Can DaVita’s (DVA) Share Buybacks Offset Mixed Q2 Earnings Trends?

- DaVita Inc. recently announced its second-quarter 2025 results, reporting US$3.38 billion in revenue and US$199.34 million in net income, while also updating on substantial share repurchases across two existing buyback programs.

- Although revenue increased year-over-year, the company completed significant share buybacks and saw a decline in net income compared to the prior period.

- We’ll now examine how DaVita’s ongoing share repurchase activity and mixed earnings results impact its investment narrative and outlook.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

DaVita Investment Narrative Recap

To be a DaVita shareholder, an investor needs confidence in the steady demand for dialysis services as the population ages and the company makes progress in operational efficiency. The recent earnings highlighted growth in revenue but a decline in net income, while share repurchases continued; these updates do not appear to shift the main short-term catalyst, recovery in treatment volumes, or significantly alter the biggest immediate risk, which remains patient volume pressures and reimbursement headwinds.

The most relevant announcement is DaVita’s continued aggressive share buybacks, with over 5.8 million shares repurchased between April and August 2025 across two buyback programs. This ongoing reduction in share count may support earnings per share in light of near-term earnings challenges and signals management’s commitment to returning value, but it does not directly address the underlying concerns around volume growth and government reimbursement rates.

However, investors should also be aware that even with sustained buybacks, reimbursement pressure from CMS updates could still...

Read the full narrative on DaVita (it's free!)

DaVita's narrative projects $15.0 billion in revenue and $970.4 million in earnings by 2028. This requires 4.4% yearly revenue growth and a $134 million earnings increase from the current earnings of $836.3 million.

Uncover how DaVita's forecasts yield a $155.88 fair value, a 20% upside to its current price.

Exploring Other Perspectives

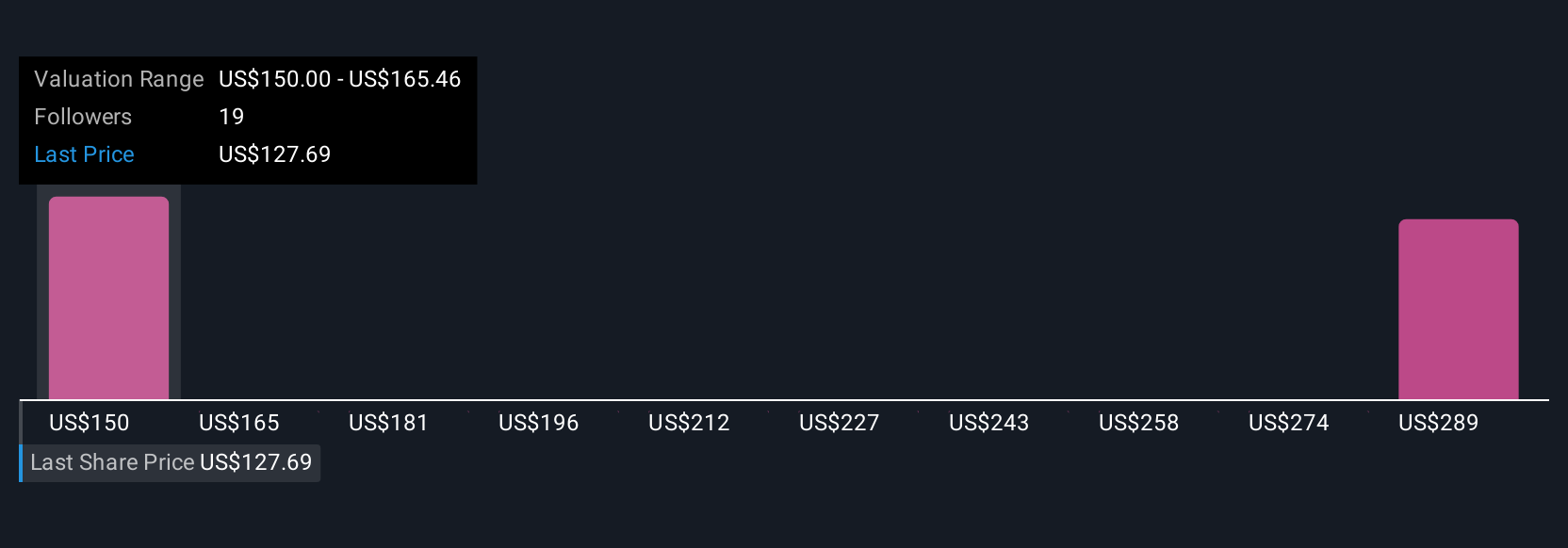

Individual fair value estimates from the Simply Wall St Community span from US$150 to US$304.62 across three analyses. Ongoing margin pressures due to government reimbursement rates remain a key concern for overall company performance, so it’s worth considering multiple viewpoints.

Explore 3 other fair value estimates on DaVita - why the stock might be worth just $150.00!

Build Your Own DaVita Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DaVita research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DaVita research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DaVita's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal