What Dollar Tree (DLTR)'s Leadership Change and Family Dollar Sale Mean for Shareholders

- In late July 2025, Dollar Tree announced the departure of Chief Legal Officer Jonathan B. Leiken and the appointment of John S. Mitchell, Jr. as his successor, coinciding with the recent completion of the Family Dollar business sale and a US$342.45 million shelf registration filing related to its Employee Stock Ownership Plan.

- This series of operational and leadership changes highlights Dollar Tree's sharpened focus on its core business and efforts to streamline corporate governance after a significant divestiture.

- We'll examine how the completion of the Family Dollar divestiture influences Dollar Tree's investment narrative and prospects for margin improvement.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Dollar Tree Investment Narrative Recap

To own shares in Dollar Tree, an investor needs to believe the company can drive margin recovery and meaningful earnings growth now that it has divested Family Dollar and sharpened its focus on the core Dollar Tree banner. The recent departure of the Chief Legal Officer and appointment of John S. Mitchell, Jr. is unlikely to materially alter the most important near-term catalyst: realizing net margin improvement from operating as a leaner, simpler enterprise. The biggest immediate risk remains execution on cost structure changes following the Family Dollar sale.

Among recent developments, Dollar Tree's US$342.45 million shelf registration related to its Employee Stock Ownership Plan stands out for its relevance to the current executive transition and ongoing transformation. While the shelf filing itself may not directly impact catalysts or risks, it signals the company’s commitment to employee alignment and internal investment as the organization realigns after the divestiture and management changes. However, despite efficiency opportunities, there remains the challenge of shared services costs in this period of transition that investors should be aware of...

Read the full narrative on Dollar Tree (it's free!)

Dollar Tree's outlook anticipates $21.1 billion in revenue and $1.3 billion in earnings by 2028. This reflects a 6.3% annual revenue growth rate and a $0.3 billion increase in earnings from the current $1.0 billion level.

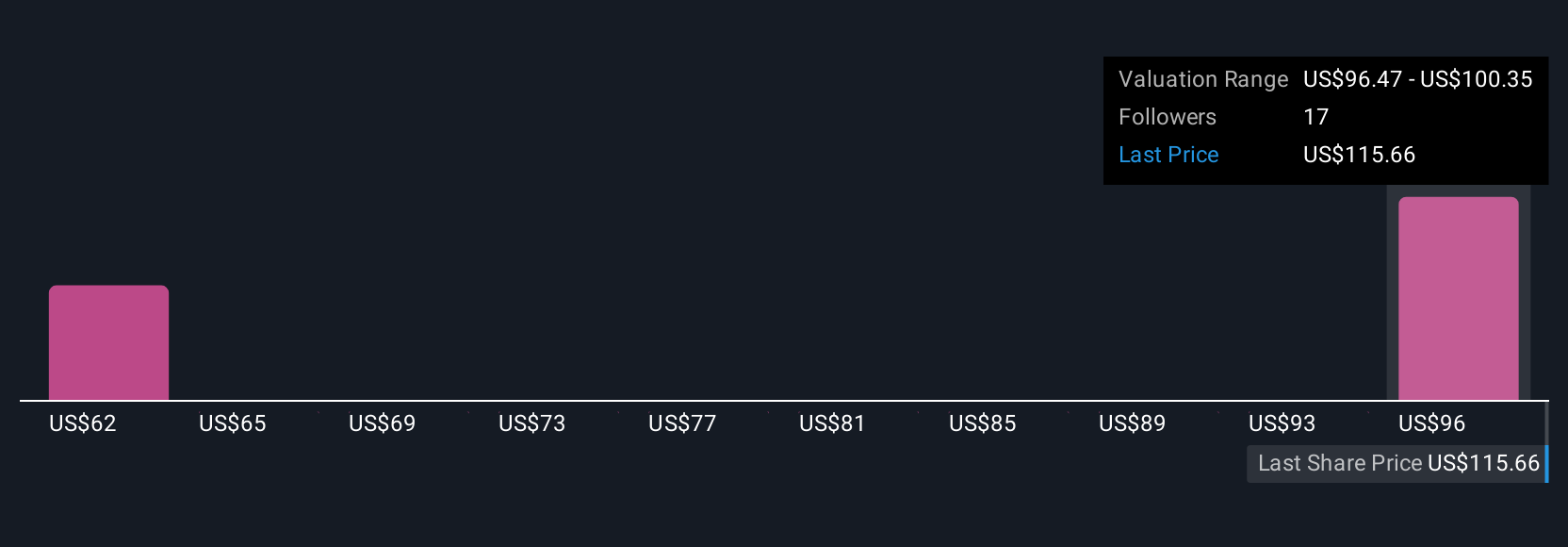

Uncover how Dollar Tree's forecasts yield a $100.35 fair value, a 13% downside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range from US$64.99 to US$100.35 across 3 viewpoints, illustrating widely differing opinions on Dollar Tree's future. With shared services costs after the Family Dollar sale remaining a concern, readers should compare diverse expectations with the company’s evolving fundamentals.

Explore 3 other fair value estimates on Dollar Tree - why the stock might be worth 44% less than the current price!

Build Your Own Dollar Tree Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dollar Tree research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Dollar Tree research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dollar Tree's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal