Does Cintas' 42-Year Dividend Growth Streak Reveal Deeper Strengths in Its Capital Strategy (CTAS)?

- In recent days, Cintas Corporation announced that its Board of Directors approved a quarterly cash dividend of US$0.45 per share, a 15.4% increase, payable on September 15, 2025, to shareholders of record as of August 15, 2025.

- This dividend increase continues a 42-year annual streak since its IPO, emphasizing Cintas' ongoing commitment to shareholder returns and operational consistency.

- We'll now explore how Cintas' long history of dividend growth may influence its investment narrative and market perception.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Cintas Investment Narrative Recap

To be a Cintas shareholder, you need to believe in its ability to grow recurring revenue streams by expanding integrated services, securing high customer retention, and efficiently allocating capital to drive consistent returns. The recently announced 15.4% dividend hike highlights this long-term strategy and operational dependability, but it does not materially change the most important short-term catalyst: demand growth for workplace outsourcing. The biggest risk, structural shifts toward remote work reducing demand for uniforms, remains central and unaffected by the dividend news.

Among recent announcements, Cintas’ inclusion as one of U.S. News & World Report’s best companies to work for in 2025-2026 stands out. While this recognition affirms Cintas’ focus on workplace culture, its relevance to the current catalysts lies in the company’s ability to attract and retain talent, which could support future customer satisfaction and retention, critical drivers alongside its recurring-revenue model.

By contrast, while the dividend growth streak appeals to income-focused investors, shifts toward remote work remain a risk investors should watch for...

Read the full narrative on Cintas (it's free!)

Cintas' narrative projects $12.8 billion in revenue and $2.4 billion in earnings by 2028. This requires 7.2% yearly revenue growth and a $0.6 billion earnings increase from the current $1.8 billion.

Uncover how Cintas' forecasts yield a $221.82 fair value, in line with its current price.

Exploring Other Perspectives

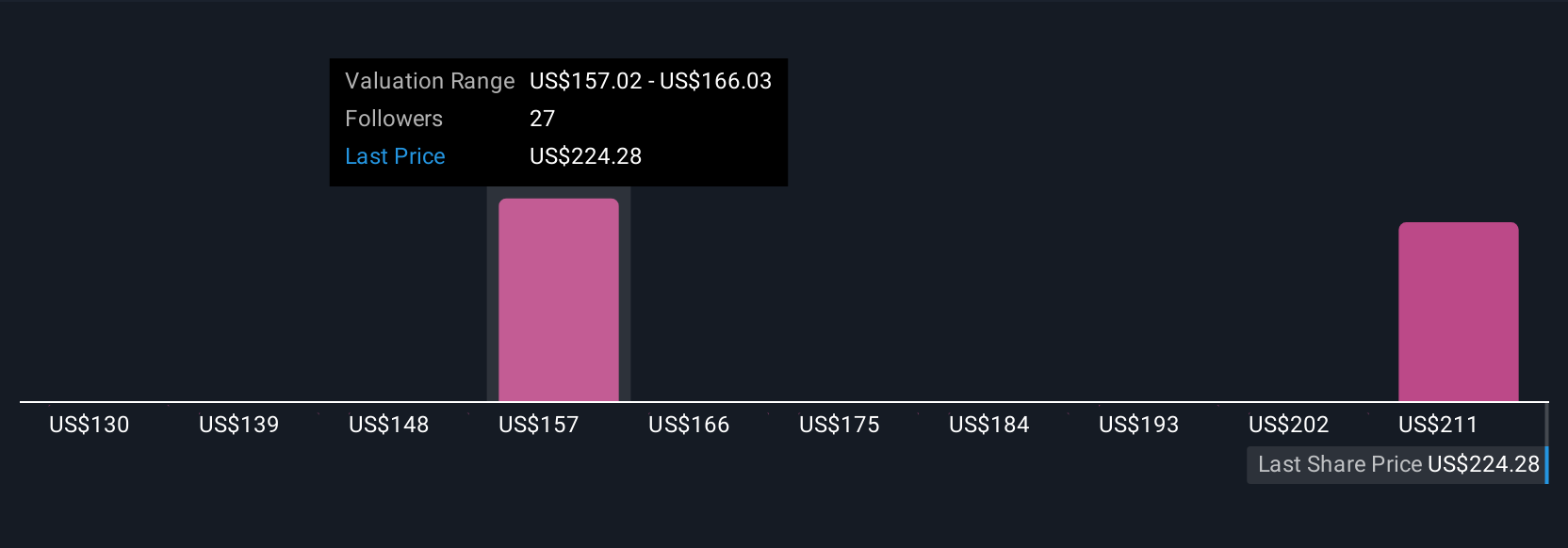

Estimates from five Simply Wall St Community members price Cintas between US$130 and US$221.82, showing substantial variability in outlook. With these competing perspectives, remember: persistent remote and hybrid work trends are a key risk that could reshape how Cintas grows its business.

Explore 5 other fair value estimates on Cintas - why the stock might be worth as much as $221.82!

Build Your Own Cintas Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cintas research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cintas research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cintas' overall financial health at a glance.

No Opportunity In Cintas?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal