Albertsons’ New Union Deal Might Change the Case for Investing in Albertsons Companies (ACI)

- In late July 2025, Albertsons Companies reached a tentative agreement with three major union locals, securing meaningful wage increases, enhanced retirement and healthcare benefits, and stronger job protections for more than 25,000 Safeway, Vons, and Albertsons workers across California.

- This agreement follows months of negotiations and the threat of a large-scale walkout, suggesting a significant reduction in the risk of operational disruption and labor uncertainty for the company.

- We'll explore how this new labor deal, which resolves months of labor tension, could shape Albertsons' investment outlook and financial assumptions.

We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Albertsons Companies Investment Narrative Recap

To be a shareholder in Albertsons Companies today is to believe in the company’s ability to improve operational stability, drive digital and omnichannel growth, and manage costs despite robust competition and industry pressures. The recent tentative labor agreement may lower near-term risk of large-scale disruption, but rising wage and benefit costs could remain the most important risk to margins, even as digital expansion and loyalty programs are widely considered key short-term drivers of performance.

One recent announcement of interest is the July 29 filing by Oxfam America, urging shareholders to support a request for a comprehensive human rights policy report by Albertsons. While this proposal highlights increasing investor and regulatory scrutiny around corporate accountability, it does not appear to substantially impact the immediate catalysts related to operations or labor dynamics. Instead, it reflects broader governance trends that may gradually influence long-term investment assumptions.

But while the risk of near-term labor disruption may be lower, investors should also be aware that continued wage pressures could still impact...

Read the full narrative on Albertsons Companies (it's free!)

Albertsons Companies' outlook anticipates $86.3 billion in revenue and $1.0 billion in earnings by 2028. This projection relies on a 2.1% annual revenue growth rate and a $45.7 million increase in earnings from the current $954.3 million.

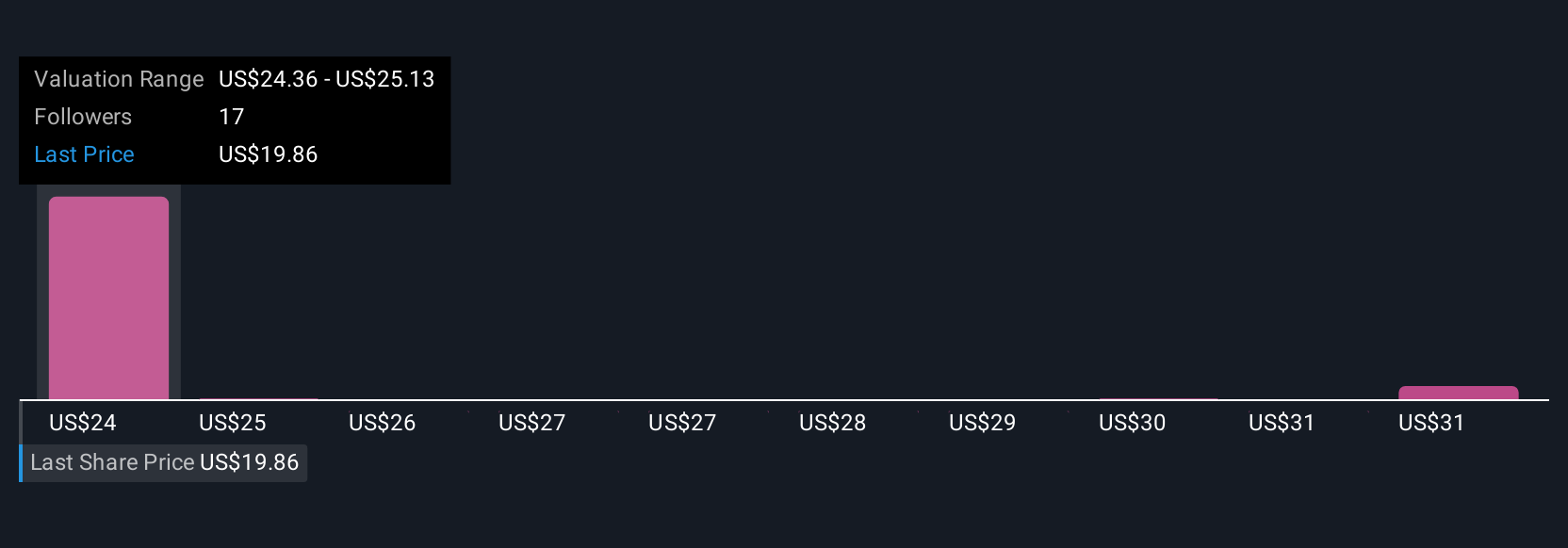

Uncover how Albertsons Companies' forecasts yield a $24.42 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Five Simply Wall St Community members estimate Albertsons’ fair value between US$24.42 and US$34.11 per share, showing wide opinion diversity. At the same time, continued wage and benefit pressures could have ripple effects beyond headline labor peace, making it worth exploring other community perspectives.

Explore 5 other fair value estimates on Albertsons Companies - why the stock might be worth just $24.42!

Build Your Own Albertsons Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Albertsons Companies research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Albertsons Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Albertsons Companies' overall financial health at a glance.

No Opportunity In Albertsons Companies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal