Can AMR’s Recent Loss Reveal Deeper Shifts in Its Long-Term Earnings Trajectory?

- Alpha Metallurgical Resources reported its second quarter and half-year 2025 results, revealing reduced revenue of US$550.27 million for the quarter and a swing to a net loss of US$4.95 million compared to net income a year prior.

- This reversal from profitability highlights recent financial and operational pressures on the company, despite previous efficiency gains and steady capital employed.

- We'll examine how Alpha Metallurgical Resources' shift from net income to net loss impacts its long-term earnings and growth outlook.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

Alpha Metallurgical Resources Investment Narrative Recap

For investors considering Alpha Metallurgical Resources, the core belief centers on the company's ability to manage cost pressures and capitalize on any rebound in global steel demand. The recent swing from profitability to a net loss, driven by lower quarterly revenues, may weigh on near-term sentiment but does not materially alter the biggest risk: ongoing weak market conditions for coal. The key short-term catalyst remains a recovery in steel markets, which could re-energize pricing and shipment volumes.

The most relevant recent announcement is Alpha’s Q2 2025 earnings report, highlighting decreased revenue and a net loss for the quarter and half-year. This financial performance ties directly to challenges around coal market conditions and shipment volumes, reaffirming that operational headwinds may continue to affect the company’s near-term growth prospects as it moves toward its next phase of mine development or potential M&A activity. Yet, in contrast to hopes of a quick market rebound, investors should not overlook the potential impact of persistent cost increases and weak demand for coal...

Read the full narrative on Alpha Metallurgical Resources (it's free!)

Alpha Metallurgical Resources' outlook projects $2.7 billion in revenue and $189.6 million in earnings by 2028. This assumes a 1.3% annual revenue growth rate and a $163 million increase in earnings from the current level of $26.6 million.

Uncover how Alpha Metallurgical Resources' forecasts yield a $140.50 fair value, a 6% downside to its current price.

Exploring Other Perspectives

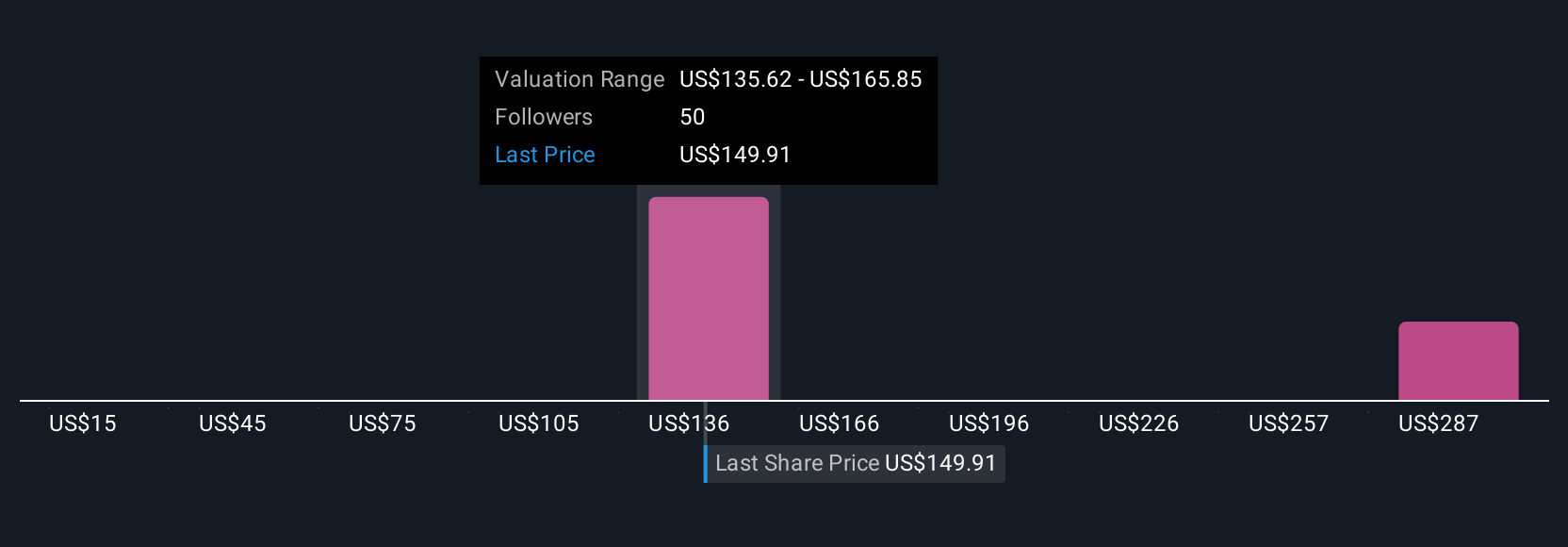

Six retail investors in the Simply Wall St Community offered fair value estimates for Alpha Metallurgical Resources spanning from US$14.69 to US$317.85 per share. With such variety in perspectives, it’s clear that outlooks on the risk of prolonged weak coal demand play a significant role in shaping broader market expectations.

Explore 6 other fair value estimates on Alpha Metallurgical Resources - why the stock might be worth over 2x more than the current price!

Build Your Own Alpha Metallurgical Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alpha Metallurgical Resources research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Alpha Metallurgical Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alpha Metallurgical Resources' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal