Higher Q2 Profits and Dividend Affirmation Might Change the Case for Investing in Global Industrial (GIC)

- Global Industrial Company recently reported its second quarter 2025 results, showing sales of US$358.9 million and net income of US$25.1 million, both higher than the prior year, while also affirming a quarterly dividend of US$0.26 per share payable on August 18, 2025.

- This earnings update highlights rising profitability and continued shareholder returns, pointing to effective execution and management’s confidence in the business outlook.

- We’ll examine how Global Industrial’s improved net income and steady dividend could affect the investment case for the company going forward.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 26 companies in the world exploring or producing it. Find the list for free.

Global Industrial Investment Narrative Recap

To be a shareholder in Global Industrial, you need to believe in its strategy of deepening relationships with large, specialized customers to drive higher-value sales and margin growth. The company’s strong Q2 earnings and affirmed dividend bolster the near-term outlook for steady profitability, yet these results do not significantly alter the biggest short-term catalyst, successful margin management as temporary cost benefits fade, nor do they resolve the key risk from concentration in select customer sectors.

Among the most relevant recent announcements, the maintained quarterly dividend at US$0.26 per share stands out. This not only signals ongoing confidence from management but also reinforces the company’s commitment to returning capital to shareholders during a period of shifting industry cost dynamics and evolving revenue sources. Despite Global Industrial’s improved earnings, investors should be aware that sequential gross margin headwinds could emerge in coming quarters due to...

Read the full narrative on Global Industrial (it's free!)

Global Industrial's narrative projects $1.5 billion revenue and $102.1 million earnings by 2028. This requires 4.4% yearly revenue growth and a $36.7 million earnings increase from $65.4 million today.

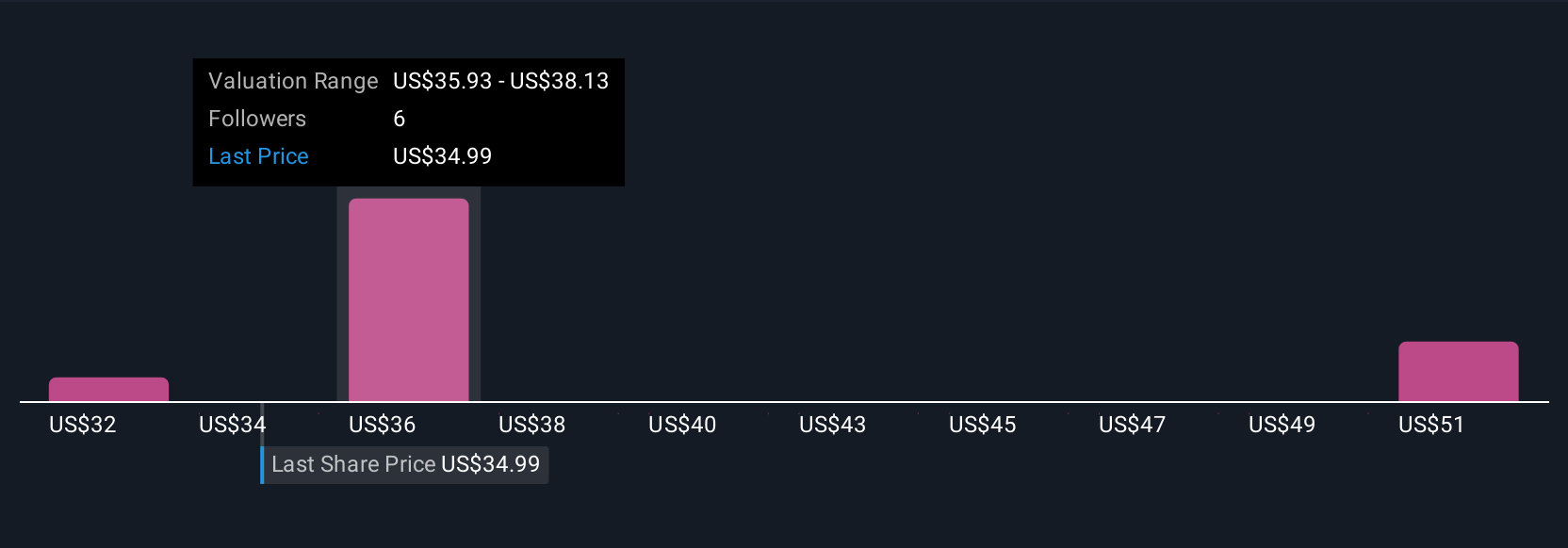

Uncover how Global Industrial's forecasts yield a $38.00 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Global Industrial range from US$31.53 to US$53.20, across three individual analyses. While you see varied opinions, keep in mind margin pressures remain a central issue ahead, which could influence future performance. Explore these diverse perspectives to help shape your own view.

Explore 3 other fair value estimates on Global Industrial - why the stock might be worth as much as 54% more than the current price!

Build Your Own Global Industrial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Global Industrial research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Global Industrial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Global Industrial's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal