Did Analyst Caution Before Earnings Change the Long-Term Thesis for Royalty Pharma (RPRX)?

- Royalty Pharma is approaching its quarterly earnings announcement, with analysts expecting higher revenues but noting that recent analyst sentiment around earnings has become more cautious.

- This shift in analyst outlook has introduced uncertainty about whether the company can surpass consensus forecasts, drawing attention to the potential for surprises in the forthcoming report.

- We'll explore how these tempered analyst expectations ahead of earnings may affect Royalty Pharma's long-term investment narrative and forecast assumptions.

Find companies with promising cash flow potential yet trading below their fair value.

Royalty Pharma Investment Narrative Recap

Owning Royalty Pharma often means believing in the continued growth of its diverse royalty portfolio and sustained returns from leading therapies in biotech. Recent analyst caution ahead of the upcoming earnings call may fuel short-term volatility, but for long-term shareholders, this sentiment shift is not material unless it is accompanied by meaningful changes to portfolio performance or deal flow, which remains a bigger risk to the business than any single quarter’s results.

The most relevant recent announcement is the $2 billion financing deal with Revolution Medicines, which expands Royalty Pharma’s synthetic royalty exposure and highlights the company’s ambition to broaden its addressable market. As this strategy becomes a more important driver of future returns, investor focus will likely shift to the scalability of synthetic royalties, now central to near-term catalysts discussed by analysts.

In contrast, while the synthetic royalty market offers promise, investors should be aware that its scalability and adoption remain uncertain if...

Read the full narrative on Royalty Pharma (it's free!)

Royalty Pharma's outlook projects $3.7 billion in revenue and $1.4 billion in earnings by 2028. This scenario requires 18.3% annual revenue growth and a $0.3 billion increase in earnings from $1.1 billion today.

Uncover how Royalty Pharma's forecasts yield a $42.15 fair value, a 14% upside to its current price.

Exploring Other Perspectives

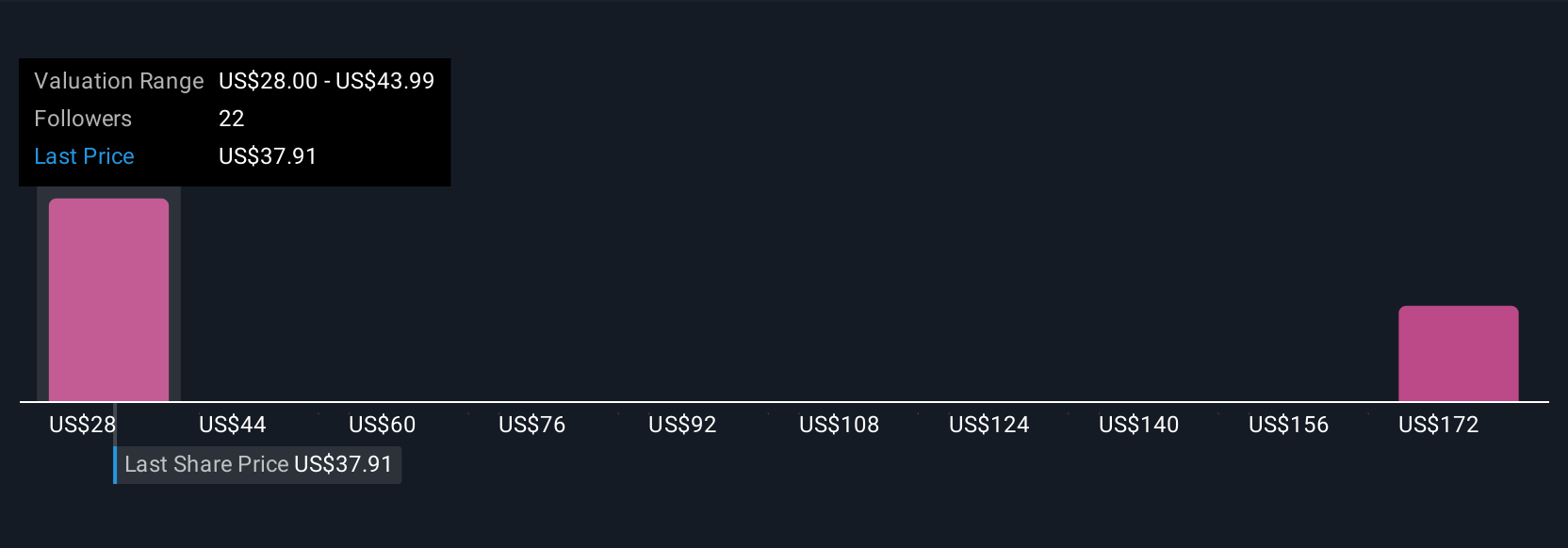

Fair value estimates from four Simply Wall St Community members range from US$28 to US$201.90 per share, reflecting far-reaching views on Royalty Pharma’s outlook. If synthetic royalties do not scale as anticipated, the underlying growth assumptions among these investors could face real challenges, see how differing opinions can shape your understanding.

Explore 4 other fair value estimates on Royalty Pharma - why the stock might be worth over 5x more than the current price!

Build Your Own Royalty Pharma Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Royalty Pharma research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Royalty Pharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Royalty Pharma's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal