Does Analyst Optimism Reflect Deeper Strengths in TJX (TJX) Cash Flow and Earnings Quality?

- In recent days, analysts have expressed growing optimism about TJX Companies' near-term earnings outlook, citing a strong track record of surpassing earnings expectations and positive earnings indicator metrics.

- A closer look at TJX Companies' financials reveals that while its net income has outpaced cash generation, the company's cash flows remain solid, and capital expenditures currently account for a significant portion of cash from operations.

- We’ll explore how increased analyst confidence in TJX’s earnings momentum could influence the company’s long-term investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

TJX Companies Investment Narrative Recap

To be a TJX Companies shareholder, you need to believe in its ability to leverage global expansion, flexible merchandising, and robust cash flows to withstand margin pressures from rising store costs and real estate. The latest analyst optimism is rooted in TJX’s history of surpassing earnings expectations, igniting hopes for another short-term beat, but foreign exchange pressures and payroll expenses remain the biggest risks. The recent fraud incident, while unfortunate, is not expected to materially impact these broader earnings drivers.

Among recent announcements, TJX’s substantial share repurchases, over US$600 million last quarter, stand out as a move that reinforces the company’s confidence in its long-term value. This directly ties into the current market narrative, as returning capital to shareholders could temper the impact of margin headwinds and provide additional support for TJX’s investment case, especially as analyst expectations rise.

But with payroll costs and global headwinds looming, investors should also watch for signs of margin pressure that could offset earnings momentum...

Read the full narrative on TJX Companies (it's free!)

TJX Companies' outlook anticipates $67.1 billion in revenue and $6.1 billion in earnings by 2028. This projection is based on an annual revenue growth rate of 5.6% and a $1.3 billion increase in earnings from the current $4.8 billion.

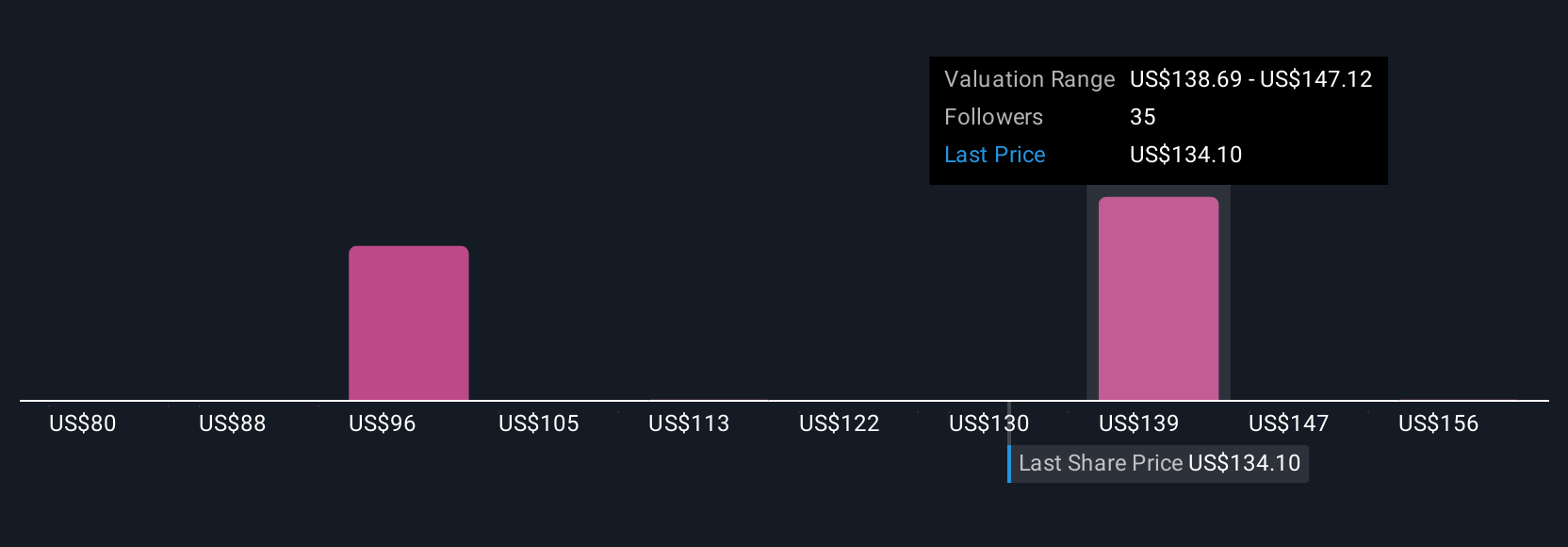

Uncover how TJX Companies' forecasts yield a $141.95 fair value, a 10% upside to its current price.

Exploring Other Perspectives

While the current consensus maintains a balanced outlook, the most optimistic analysts have forecast TJX’s annual revenue to reach US$71 billion and earnings to climb to US$6.5 billion by 2028. These forecasts assume that international expansion and e-commerce investments could unlock faster growth than others expect, but recent events and shifts in operational costs could test whether this level of optimism will hold. You’ll find many investors approach TJX from a range of expectations, so it’s useful to compare the full spectrum of opinions.

Explore 6 other fair value estimates on TJX Companies - why the stock might be worth as much as 10% more than the current price!

Build Your Own TJX Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TJX Companies research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free TJX Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TJX Companies' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal