How Investors May Respond To Cisco Systems (CSCO) Expanding AI Cybersecurity Partnership With SAFE

- In recent days, Cisco Systems revealed a new partnership with SAFE to integrate Cisco AI Defense technology into enterprise cyber risk management solutions, aiming to deliver real-time AI asset discovery and risk insights for enterprise clients.

- This collaboration marks a significant step in establishing AI security governance standards and highlights Cisco's focus on enabling secure, large-scale adoption of AI technologies across diverse customer segments.

- We'll explore how this expanded AI security partnership could influence Cisco's investment outlook and accelerate its efforts in enterprise AI innovation.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Cisco Systems Investment Narrative Recap

To own Cisco Systems stock, you need to believe that the company's push into AI security, robust subscription revenue streams, and large-scale enterprise relationships can sustain long-term growth despite rising competition and global economic pressures. The recent SAFE partnership highlights Cisco's leadership in enterprise AI security and may support its efforts to accelerate new revenue from AI infrastructure, but short-term earnings will likely remain most sensitive to ongoing shifts in IT spending and the integration of acquisitions like Splunk. Near-term, this news enhances Cisco's product offering but does not substantially alter the largest immediate risks: competitive pressure from low-cost network vendors and potential margin headwinds from trade policy or integration challenges.

Among the recent announcements, the newly expanded authorisation agreement with Carahsoft stands out, expanding Cisco's reach within public sector IT markets in the US and Canada. This partnership builds the distribution pipeline for Cisco’s networking and security products, but its relevance to AI security innovation is indirect; the SAFE integration is more closely tied to Cisco’s ambitions in this area. In contrast, investors should be aware that broad adoption of new AI security offerings does not fully mitigate the risk posed by increasing competition from white-box and ODM vendors who continue to win business with large enterprises...

Read the full narrative on Cisco Systems (it's free!)

Cisco Systems is projected to reach $64.8 billion in revenue and $13.3 billion in earnings by 2028. This outlook assumes a 5.2% annual revenue growth and an earnings increase of $3.5 billion from the current $9.8 billion.

Uncover how Cisco Systems' forecasts yield a $72.14 fair value, a 5% upside to its current price.

Exploring Other Perspectives

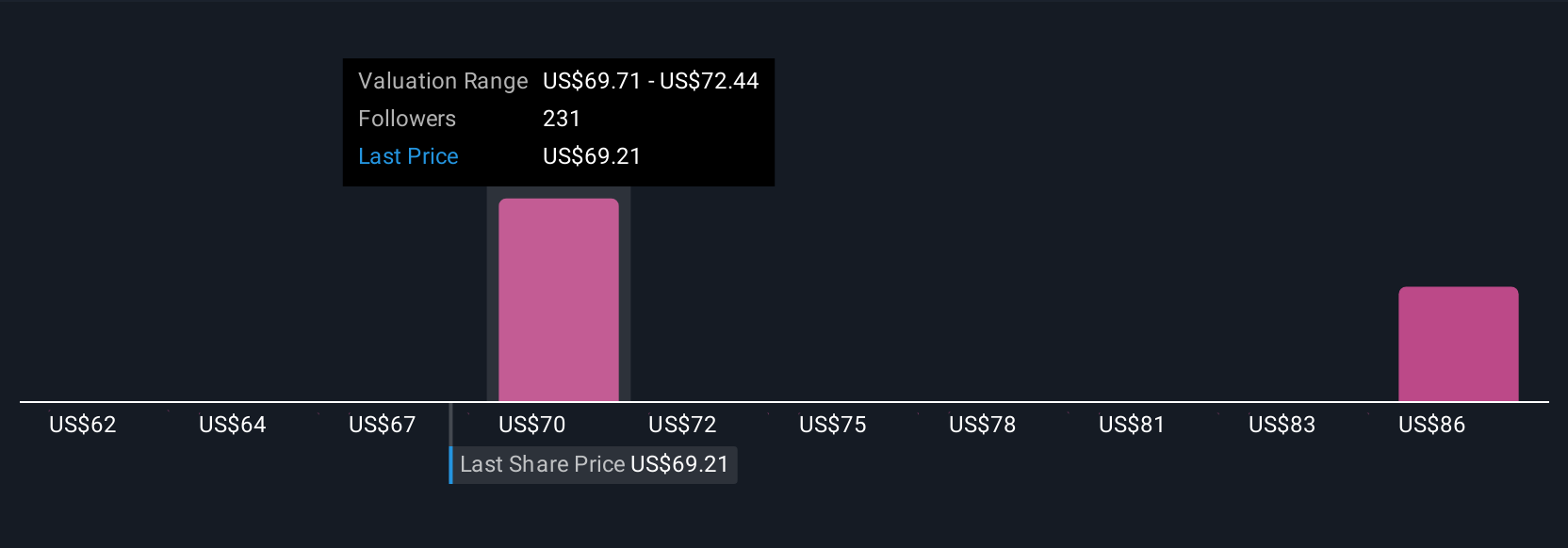

Eight members of the Simply Wall St Community estimate Cisco’s fair value from US$61.52 to US$95.19 per share. While some focus on recurring revenue catalysts, others highlight competitive threats, prompting wide differences in expectations.

Explore 8 other fair value estimates on Cisco Systems - why the stock might be worth as much as 39% more than the current price!

Build Your Own Cisco Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cisco Systems research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Cisco Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cisco Systems' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal