Will Strong Q2 Results and Share Buyback Change Coca-Cola Consolidated's (COKE) Investment Narrative?

- Coca-Cola Consolidated recently reported second quarter results, with sales rising to US$1.86 billion and net income reaching US$187.39 million, both up from the prior year period.

- An interesting detail is that the company completed a significant share buyback, repurchasing over 720,000 shares, demonstrating management’s ongoing commitment to capital returns.

- We’ll explore how the combination of robust quarterly earnings and a completed buyback shapes Coca-Cola Consolidated’s investment narrative.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Coca-Cola Consolidated's Investment Narrative?

When looking at Coca-Cola Consolidated, the central theme is consistency in profitability and disciplined capital management. The latest quarter brought a rise in both sales and net income, reinforced by the conclusion of a significant share buyback. For investors, the case centers on trusting the company’s established position as the largest independent Coca-Cola bottler in the US, its experienced board, and healthy profit margins. Short-term, the completed buyback and recent earnings beat offer some reassurance, even as year-to-date total returns remain weak compared to the broader market. The big risk right now is that while quarterly numbers looked strong, six-month profits fell versus the prior year, hinting at possible headwinds in margins or costs ahead. Given the unchanged long-term narrative, the immediate catalysts or risks have not shifted dramatically following this news, but the dip in six-month net income should not be ignored. But there are margin-related risks that investors need to weigh.

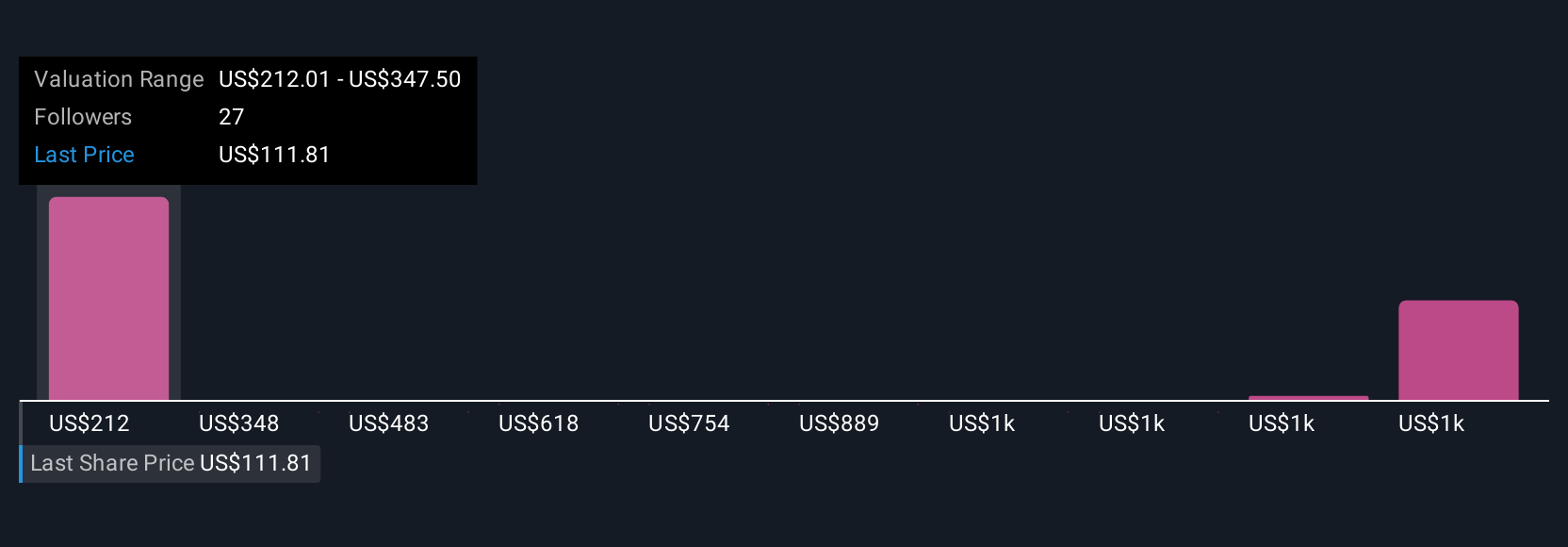

Despite retreating, Coca-Cola Consolidated's shares might still be trading 18% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 8 other fair value estimates on Coca-Cola Consolidated - why the stock might be worth just $139.23!

Build Your Own Coca-Cola Consolidated Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coca-Cola Consolidated research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Coca-Cola Consolidated research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coca-Cola Consolidated's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 25 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal