Hawkins (HWKN) Is Up 5.1% After Beating Q1 Estimates and Raising Dividend – What's Changed?

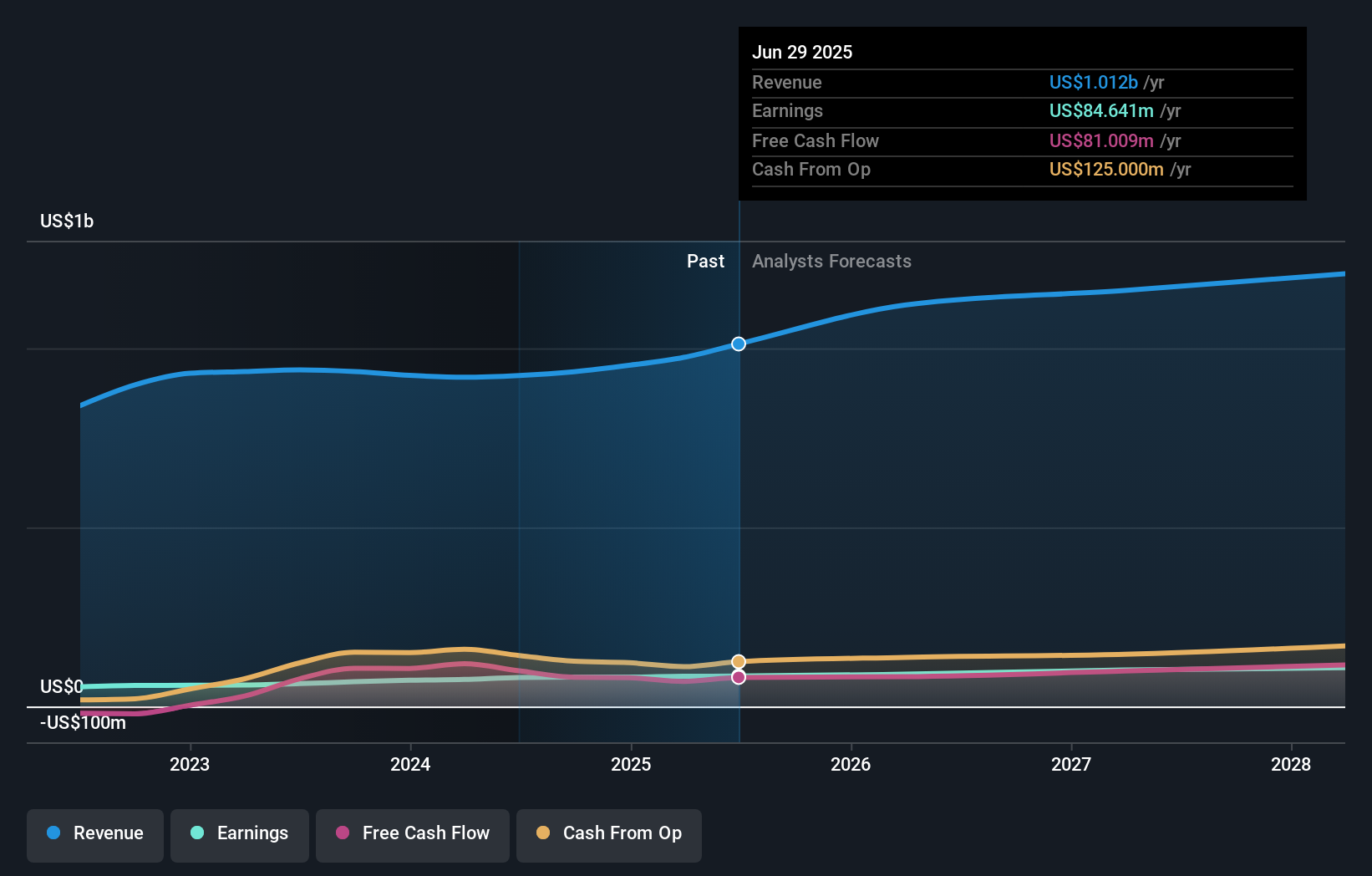

- Hawkins, Inc. reported strong first-quarter results for the period ended June 29, 2025, with revenue and earnings per share both surpassing the prior year's figures, and also announced a 6% increase in its quarterly cash dividend to US$0.19 per share.

- This combination of robust financial results and a higher dividend signals management's confidence in the company's ongoing performance and its commitment to returning value to shareholders.

- We’ll explore how Hawkins’ dividend hike shapes the company’s investment narrative amid stronger-than-expected quarterly results.

We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Hawkins' Investment Narrative?

To believe in Hawkins as a shareholder today, one has to see the company's consistent execution: solid first-quarter results and a fresh 6% dividend increase, all backed by steady earnings and revenue growth. This pattern underscores a management team that appears confident in near-term performance and in rewarding shareholders. The recent price surge is one signal that the market welcomed the latest updates, though analysts have made a modest downgrade to their future earnings outlook. The ratification of Deloitte & Touche LLP as the new auditor should not materially affect core business catalysts, but it does keep focus on governance and financial transparency, reducing a risk that could have cropped up during auditor transitions. The biggest short-term factors to watch remain earnings, margin trends, and how dividend growth balances with debt levels. Given current information, none of the latest news significantly shifts these key risks or catalysts, but the high valuation and slower projected growth are important to keep on your radar. Yet, some investors may be overlooking how Hawkins’ premium valuation can amplify risks if growth starts to lag.

Hawkins' shares are on the way up, but they could be overextended by 7%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on Hawkins - why the stock might be worth 7% less than the current price!

Build Your Own Hawkins Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hawkins research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Hawkins research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hawkins' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal