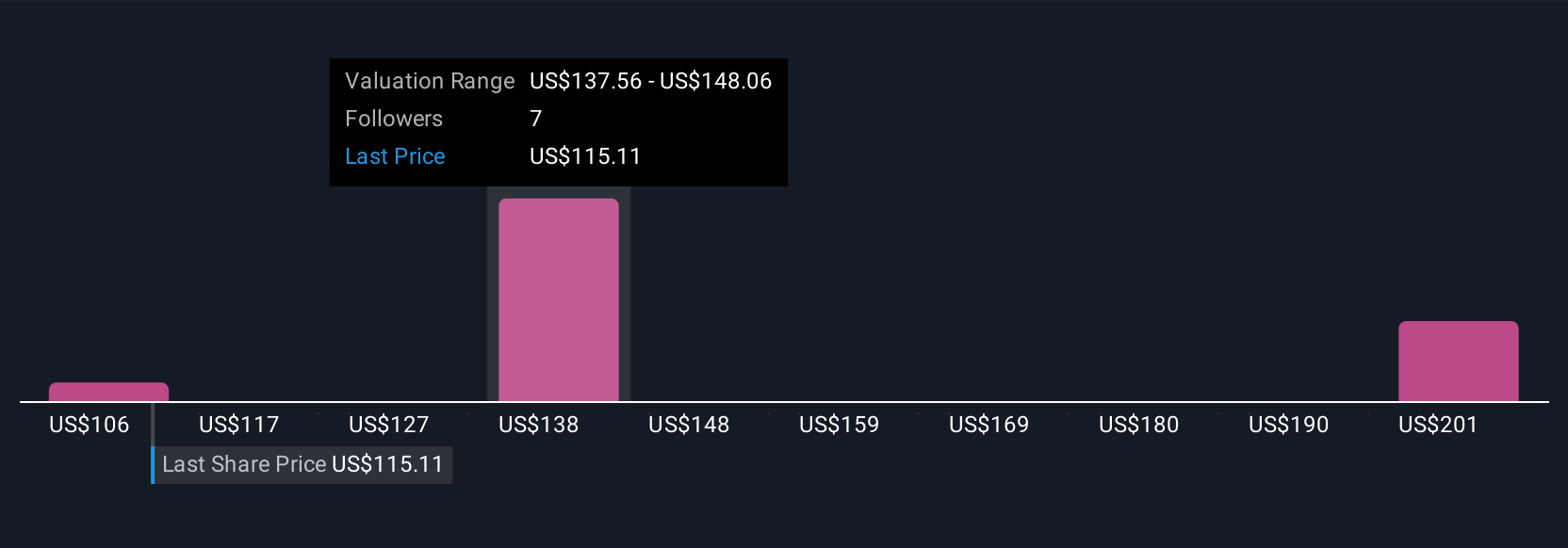

Uncover how Addus HomeCare's forecasts yield a $138.18 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Four recent fair value estimates from the Simply Wall St Community span a wide range, from US$106.06 to US$211.05 per share. As you consider these differing opinions, remember that shifts in government reimbursement policy may have far-reaching implications for Addus’s future results.

Explore 4 other fair value estimates on Addus HomeCare - why the stock might be worth just $106.06!

Build Your Own Addus HomeCare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Addus HomeCare research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Addus HomeCare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Addus HomeCare's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal