Celcuity (CELC) Is Up 189.8% After Positive Phase 3 Breast Cancer Trial Results and FDA Plans

- Celcuity recently announced highly positive topline results from its Phase 3 VIKTORIA-1 trial, in which gedatolisib, combined with other therapies, significantly reduced the risk of disease progression or death for patients with HR+/HER2- advanced breast cancer and showed an improved safety profile, with plans to submit a New Drug Application to the FDA by year-end.

- This outcome marks a potential advance in targeted cancer therapy, as both triplet and doublet combinations outperformed prior benchmarks for efficacy and patient tolerability in this clinical setting.

- We'll explore how these robust Phase 3 findings and the impending FDA application shape Celcuity's investment narrative, particularly given its innovative therapeutic approach.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Celcuity's Investment Narrative?

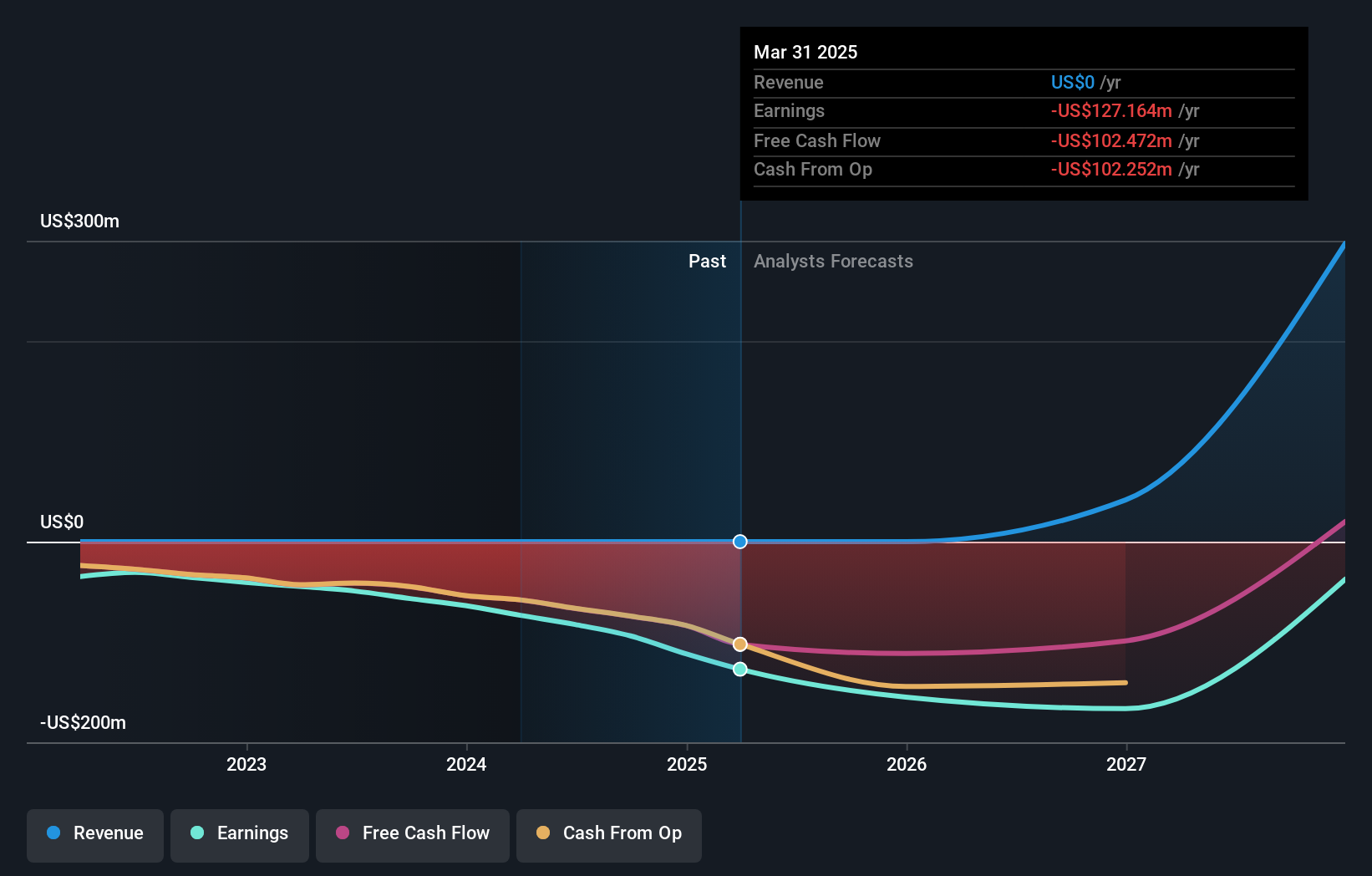

To own Celcuity shares today, you’d need to believe in the long-term potential of their novel cancer therapies, with a particular focus on gedatolisib after the breakthrough Phase 3 VIKTORIA-1 results. The news, which sent the stock soaring to all-time highs, has shifted the most important short-term catalyst firmly to the FDA submission expected by year-end. With positive late-stage data and Breakthrough Therapy Designation in hand, Celcuity seems closer than ever to possible commercialization, but this success also heightens attention on regulatory milestones and commercialization execution risks. Recent equity and convertible bond offerings have boosted cash reserves, potentially providing a buffer for ongoing development, but further dilution risk and a lack of revenue remain central challenges. While the clinical win has transformed the narrative, critical questions around FDA approval and sustained funding still matter most for the near future.

But even with VIKTORIA-1’s success, future dilution risks are something investors should factor in. Celcuity's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on Celcuity - why the stock might be worth over 9x more than the current price!

Build Your Own Celcuity Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Celcuity research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Celcuity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Celcuity's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 25 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal