How Record Earnings and Expanded Buybacks at KLA (KLAC) Have Changed Its Investment Story

- KLA Corporation recently reported its fourth-quarter and full-year 2025 earnings, posting quarterly revenue of US$3.17 billion and net income of US$1.20 billion, both up strongly from the previous year, and additionally announced optimistic guidance for the upcoming quarter.

- The company also increased its quarterly dividend and authorized a new US$5 billion share repurchase plan, highlighting management's confidence in its ongoing cash generation and shareholder returns.

- We'll examine how KLA's record financial results and expanded capital return initiatives influence the company's overall investment narrative.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

KLA Investment Narrative Recap

Investors in KLA must believe in the company's leading role in semiconductor process control and its exposure to AI-driven demand, but also remain mindful of the risks from evolving global trade policy and export controls. The latest record quarterly earnings are impressive and may support near-term momentum, yet they do not fundamentally change the primary immediate catalyst, the pace of AI infrastructure investment, or the biggest risk, which remains the unpredictable impact of tariffs and export restrictions, especially involving China. This news affirms KLA’s strong current traction, but potential margin pressures from external headwinds still deserve close attention.

Among recent announcements, KLA’s new US$5 billion share repurchase plan stands out as especially relevant in the context of robust earnings and cash generation. This move suggests continued shareholder returns as a priority, aligning capital allocation with investor interests, while the company navigates a period marked by both heightened demand and global policy risks.

By contrast, the unpredictability of tariff-related costs and China policy changes remains an area investors should be aware of, particularly as...

Read the full narrative on KLA (it's free!)

KLA's narrative projects $14.1 billion revenue and $4.9 billion earnings by 2028. This requires 6.8% yearly revenue growth and a $1.2 billion earnings increase from $3.7 billion today.

Uncover how KLA's forecasts yield a $870.38 fair value, in line with its current price.

Exploring Other Perspectives

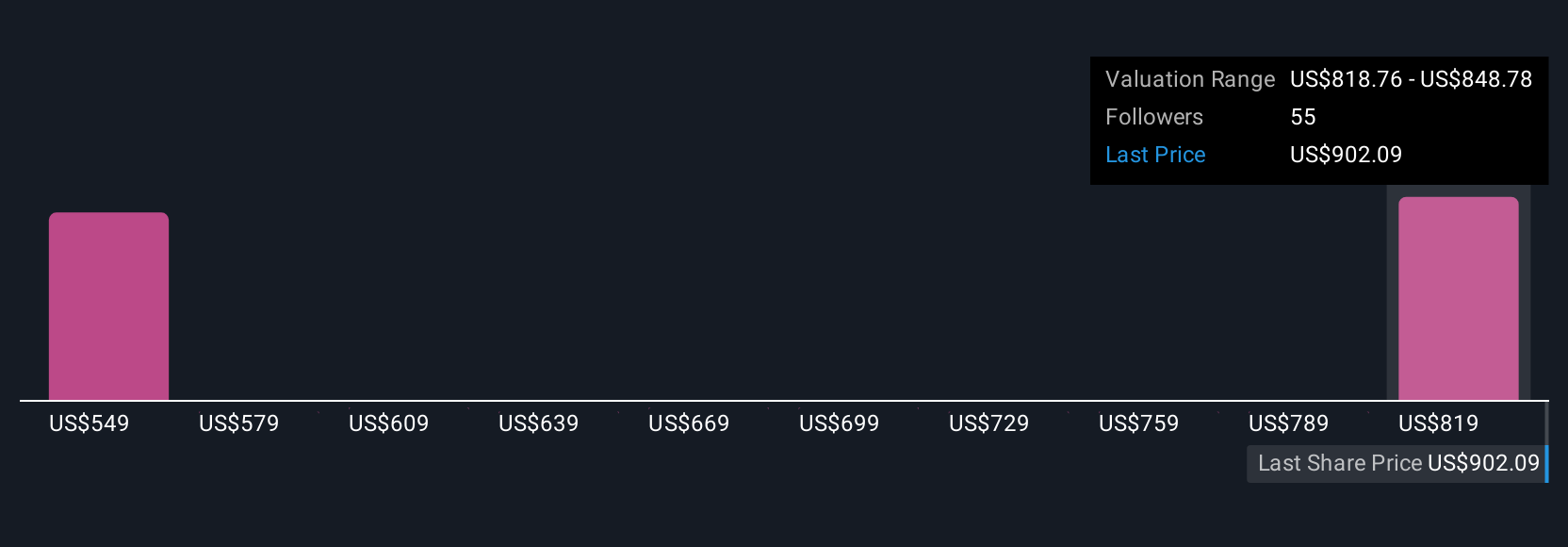

Five fair value estimates from the Simply Wall St Community range from US$542.61 to US$870.38 per share. With KLA’s recent earnings highlighting strong cash flow and share buybacks, investors should compare these diverse community valuations to evolving risks around tariffs and policy restrictions.

Explore 5 other fair value estimates on KLA - why the stock might be worth as much as $870.38!

Build Your Own KLA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KLA research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free KLA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KLA's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal