National Vision Holdings (EYE) Lifts Outlook and Rebrands but What Does This Signal About Its Competitive Edge?

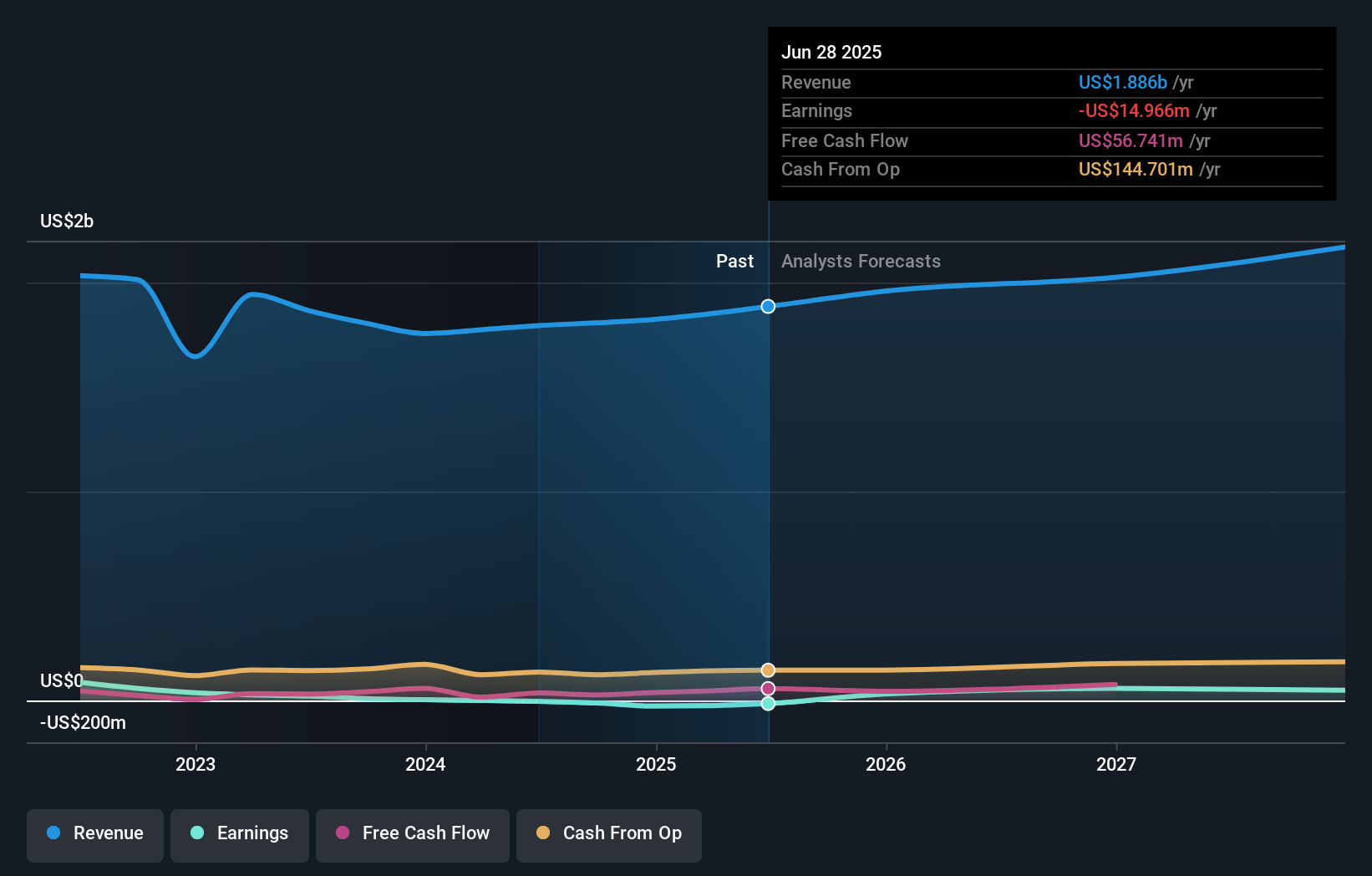

- National Vision Holdings recently reported second quarter results showing year-over-year revenue growth to US$486.42 million and a return to profitability, while also raising its full-year 2025 net revenue guidance to a range of US$1.93 billion to US$1.97 billion.

- Alongside these improved financials, the company introduced a new corporate brand identity, highlighting its renewed focus on accessibility, modernization, and its mission in eye care.

- We'll assess how National Vision's updated revenue outlook and brand transformation could shape its investment narrative and future prospects.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

National Vision Holdings Investment Narrative Recap

To be a shareholder in National Vision Holdings, you need to believe that expanding managed care, an uptick in digital eye strain, and evolving consumer preferences will continue to drive demand for comprehensive eye care and eyewear solutions. The company’s stronger than expected second quarter results and raised 2025 guidance signal near-term progress, but the update does not appear to materially alter the most critical catalyst: capturing and retaining insured customers. The biggest risk remains the possibility of ongoing pressure from e-commerce and changing shopping habits impacting in-store traffic, which hasn’t faded.

Among recent announcements, the launch of National Vision’s new corporate brand identity stands out in context of current catalysts. This rebrand, emphasizing accessibility and modernization, may help the company better appeal to younger or digitally engaged customers, which could be important as more eyewear transactions move online and as the managed care shift accelerates. How this effort translates into competitive differentiation and traffic gains will depend on execution and customer perception in the months ahead.

In contrast, investors should be aware that even with upbeat guidance, persistent headwinds from online competition and consumer migration toward digital channels …

Read the full narrative on National Vision Holdings (it's free!)

National Vision Holdings' outlook projects $2.2 billion in revenue and $64.4 million in earnings by 2028. This assumes a 5.4% annual revenue growth and a $79.4 million increase in earnings from the current level of -$15.0 million.

Uncover how National Vision Holdings' forecasts yield a $28.05 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community range from US$14.02 to US$25.41 per share. The wide spread of opinions highlights that ongoing e-commerce risk could drive very different outcomes, so you can explore several alternative viewpoints here.

Explore 3 other fair value estimates on National Vision Holdings - why the stock might be worth 38% less than the current price!

Build Your Own National Vision Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your National Vision Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free National Vision Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate National Vision Holdings' overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal