How Investors Are Reacting To Lockheed Martin (LMT) Class Actions and Internal Control Disclosures

- In late July 2025, Lockheed Martin faced multiple class action lawsuits alleging the company misled investors and failed to disclose internal control and contract performance issues, following the announcement of over US$1.6 billion in program losses and materially lower earnings. These events triggered heightened scrutiny of Lockheed Martin's financial oversight and risk management practices at a critical time for the business.

- This legal and operational disclosure raises questions about Lockheed Martin's ability to sustain margin recovery and profit growth amid ongoing risks from complex government contracts and internal controls.

- We'll examine how the internal control issues and resulting class actions may affect Lockheed Martin's investment narrative and future risk profile.

Find companies with promising cash flow potential yet trading below their fair value.

Lockheed Martin Investment Narrative Recap

To be a Lockheed Martin shareholder, you typically need to believe in the company’s long-term technological leadership and sustained demand for advanced defense platforms, offsetting periodic setbacks from complex government contracts. The recent class action lawsuits and disclosures of internal control issues pose real questions about near-term margin recovery, with the key catalyst of new contract wins now facing greater scrutiny; the biggest risk remains further program losses or financial restatements if these problems persist.

Among recent announcements, Lockheed Martin’s lowered earnings guidance for 2025 stands out in direct connection to these events, as it reflects the immediate financial impact of the $1.6 billion in revealed program losses and legal uncertainties, putting additional focus on the company’s ability to restore profitability and manage risk as it pursues upcoming contracts.

Yet beneath the company’s strong backlog, investors should be aware of the growing risk from cost overruns and challenges in legacy and classified programs that could...

Read the full narrative on Lockheed Martin (it's free!)

Lockheed Martin is projected to reach $81.0 billion in revenue and $7.1 billion in earnings by 2028. To achieve this, analysts anticipate annual revenue growth of 4.1% and an earnings increase of $2.9 billion from the current earnings of $4.2 billion.

Uncover how Lockheed Martin's forecasts yield a $492.30 fair value, a 16% upside to its current price.

Exploring Other Perspectives

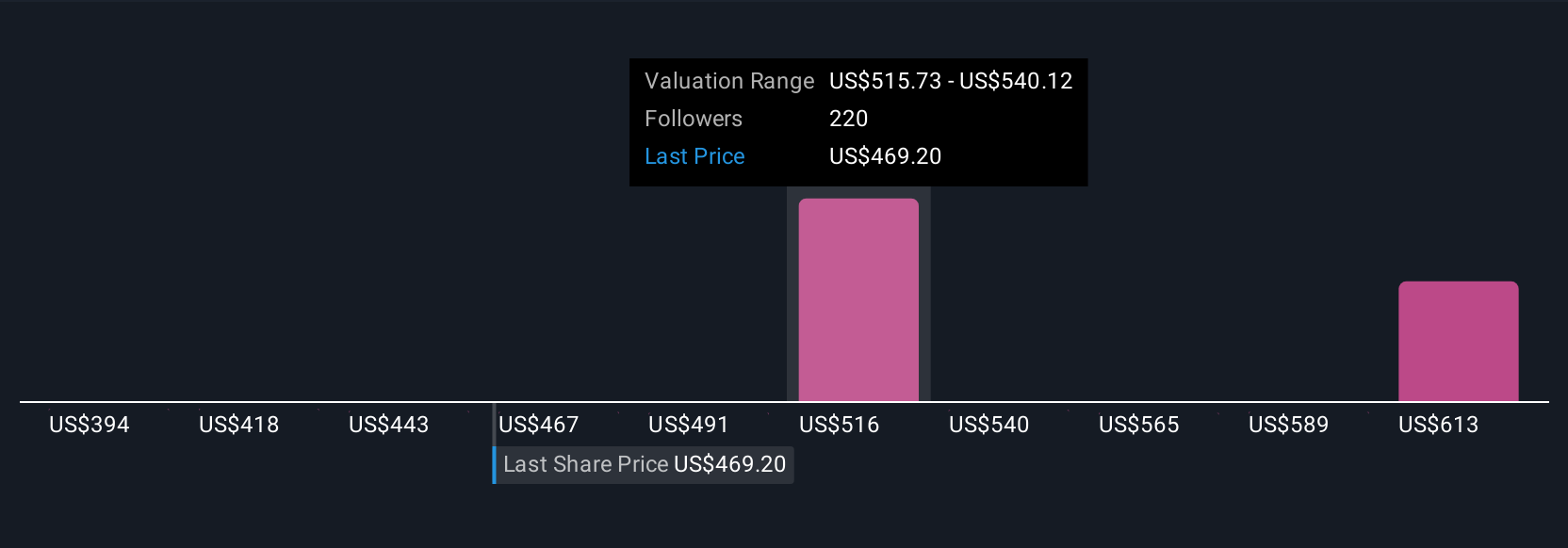

The Simply Wall St Community includes 25 individual fair value estimates for Lockheed Martin ranging from US$374.25 to US$611.08 per share. While some anticipate future contract wins and sustained demand, persistent cost overruns in legacy programs now weigh on confidence and could reshape profit expectations.

Explore 25 other fair value estimates on Lockheed Martin - why the stock might be worth 12% less than the current price!

Build Your Own Lockheed Martin Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lockheed Martin research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Lockheed Martin research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lockheed Martin's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal