Ensign Group (ENSG) Expands With 1,200 New Beds Will Growth via Acquisition Sustain Its Edge?

- Earlier this month, the Ensign Group announced the acquisition of over a dozen skilled nursing and assisted living facilities across California, Wisconsin, and Iowa, totaling more than 1,200 new operational beds and expanding its reach to 361 healthcare operations in 17 states.

- This expansion underscores the company's active pursuit of growth through both ownership and management agreements, strengthening its footprint and diversifying its real estate holdings within the senior care sector.

- We'll examine how adding more than 1,200 beds through these acquisitions may influence Ensign Group's future growth narrative.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Ensign Group Investment Narrative Recap

To be a shareholder in Ensign Group, you need ongoing confidence in its ability to drive growth by acquiring and integrating new skilled nursing and senior living facilities, leveraging both industry tailwinds and operational scale. The latest round of acquisitions, more than 1,200 new beds across California, Wisconsin, and Iowa, reinforces this expansion narrative. However, these additions may not materially impact the most important near-term catalyst, which remains Ensign’s capacity to efficiently integrate acquired assets and improve their performance. The greatest immediate risk continues to be potential changes in government reimbursement rates, as these programs represent a significant portion of the company’s revenue. The company’s recent announcement of raised earnings and revenue guidance following its July 2025 Q2 results stands out as a significant update. Management boosted full-year earnings guidance to a range of US$6.34 to US$6.46 per diluted share and projected higher annual revenue. In context of the expansion news, this guidance upgrade signals increased conviction in the company’s integration capabilities and underlying demand, tying directly back to the catalyst of scalable, profitable acquisitions. But for investors, the most pressing question may be whether reimbursement policies will change and how quickly those shifts could impact Ensign Group’s bottom line...

Read the full narrative on Ensign Group (it's free!)

Ensign Group's narrative projects $6.5 billion revenue and $483.4 million earnings by 2028. This requires 12.0% yearly revenue growth and a $160.6 million earnings increase from $322.8 million.

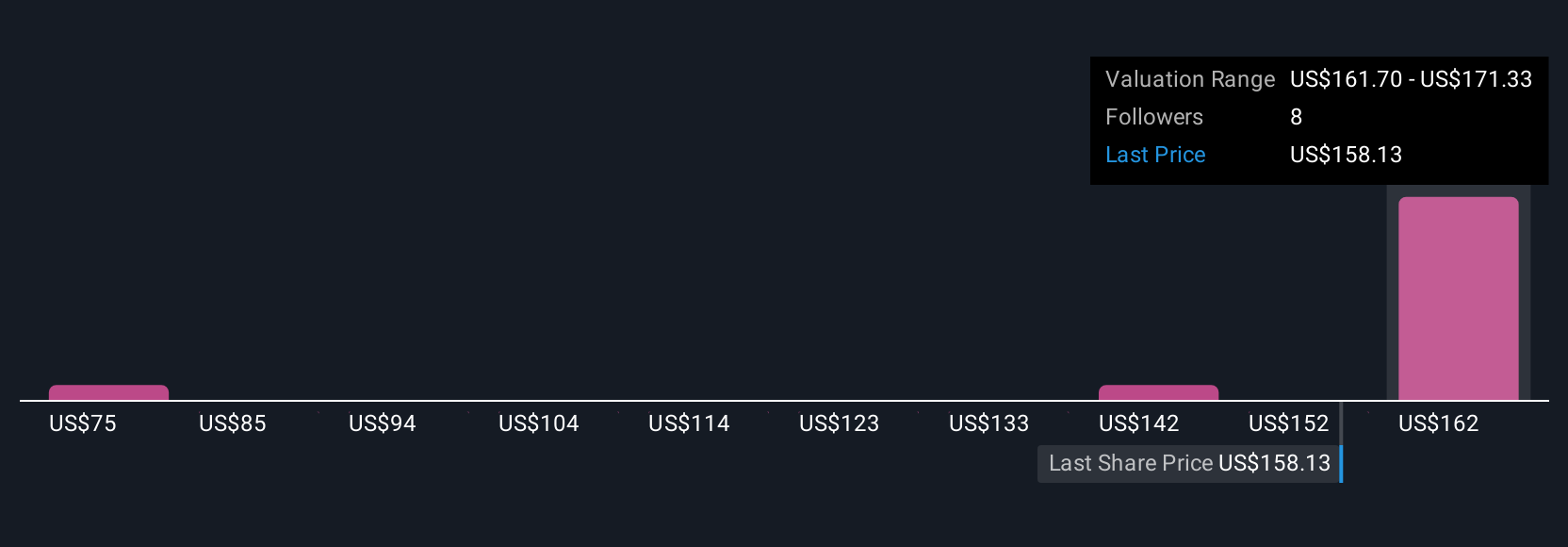

Uncover how Ensign Group's forecasts yield a $171.33 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members valued Ensign Group between US$75 and US$171.33, reflecting a wide spectrum across four estimates. With government reimbursement always in focus, you’ll want to see how these varied perspectives may inform your own expectations for the company’s future.

Explore 4 other fair value estimates on Ensign Group - why the stock might be worth as much as 8% more than the current price!

Build Your Own Ensign Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ensign Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Ensign Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ensign Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 26 companies in the world exploring or producing it. Find the list for free.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal