Does FCFS’s Bigger Dividend Reflect Long-Term Strength or Just Management Optimism?

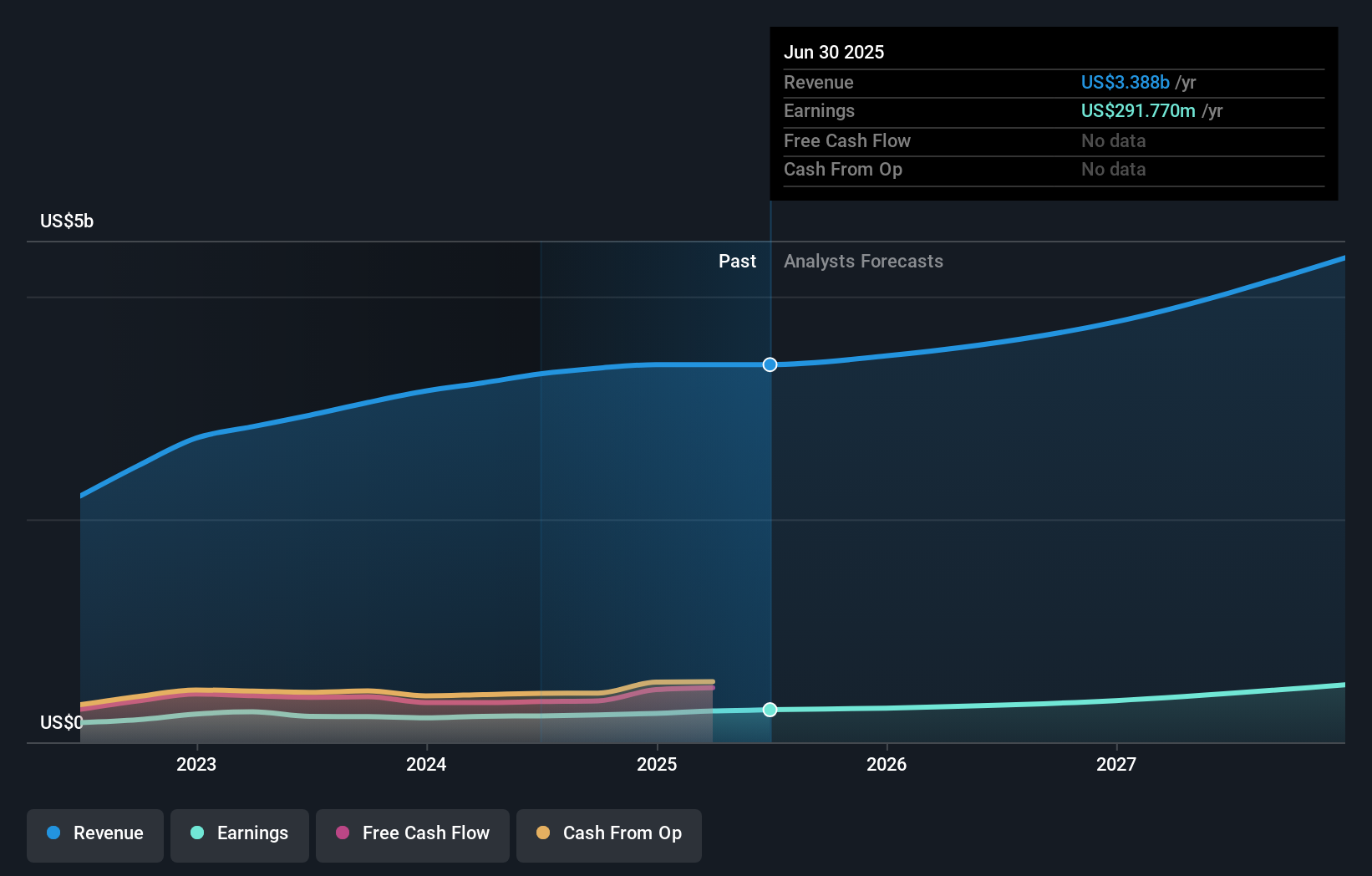

- FirstCash Holdings recently reported second-quarter 2025 results, highlighted by increased net income to US$59.81 million and an 11% quarterly dividend increase to US$0.42 per share, along with reaffirmed positive earnings guidance for the year.

- This performance occurred despite nearly flat year-over-year revenue, signaling resilience in the company's core pawn lending and retail services business.

- We'll examine how the significant dividend increase highlights management's confidence in future earnings and shapes FirstCash's investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is FirstCash Holdings' Investment Narrative?

For anyone considering FirstCash Holdings, the main story to believe in is the durability and adaptability of its core pawn lending and retail operations. The latest results show strong net income growth and a solid dividend increase, even as headline revenue remains flat. That combination, plus reaffirmed earnings guidance, could strengthen faith in management’s ability to drive value regardless of short-term sales swings. The recent news also clarifies some potential risks and catalysts. Most notably, the company paused share buybacks, likely due to tighter debt covenants stemming from past debt financing activities. While the lack of repurchases hasn’t rattled the share price, recent gains suggest optimism about ongoing earnings growth, the importance of dividend reliability and execution on expansion plans moves front and center. This shift in capital allocation means investors need to watch the company’s balance between debt, acquisitions, and shareholder returns more closely than before. Yet with an 11% dividend lift and continued guidance positivity, FirstCash’s leadership is clearly signaling confidence, even as questions about leverage linger. But keep in mind, tighter debt restrictions could put pressure on future capital returns, something prudent investors should always factor in.

FirstCash Holdings' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 3 other fair value estimates on FirstCash Holdings - why the stock might be worth as much as 13% more than the current price!

Build Your Own FirstCash Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FirstCash Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free FirstCash Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FirstCash Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 25 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal