Do Fortive’s (FTV) Lower Earnings and Ongoing Buybacks Signal a Shift in Capital Priorities?

- Fortive Corporation recently announced second quarter 2025 results, reporting revenue of US$1,518.8 million and net income of US$166.6 million, both down compared to the previous year.

- Alongside these earnings, Fortive disclosed ongoing share repurchases, with nearly 27.41 million shares bought back for a total of US$1.94 billion under its continuing buyback program since 2022.

- We will look at what these lower earnings and continued buybacks could mean for Fortive’s broader investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Fortive Investment Narrative Recap

To be a Fortive shareholder, you generally need to believe in the company’s ability to manage through industrial cycles, deliver steady operational performance, and unlock value through business transformation, most recently, a spin-off and plans to boost recurring revenues. The latest quarterly results, with revenue and net income both down, may contribute to concerns over near-term earnings pressure, but the main catalyst remains the successful separation and realignment of key segments. The biggest risk continues to be the lagging recovery in Precision Technologies; the recent news doesn’t materially change this risk or the outlook for the catalyst.

Of the company's recent announcements, the completion of nearly US$1.94 billion in share buybacks stands out. This is especially relevant given ongoing earnings declines, as it demonstrates a substantial commitment to shareholder returns despite operational headwinds. The effectiveness of such capital return programs may hinge on progress in stabilizing earnings and offsetting margin pressures brought by tariffs and weak demand.

On the flip side, investors should be aware that even ambitious buyback activity does not eliminate the impact of stubbornly slow precision segment recovery and...

Read the full narrative on Fortive (it's free!)

Fortive's narrative projects $4.5 billion revenue and $741.6 million earnings by 2028. This requires a 10.2% annual revenue decline and a $55.8 million decrease in earnings from the current $797.4 million.

Uncover how Fortive's forecasts yield a $65.85 fair value, a 39% upside to its current price.

Exploring Other Perspectives

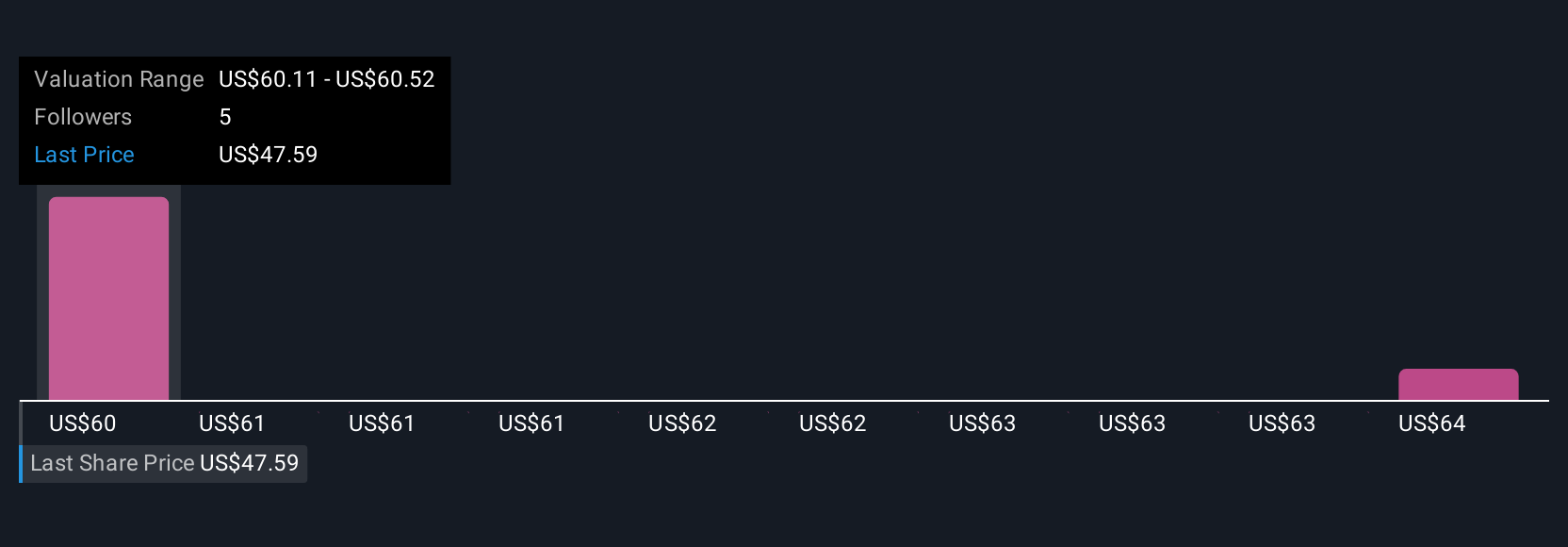

Two Simply Wall St Community members shared fair value estimates for Fortive ranging narrowly between US$64.40 and US$65.85 per share. With persistent weakness in Precision Technologies still weighing on short-term results, consider how other community viewpoints compare before making up your mind.

Explore 2 other fair value estimates on Fortive - why the stock might be worth as much as 39% more than the current price!

Build Your Own Fortive Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fortive research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fortive research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fortive's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal