Exploring US Market's Undiscovered Gems With Three Promising Stocks

In the midst of a turbulent U.S. market, marked by recent declines in major indices such as the S&P 500 and Nasdaq due to weak job reports and renewed tariff concerns, investors are increasingly on the lookout for opportunities that might be overlooked in broader market volatility. Identifying promising stocks often involves finding companies with strong fundamentals and growth potential that can weather economic uncertainties, making them true "undiscovered gems" in today's challenging environment.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | NA | 3.34% | 3.70% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| FineMark Holdings | 115.14% | 2.22% | -28.34% | ★★★★★★ |

| Preformed Line Products | 7.86% | 6.57% | 8.22% | ★★★★★★ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Rich Sparkle Holdings | 26.73% | -6.13% | 1.75% | ★★★★★☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

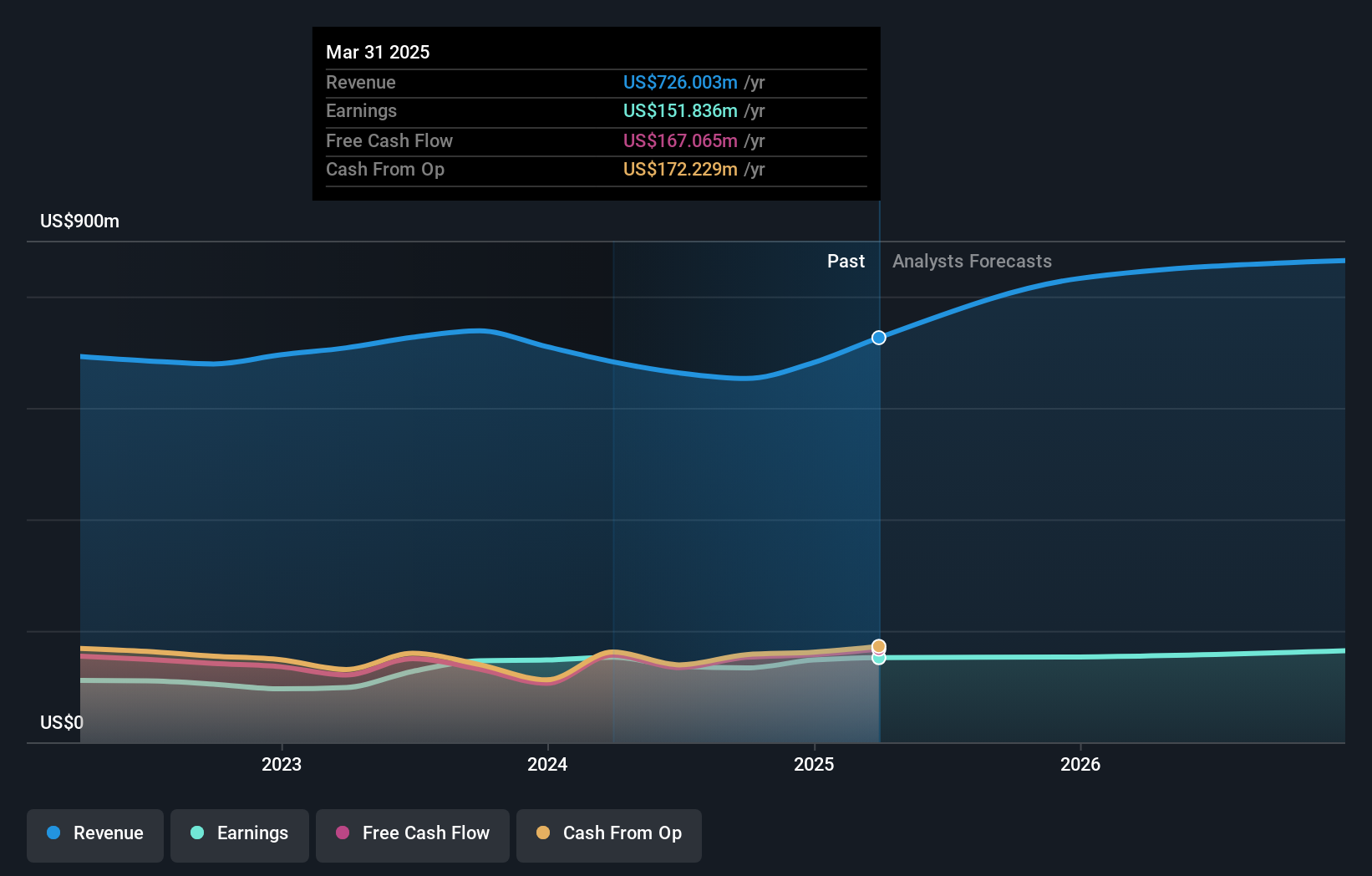

Perdoceo Education (PRDO)

Simply Wall St Value Rating: ★★★★★★

Overview: Perdoceo Education Corporation offers postsecondary education through online, campus-based, and blended learning programs in the United States, with a market capitalization of approximately $1.93 billion.

Operations: The primary revenue streams for Perdoceo Education Corporation come from Colorado Technical University, generating $468.05 million, and The American Intercontinental University System, contributing $289.98 million.

Perdoceo Education, a nimble player in the education sector, reported Q2 2025 revenue of US$209.58 million and net income of US$41.03 million, reflecting solid growth from the previous year. The company remains debt-free and trades at 73% below its estimated fair value, highlighting its potential as an undervalued asset. Recent strategic acquisitions like the University of St. Augustine for Health Sciences aim to diversify offerings and improve operational efficiencies, with analysts expecting an annual revenue growth rate of 11.5%. However, challenges such as regulatory scrutiny and integration issues may impact future profitability.

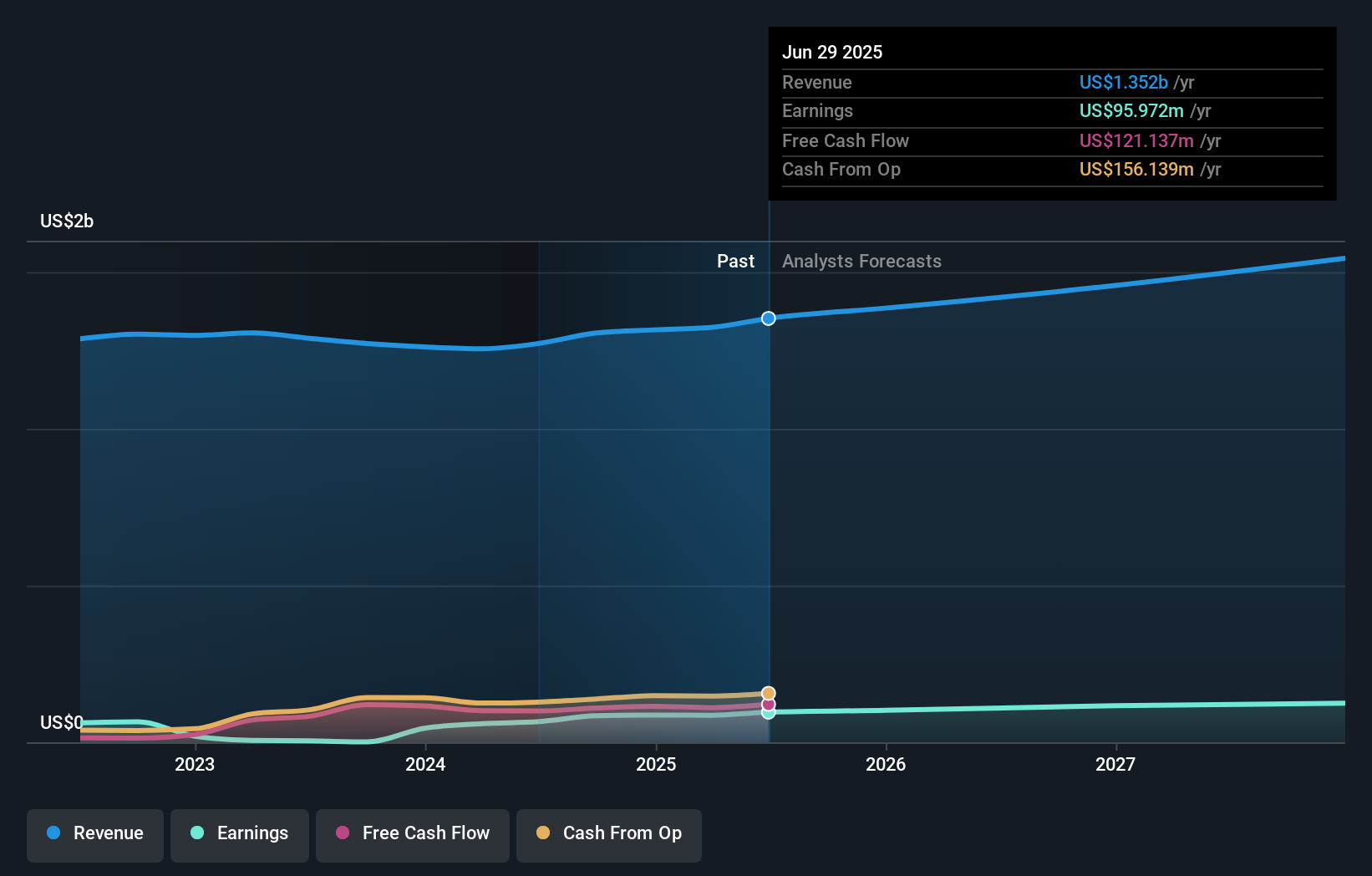

Interface (TILE)

Simply Wall St Value Rating: ★★★★★★

Overview: Interface, Inc. is a company that designs, produces, and sells modular carpet products across multiple continents including the United States, Canada, Latin America, Europe, Africa, Asia, and Australia with a market cap of approximately $1.44 billion.

Operations: Interface generates revenue primarily from its Americas segment, contributing approximately $835.31 million, and the Europe, Africa, Asia, and Australia segment with about $516.95 million.

Interface has been making waves with its strategic focus on innovation and sustainability, aiming for carbon negativity by 2040. Over the past year, earnings grew by 45%, outpacing the Commercial Services industry average of 6.5%. The company's net debt to equity ratio stands at a satisfactory 31.8%, reflecting sound financial management as it reduced from 247% over five years. Recently added to multiple Russell indexes, Interface is trading at a significant discount of about 69% below estimated fair value. With raised sales guidance for fiscal year 2025 and new product launches, Interface is positioned for potential growth despite macroeconomic challenges.

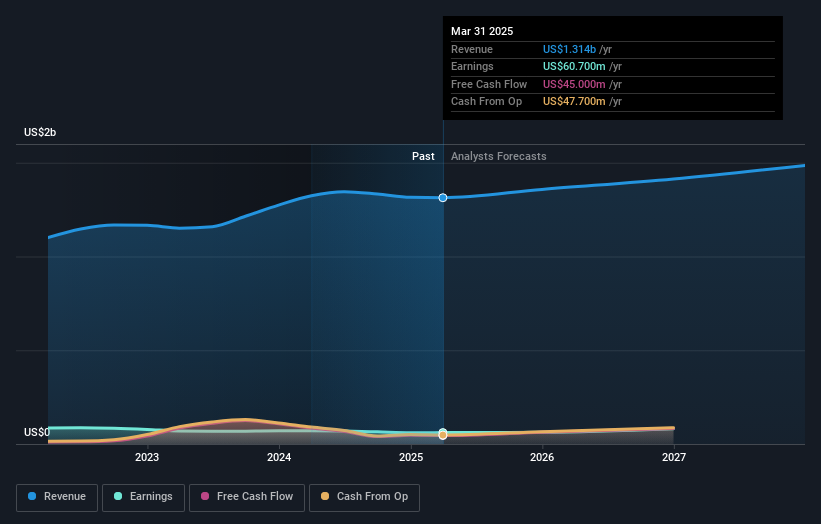

Global Industrial (GIC)

Simply Wall St Value Rating: ★★★★★★

Overview: Global Industrial Company operates as an industrial distributor of MRO products in the United States and Canada, with a market cap of $1.27 billion.

Operations: Global Industrial generates revenue primarily through its Industrial Products Group, which reported $1.32 billion in sales.

Global Industrial, a nimble player in the industrial distribution sector, showcases its strategic agility with an asset-light model and no debt burden. Recent earnings for Q2 2025 revealed sales of US$358.9 million and net income of US$25.1 million, reflecting a steady climb from last year's figures. The company's focus on digital transformation and high-value accounts aims to enhance efficiency while navigating rising costs and competitive pressures. Trading at 41% below estimated fair value, it offers potential upside with projected earnings growth of 14% annually over the next five years despite recent negative earnings growth of -4.9%.

Make It Happen

- Access the full spectrum of 293 US Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal