How PriceSmart’s (PSMT) Soaring Shareholder Returns and Earnings Growth Could Shape Investor Sentiment

- Over the past three years, PriceSmart, Inc. has delivered robust compound earnings per share growth and total shareholder returns that outpaced the broader market, including dividends.

- Interestingly, while earnings growth has been strong, even greater gains in shareholder returns point to markedly improved investor sentiment toward the company over this period.

- With investor confidence on the rise, we'll explore how PriceSmart's multi-year performance may alter its investment outlook moving forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

PriceSmart Investment Narrative Recap

For anyone considering PriceSmart as an investment, the underlying belief hinges on the company's ability to expand its membership warehouse model in rapidly growing Latin American markets, driving top-line growth while managing operational risks linked to currency volatility and local regulations. The recent three-year surge in share price and strong total shareholder returns highlight a boost in investor optimism but do not fundamentally change the primary short-term catalyst, the success of new club openings in high-growth regions, or the ongoing risk from foreign currency headwinds, which remain significant concerns for near-term performance.

Among recent developments, PriceSmart’s third-quarter earnings release on July 10, 2025, is particularly relevant. The company posted year-over-year revenue and net income growth, reinforcing the core growth catalyst of expanding sales in both established and newer markets, even as external risks like FX volatility remain unresolved. The solid results align closely with the upbeat investor sentiment that has fueled the stock’s outperformance over the past year.

Yet in contrast, continued pressure from persistent currency and liquidity constraints in certain markets is a factor investors should not overlook, especially if...

Read the full narrative on PriceSmart (it's free!)

PriceSmart's outlook anticipates $6.9 billion in revenue and $209.1 million in earnings by 2028. This is based on a projected annual revenue growth rate of 10.1% and an earnings increase of $66.5 million from current earnings of $142.6 million.

Uncover how PriceSmart's forecasts yield a $111.67 fair value, in line with its current price.

Exploring Other Perspectives

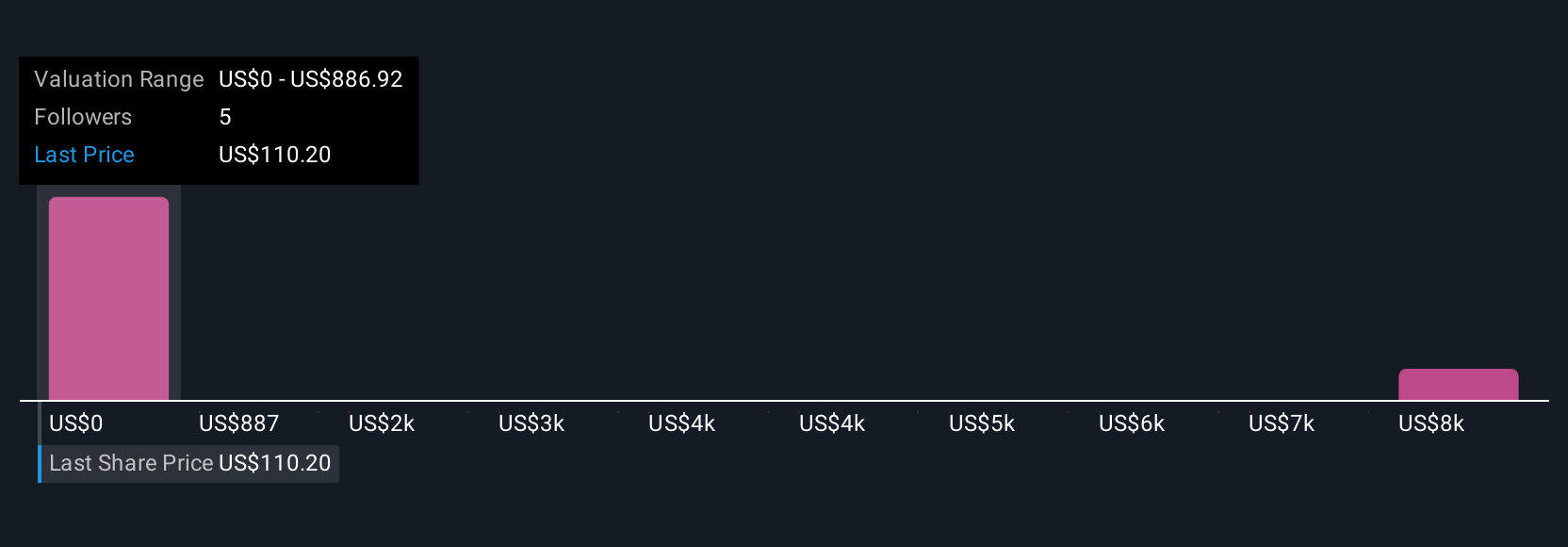

Fair value estimates from five Simply Wall St Community members span from US$886,922 to US$8,869,220, a striking display of differing outlooks. With currency headwinds still a central risk, your own view could shift as you compare these contrasting forecasts with the latest business momentum.

Explore 5 other fair value estimates on PriceSmart - why the stock might be a potential multi-bagger!

Build Your Own PriceSmart Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PriceSmart research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PriceSmart research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PriceSmart's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 25 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal