11 Analysts Assess Cava Group: What You Need To Know

Providing a diverse range of perspectives from bullish to bearish, 11 analysts have published ratings on Cava Group (NYSE:CAVA) in the last three months.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 3 | 5 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 2 | 0 | 0 |

| 2M Ago | 1 | 2 | 0 | 0 | 0 |

| 3M Ago | 2 | 1 | 2 | 0 | 0 |

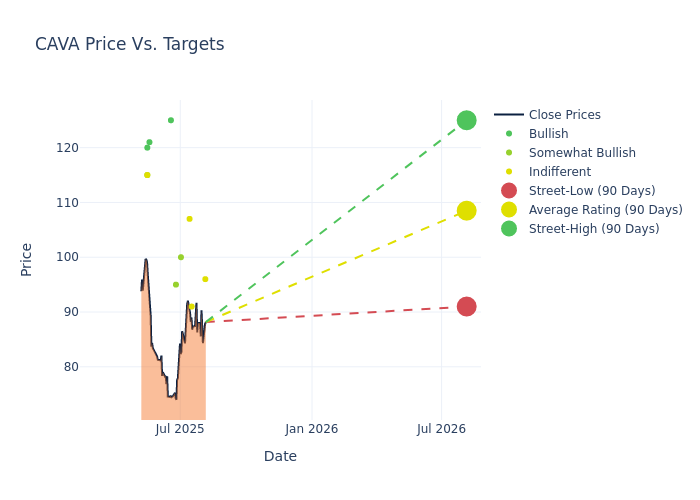

Insights from analysts' 12-month price targets are revealed, presenting an average target of $108.82, a high estimate of $125.00, and a low estimate of $91.00. A 8.01% drop is evident in the current average compared to the previous average price target of $118.30.

Exploring Analyst Ratings: An In-Depth Overview

The perception of Cava Group by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Dennis Geiger | UBS | Lowers | Neutral | $96.00 | $112.00 |

| Jeffrey Bernstein | Barclays | Raises | Equal-Weight | $91.00 | $90.00 |

| Brian Harbour | Morgan Stanley | Lowers | Equal-Weight | $107.00 | $115.00 |

| Christopher Carril | Keybanc | Announces | Overweight | $100.00 | - |

| John Ivankoe | JP Morgan | Lowers | Overweight | $95.00 | $115.00 |

| Chris O'Cull | Stifel | Lowers | Buy | $125.00 | $175.00 |

| Sara Senatore | B of A Securities | Raises | Buy | $121.00 | $112.00 |

| Jon Tower | Citigroup | Raises | Neutral | $115.00 | $114.00 |

| David Tarantino | Baird | Raises | Outperform | $115.00 | $105.00 |

| Andrew Charles | TD Securities | Maintains | Buy | $120.00 | $120.00 |

| Dennis Geiger | UBS | Lowers | Neutral | $112.00 | $125.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Cava Group. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Cava Group compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

For valuable insights into Cava Group's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Cava Group analyst ratings.

Discovering Cava Group: A Closer Look

Cava Group Inc owns and operates a chain of restaurants. It is the category-defining Mediterranean fast-casual restaurant brand, bringing together healthful food and bold, satisfying flavors at scale. The company's dips, spreads, and dressings are centrally produced and sold in grocery stores. The company's operations are conducted as two reportable segments: CAVA and Zoes Kitchen. The company generates all of its revenue from the CAVA segment.

Cava Group: Financial Performance Dissected

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Cava Group displayed positive results in 3M. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 28.12%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Consumer Discretionary sector.

Net Margin: Cava Group's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 7.75% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Cava Group's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 3.62%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Cava Group's ROA stands out, surpassing industry averages. With an impressive ROA of 2.14%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.57.

Analyst Ratings: Simplified

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal