What 3M (MMM)'s Sustained Safety and Industrial Momentum Means for Shareholders

- In recent days, 3M reported that its Safety and Industrial segment achieved its fifth consecutive quarter of organic revenue growth, supported by strong demand for personal safety products, adhesives, abrasives, and electrical solutions. The company's commercial excellence initiative has also improved sales efficiency and customer retention, helping to offset softness in the automotive aftermarket and broader macroeconomic worries.

- This ongoing momentum highlights the impact of targeted operational improvements in driving segment-level resilience despite some challenging industry conditions.

- We'll consider how continued demand for personal safety and industrial products could influence 3M's future earnings outlook and narrative.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

3M Investment Narrative Recap

To be a 3M shareholder today, you need to trust in the company’s ability to deliver steady organic revenue growth from its diversified industrial and safety offerings, even in the face of sector-specific headwinds. While the recent report of continued growth in the Safety and Industrial segment points to encouraging operational momentum, it does not change the fact that the largest near-term catalyst remains improved commercial execution, and the most significant risk continues to be the unpredictable scope of PFAS-related litigation. The recent news strengthens confidence in operational improvements but does not materially shift these core factors.

Among company announcements, the July 2025 update on 3M’s share buyback program stands out. The repurchase of over 12.7 million shares this year, totaling nearly US$1.9 billion, underlines management’s confidence in 3M’s underlying business strength, with cash being returned to shareholders during a period of segment resilience, though the company still faces margin pressure from ongoing legal and compliance costs.

By contrast, it’s often the unresolved dimension of PFAS liabilities that investors should be aware of...

Read the full narrative on 3M (it's free!)

3M's outlook projects $26.2 billion in revenue and $4.7 billion in earnings by 2028. This is based on analysts' expectations of 2.1% annual revenue growth and a $0.8 billion increase in earnings from the current $3.9 billion.

Uncover how 3M's forecasts yield a $161.15 fair value, a 9% upside to its current price.

Exploring Other Perspectives

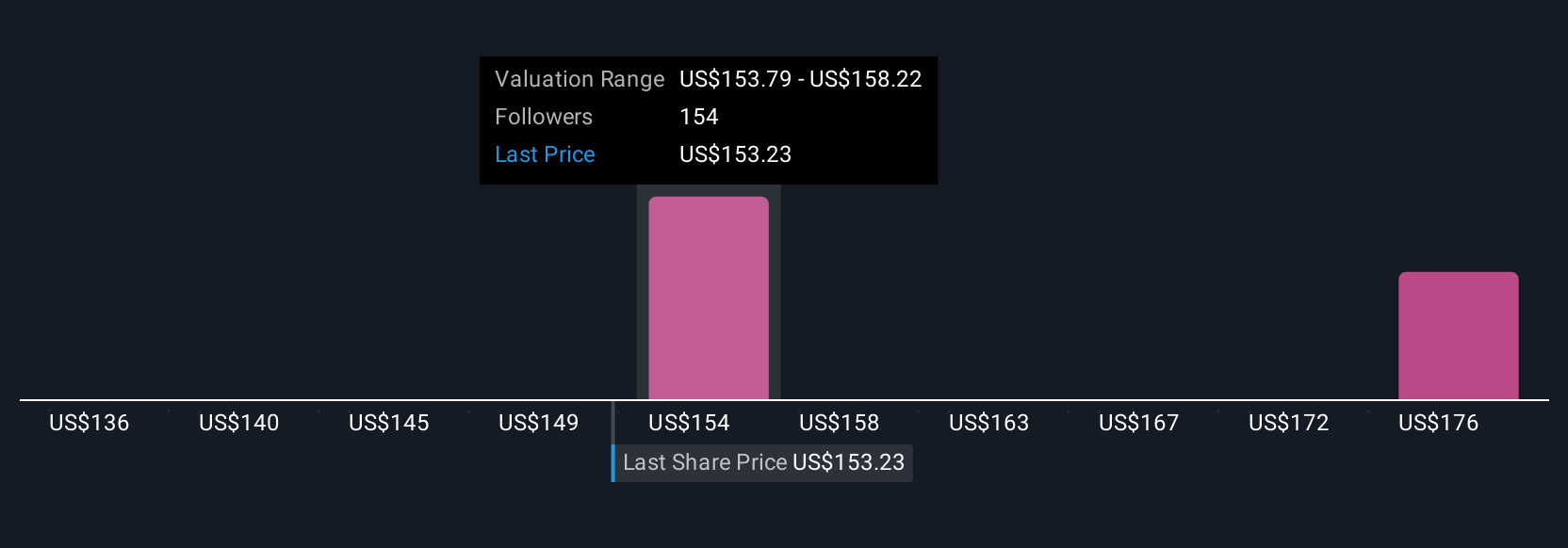

Fair value opinions from five members of the Simply Wall St Community range widely, from US$127.78 to US$179.57 per share. While these views vary, many remain focused on the importance of sustained innovation and the challenges posed by legal overhangs as crucial to 3M’s future performance, consider how your outlook fits among these diverse perspectives.

Explore 5 other fair value estimates on 3M - why the stock might be worth as much as 21% more than the current price!

Build Your Own 3M Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your 3M research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free 3M research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate 3M's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 25 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal