How Investors Are Reacting To Delek Logistics Partners (DKL) Dividend Hike Despite Lower Second-Quarter Revenue

- Delek Logistics Partners recently reported second-quarter 2025 earnings, with net income increasing to US$44.57 million despite a decline in revenue to US$246.35 million compared to the prior year.

- The company's decision to boost its quarterly cash distribution to US$1.115 per unit, payable in August, highlights its emphasis on shareholder returns even in a period of lower topline sales.

- We'll examine how the increased dividend announces the company's confidence in ongoing distributable cash flow growth and operational stability.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Delek Logistics Partners Investment Narrative Recap

To be a shareholder in Delek Logistics Partners, you need confidence in the company’s ability to deliver stable and growing distributable cash flows from its Permian-focused midstream assets, even as energy transition trends and customer concentration risks loom. The recent Q2 2025 results, with net income growth despite lower sales, reinforce the importance of operational resilience as the most important short-term catalyst, while reliance on high-yield debt remains the biggest risk; the latest news does not appear to alter either dynamic in a material way.

Among recent announcements, the company’s quarterly cash distribution hike to US$1.115 per unit stands out, as it reinforces the focus on returning capital to shareholders in a period marked by volatile revenue and sector headwinds. This signals continued confidence in near-term distributable cash flow, which is central to supporting investor returns even if revenue growth is uneven.

Yet, despite this positive momentum, investors should also be aware that higher leverage and substantial debt service requirements could become a constraint if...

Read the full narrative on Delek Logistics Partners (it's free!)

Delek Logistics Partners is projected to reach $1.2 billion in revenue and $292.8 million in earnings by 2028. This outlook is based on an annual revenue growth rate of 9.1% and represents an earnings increase of $141 million from current earnings of $151.8 million.

Uncover how Delek Logistics Partners' forecasts yield a $43.50 fair value, a 3% downside to its current price.

Exploring Other Perspectives

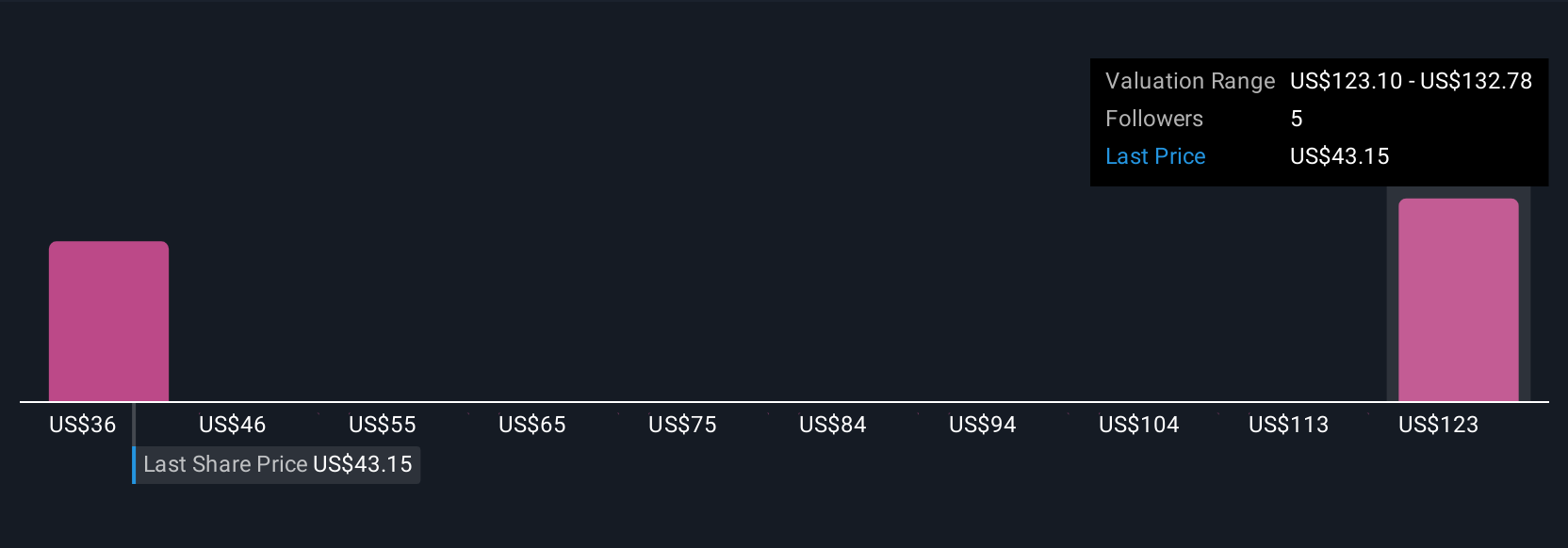

Community members at Simply Wall St see fair values spanning from US$36 to US$133 across three unique views. While some are drawn to distributable cash flow growth, others highlight the long-term risk if demand for fossil fuel infrastructure weakens, inviting you to compare perspectives.

Explore 3 other fair value estimates on Delek Logistics Partners - why the stock might be worth over 2x more than the current price!

Build Your Own Delek Logistics Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Delek Logistics Partners research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Delek Logistics Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Delek Logistics Partners' overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal