How Investors May Respond To Ulta Beauty (ULTA) Facing Renewed Backlash Over Inclusive Marketing Campaign

- Ulta Beauty recently faced renewed backlash as its latest promotional campaign featuring non-binary influencer Jonathan Van Ness reignited the #BoycottUltaBeauty movement online, sparking widespread controversy over its messaging of inclusivity and self-expression.

- This reaction echoes similar resistance encountered during past inclusive campaigns and has brought Ulta’s approach to inclusive marketing back into the public spotlight.

- We'll review how the online backlash surrounding Jonathan Van Ness may influence Ulta Beauty's core investment case and future outlook.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Ulta Beauty Investment Narrative Recap

To be a shareholder in Ulta Beauty, you have to believe in its unique position as a top specialty beauty retailer with the ability to drive growth through exclusive brand launches, enhanced digital capabilities, and operational efficiencies. The recent controversy around its inclusive marketing campaign with Jonathan Van Ness has drawn social media attention but, at present, it does not appear to materially impact Ulta’s most important short-term catalyst, continued product innovation and assortment expansion. The biggest risk, ongoing competition and margin pressure, remains unchanged following this event.

The company has recently expanded its K-Beauty product assortment in partnership with K-Beauty World, adding popular Korean skincare and makeup lines both in-store and online. This launch directly supports Ulta’s growth catalyst of diversifying and strengthening its brand portfolio to drive incremental sales, even as external factors shape consumer sentiment and engagement.

In contrast, what investors should pay attention to is how operational challenges or consumer reactions might start to affect Ulta Beauty’s core growth drivers…

Read the full narrative on Ulta Beauty (it's free!)

Ulta Beauty's narrative projects $13.1 billion revenue and $1.2 billion earnings by 2028. This requires 4.6% yearly revenue growth and no earnings change from the current $1.2 billion earnings.

Uncover how Ulta Beauty's forecasts yield a $492.52 fair value, a 4% downside to its current price.

Exploring Other Perspectives

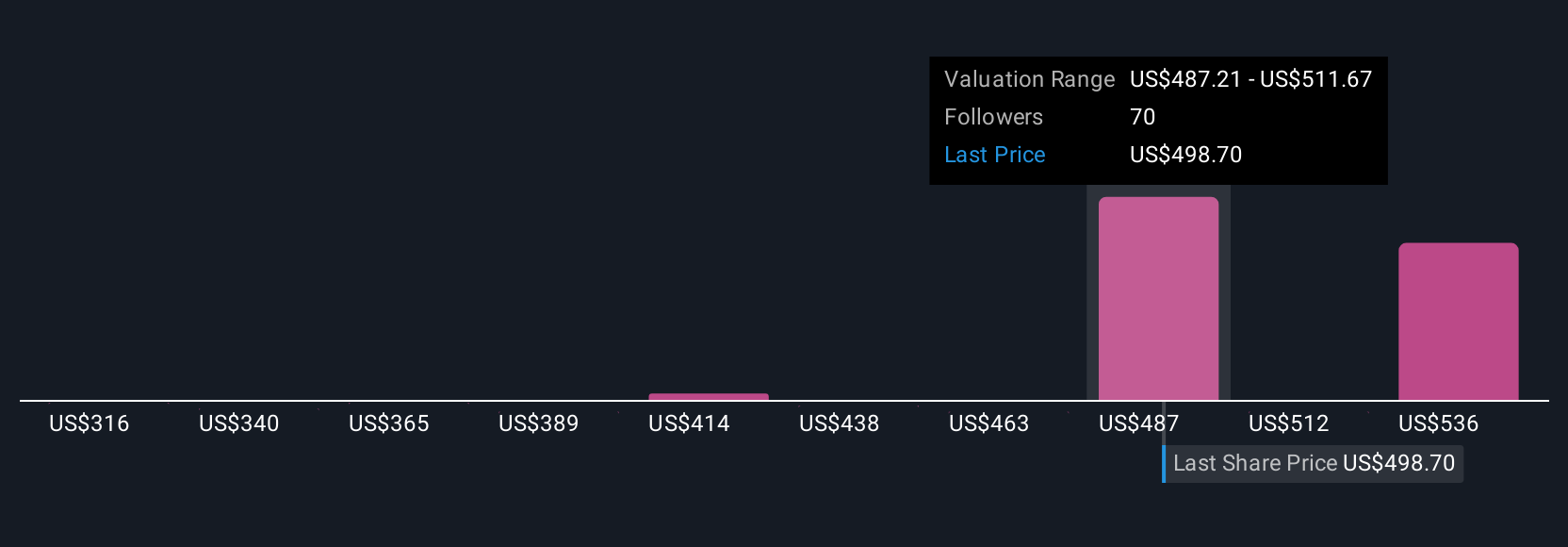

Seventeen investors in the Simply Wall St Community estimate Ulta Beauty’s fair value from US$300 up to US$599, showing a wide spread in expectations. Against this backdrop, competition and execution risks could weigh on the company's ability to deliver targeted sales growth, so consider multiple viewpoints as you assess the outlook.

Explore 17 other fair value estimates on Ulta Beauty - why the stock might be worth as much as 16% more than the current price!

Build Your Own Ulta Beauty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ulta Beauty research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Ulta Beauty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ulta Beauty's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal