What PepsiCo (PEP)'s Dividend Hike Debt Offering and Health Push Signal for Shareholders

- In late July 2025, PepsiCo declared a quarterly dividend of US$1.4225 per share, reflecting a 5% increase over the previous year, and completed a US$3.48 billion debt offering to fund general corporate purposes including repayment of commercial paper.

- The company also announced the launch of Pepsi Prebiotic Cola and continued a broader push into health-focused products, indicating an ongoing commitment to meet evolving consumer preferences and support portfolio diversification.

- We will explore how PepsiCo’s emphasis on health-conscious product innovation may influence its current investment narrative and future outlook.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

PepsiCo Investment Narrative Recap

Investors in PepsiCo share a belief in the company’s ability to navigate evolving consumer tastes while driving steady returns through its global beverage and snacks portfolio. Recent announcements of higher dividends and successful debt financing do not materially alter the most important short-term catalyst, faster penetration of health-conscious products, nor mitigate the biggest near-term risk: sluggish North American beverage demand amid cost pressures and ongoing restructuring.

Among the latest developments, PepsiCo’s launch of Pepsi Prebiotic Cola directly addresses shifting consumer preferences toward lower-sugar, functional beverages. While innovation in this area supports the company's growth ambitions, the pace at which healthier alternatives gain traction remains key to whether this catalyst can offset stagnating core product volumes.

Yet, as health trends accelerate, investors should be aware that slower adoption of new alternatives could mean PepsiCo’s traditional categories are facing...

Read the full narrative on PepsiCo (it's free!)

PepsiCo's outlook anticipates $101.0 billion in revenue and $11.8 billion in earnings by 2028. This scenario is based on a 3.2% annual revenue growth rate and a $4.2 billion earnings increase from current earnings of $7.6 billion.

Uncover how PepsiCo's forecasts yield a $152.65 fair value, a 10% upside to its current price.

Exploring Other Perspectives

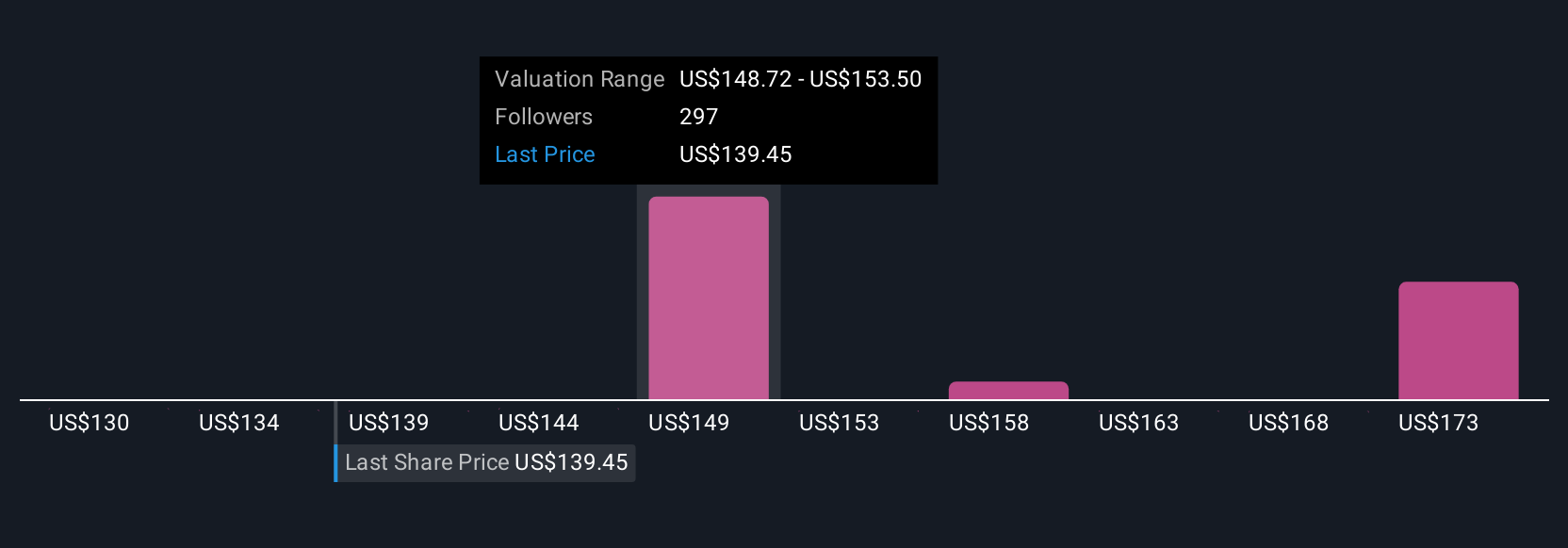

Thirty community contributors on Simply Wall St value PepsiCo between US$129.62 and US$189.92 per share. While opinions are wide ranging, several highlight the urgency of healthier, functional product adoption as a key to future performance.

Explore 30 other fair value estimates on PepsiCo - why the stock might be worth as much as 36% more than the current price!

Build Your Own PepsiCo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PepsiCo research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free PepsiCo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PepsiCo's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal