Can Textron's (TXT) Share Repurchases and Dividend Reveal a New Capital Allocation Direction?

- Textron Inc. recently reported its second quarter 2025 earnings, showing year-over-year revenue growth to US$3.72 billion and steady diluted earnings per share of US$1.35, while the Board declared a US$0.02 per share quarterly dividend to be paid in October 2025.

- The completion of a major share repurchase program and the reaffirmation of full-year guidance suggest a maintained focus on shareholder returns and operational stability.

- We'll explore how the completion of Textron's large-scale share buyback could impact the company's investment narrative and outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Textron Investment Narrative Recap

To be a Textron shareholder, you need to believe in the company’s ability to deliver consistent revenue growth across its aerospace and industrial businesses, while managing costs and operational challenges. The recent quarterly earnings and dividend affirmation reinforce the company’s near-term stability, but they do not materially change the biggest catalyst, execution on key growth programs, or address core risks such as margin pressure from unfavorable product mix and cost control concerns.

Among the recent headlines, Textron’s completed buyback program stands out for its potential impact on share value and capital allocation. With over 25 million shares repurchased for about US$2.05 billion, this signals ongoing focus on shareholder returns, even as execution risks tied to segment profits and product mix linger.

Yet, while results show stability, investors should pay close attention to how ongoing challenges in margin management could affect future profitability if cost pressures persist...

Read the full narrative on Textron (it's free!)

Textron's outlook forecasts $16.2 billion in revenue and $1.1 billion in earnings by 2028. This projection is based on annual revenue growth of 4.8% and a $284 million increase in earnings from the current $816 million.

Uncover how Textron's forecasts yield a $92.60 fair value, a 18% upside to its current price.

Exploring Other Perspectives

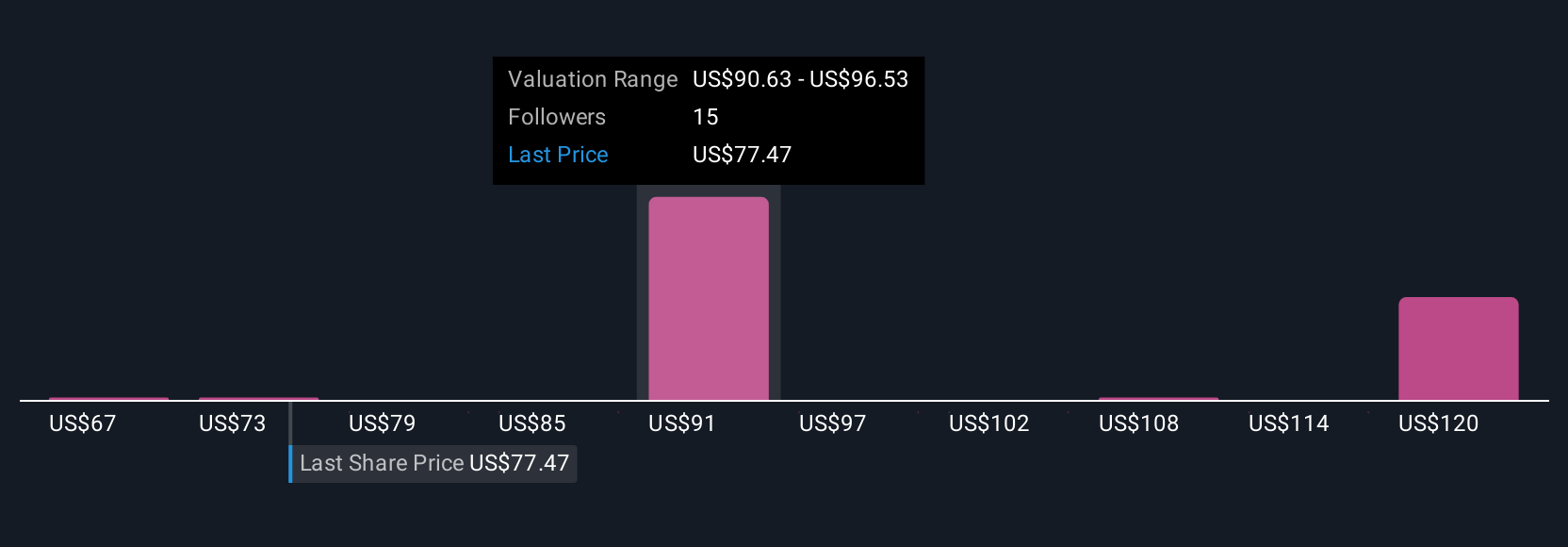

Five members of the Simply Wall St Community gave fair value estimates for Textron ranging widely from US$67.04 to US$125.93 per share. With cost management and margin improvement still a concern, these contrasting views highlight the importance of exploring multiple opinions before making any decision.

Explore 5 other fair value estimates on Textron - why the stock might be worth as much as 61% more than the current price!

Build Your Own Textron Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Textron research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Textron research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Textron's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal