What Best Buy (BBY)'s New IKEA Shop-in-Shop Partnership Means For Shareholders

- Best Buy and IKEA U.S. launched an in-store partnership, bringing IKEA's home furnishings and planning services into ten Best Buy locations across Florida and Texas for the first time in the U.S. through a "shop-in-shop" model.

- This collaboration opens a unique multi-brand retail experience, allowing customers to integrate high-tech appliances with affordable design, and marks IKEA's first retail presence within another U.S. store chain.

- We'll explore how IKEA's entry into Best Buy locations could influence the company's investment outlook and customer engagement strategy.

Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

Best Buy Investment Narrative Recap

To own Best Buy shares, you need to believe in the company’s ability to evolve its brick-and-mortar strategy to attract customers amid a shifting retail climate. The Best Buy and IKEA partnership is likely to support the company’s omnichannel focus and could boost store traffic in select locations, but near-term financial impact may be limited, with the bigger catalyst still being the success of new digital and in-store profit streams. Competitive pressures and declining appliance sales remain the most pressing risks today.

One recent announcement directly relevant to this initiative is Best Buy’s ongoing investment in store enhancements and employee expertise, which aims to create unique in-store experiences and deepen customer relationships, goals closely aligned with the IKEA collaboration. Investors continue to monitor whether these efforts can offset headwinds such as margin pressure and softer consumer electronics demand.

In contrast, investors should keep an eye on how rising competition could squeeze margins if...

Read the full narrative on Best Buy (it's free!)

Best Buy's outlook anticipates $43.8 billion in revenue and $1.5 billion in earnings by 2028. This scenario assumes a 1.8% annual revenue growth rate and a $617 million increase in earnings from the current $883 million.

Uncover how Best Buy's forecasts yield a $78.52 fair value, a 19% upside to its current price.

Exploring Other Perspectives

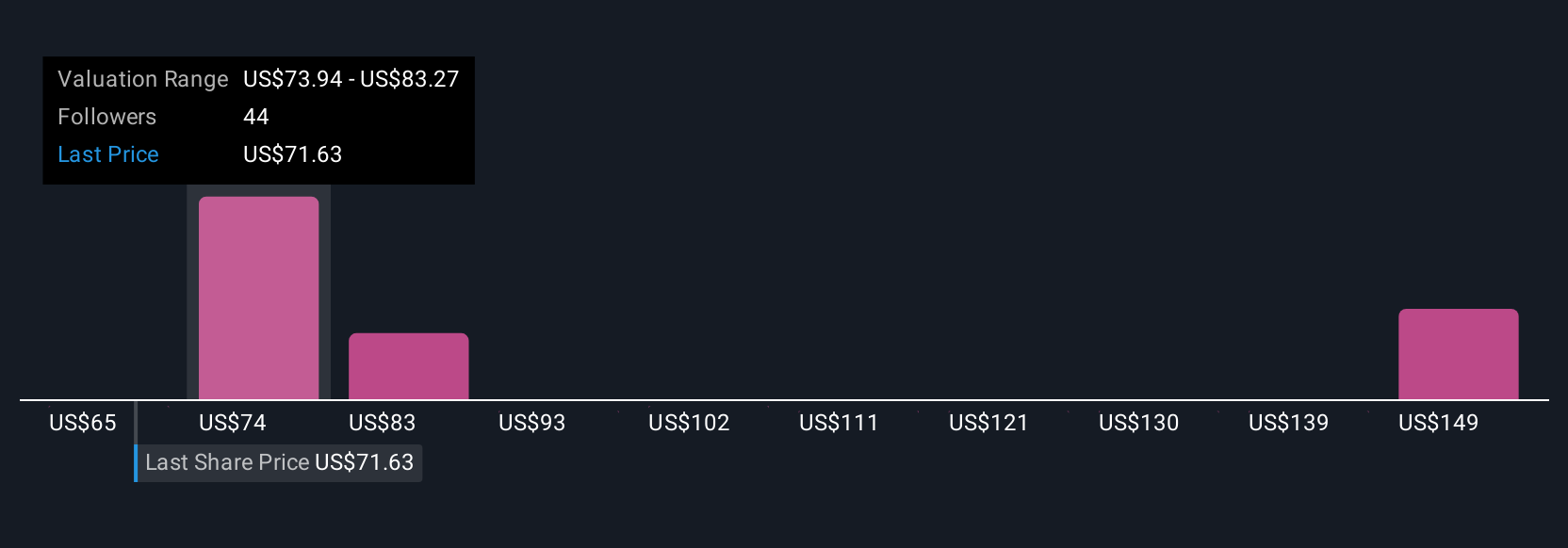

Six Simply Wall St Community members estimate Best Buy’s fair value from US$64.62 to US$165.04 per share. Your analysis may differ, especially given risks from margin pressure and shifting consumer demand in the electronics sector.

Explore 6 other fair value estimates on Best Buy - why the stock might be worth over 2x more than the current price!

Build Your Own Best Buy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Best Buy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Best Buy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Best Buy's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal