Tractor Supply (TSCO) Announces US$0.23 Quarterly Dividend Payout

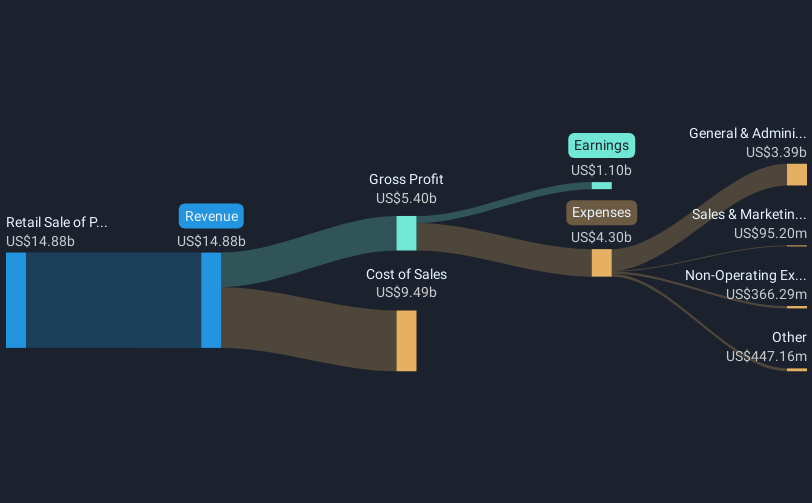

Tractor Supply (TSCO) announced its quarterly cash dividend of $0.23 per share, enhancing its commitment to shareholder value. Over the last quarter, the company's share price rose by 17.00%, fueled not only by this dividend affirmation but also by Q2 earnings that showed modest improvements in sales and net income. Additionally, the company's share buyback initiative and new product additions, including SmartEquine's health solutions, likely contributed positively. These actions and financial results aligned with broader market trends, as the major U.S. indexes showed gains, underscoring Tractor Supply's role within the overall economic environment.

We've spotted 1 possible red flag for Tractor Supply you should be aware of.

Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

The news about Tractor Supply's commitment to shareholder value through a quarterly cash dividend and the introduction of SmartEquine products could support ongoing revenue and earnings improvements. These efforts may help in maintaining a strong customer base while enhancing overall margins, aligning well with the company's strategy to diversify supply chains and integrate PetRx solutions. Such moves address some of the challenges posed by tariffs and economic uncertainties, suggesting a potential for sustained revenue growth and improved profitability.

Over a five-year period, Tractor Supply has delivered a total return, including share price appreciation and dividends, of 118.44%. The share price increase of 17% this quarter shows positive momentum in line with broader market trends, yet the one-year performance lagged the US Specialty Retail industry, which saw a return of 19.5%. Despite recent gains, the current share price of US$60.02 is slightly below the consensus price target of US$62.41, indicating a minor upside. Analysts remain optimistic, forecasting earnings to reach US$1.4 billion by August 2028, although this growth expectation is somewhat tempered when compared to the broader market and industry outlook.

Evaluate Tractor Supply's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal