How Star Bulk’s Dividend Streak and Earnings Beat Could Reshape Sentiment for SBLK Investors

- Star Bulk Carriers Corp., a Greece-based dry bulk shipping company, announced a US$0.05 per share dividend, the 17th consecutive quarter of capital returns, while recently reporting revenue and EPS figures that topped consensus estimates.

- While the company has outperformed on recent earnings, investor caution has persisted, with skepticism about Star Bulk's ability to deliver on future growth forecasts despite positive analyst revisions.

- We will review how Star Bulk’s stronger-than-expected earnings surprise and ongoing capital returns influence its investment narrative going forward.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Star Bulk Carriers Investment Narrative Recap

To be a shareholder in Star Bulk Carriers, you need to believe in the company's ability to convert its scale and operational efficiency into resilient earnings, even as dry bulk shipping faces cyclicality and global uncertainty. The recent dividend announcement and outperformance on earnings provide some reassurance; however, neither development materially changes the central short-term catalyst, which remains the post-integration gains from the Eagle Bulk acquisition. The biggest risk continues to be Star Bulk’s high debt load if earnings growth doesn't keep pace or if interest rates rise.

Among recent announcements, the company's repurchase of over 1.2 million shares in May stands out in the context of ongoing capital returns. With the stock trading at a discount to consensus price targets despite positive earnings surprises, these buybacks could bolster per-share earnings, especially if synergy gains and operational optimizations meet expectations over the coming quarters.

However, investors should be aware that despite improved earnings and continued capital returns, the company’s $1.3 billion in debt could remain a concern if...

Read the full narrative on Star Bulk Carriers (it's free!)

Star Bulk Carriers is expected to generate $1.0 billion in revenue and $424.1 million in earnings by 2028. This forecast assumes a 5.9% annual revenue decline and a $193.8 million increase in earnings from the current level of $230.3 million.

Uncover how Star Bulk Carriers' forecasts yield a $20.82 fair value, a 13% upside to its current price.

Exploring Other Perspectives

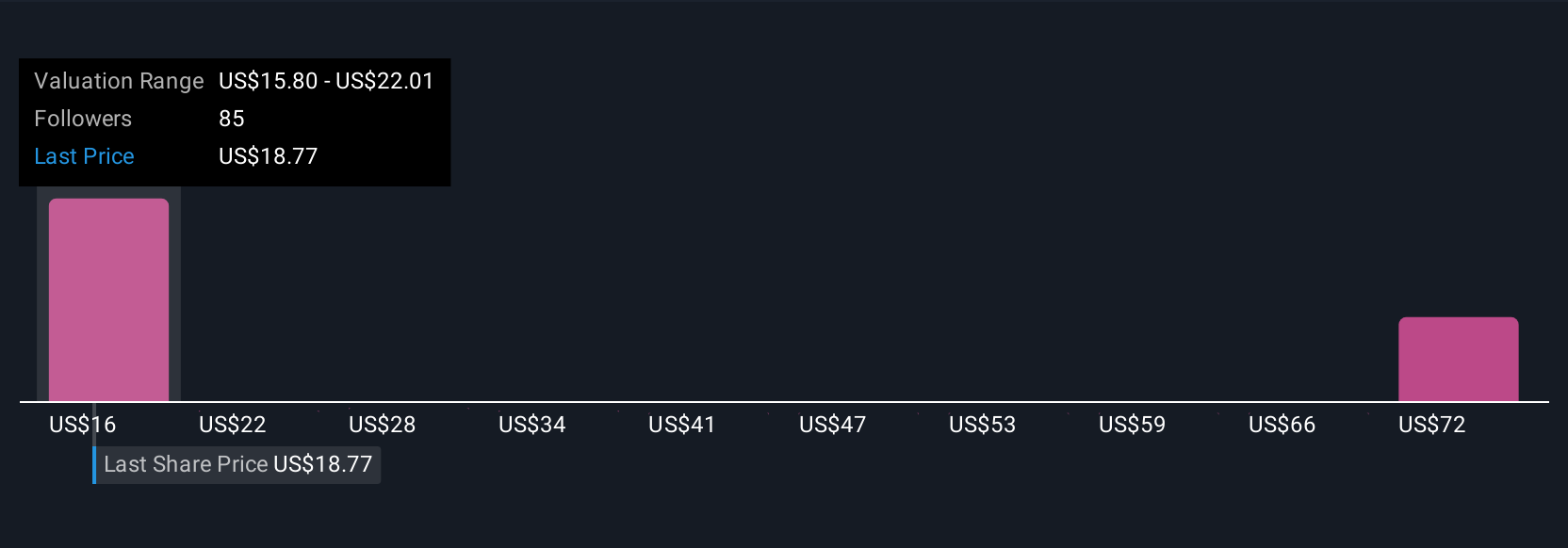

Ten members of the Simply Wall St Community value Star Bulk Carriers between US$15.80 and US$75.21, reflecting wide differences in outlook. While some are optimistic, the company's substantial debt load continues to influence market sentiment and outlook on its future growth.

Explore 10 other fair value estimates on Star Bulk Carriers - why the stock might be worth 14% less than the current price!

Build Your Own Star Bulk Carriers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Star Bulk Carriers research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Star Bulk Carriers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Star Bulk Carriers' overall financial health at a glance.

No Opportunity In Star Bulk Carriers?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal