Did Soaring Profits and a Higher Dividend Just Shift AngloGold Ashanti's (AU) Investment Narrative?

- In the past week, AngloGold Ashanti reported a very large increase in second-quarter net income to US$1.11 billion and announced an interim dividend of US$0.80 per share, following significant growth in both gold production and profit, driven largely by higher gold prices and operational improvements.

- With its addition to major US equity indexes and a reaffirmed production outlook, the company’s increased visibility and clear operational momentum highlight growing investor confidence and a strengthened position in the global gold mining sector.

- We’ll now examine how AngloGold Ashanti’s sharp profit growth and increased dividend could influence its forward-looking investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

AngloGold Ashanti Investment Narrative Recap

For investors considering AngloGold Ashanti, the story hinges on the company's ability to sustain margin expansion through disciplined cost management and capitalizing on strong gold prices. The latest surge in profit and dividend signals effective operational execution, but does not alter the most important short-term factors: ongoing gold price volatility remains the key catalyst, while any unexpected cost escalation is still the biggest risk to watch. These updates reflect progress, yet the fundamental drivers have not seen a material shift.

Among recent announcements, the reaffirmation of 2025 production and cost guidance stands out as particularly relevant. This commitment provides a degree of predictability for shareholders as the company continues efforts to deliver stable output and curb cost pressures, critical factors with gold price movements dictating near-term sentiment.

However, despite the upbeat results, investors should be aware that cost pressures remain a risk if...

Read the full narrative on AngloGold Ashanti (it's free!)

AngloGold Ashanti's outlook anticipates $9.8 billion in revenue and $2.9 billion in earnings by 2028. This requires 14.1% annual revenue growth and a $1.5 billion earnings increase from the current $1.4 billion level.

Uncover how AngloGold Ashanti's forecasts yield a $51.67 fair value, a 6% upside to its current price.

Exploring Other Perspectives

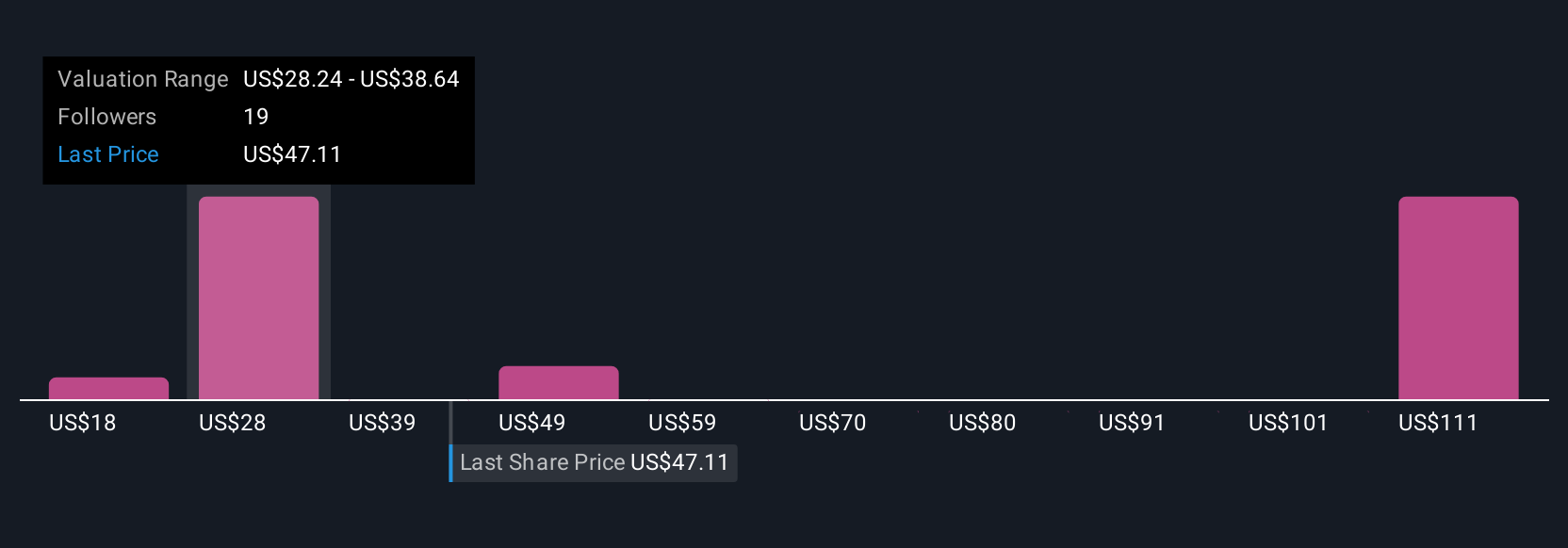

Eleven members of the Simply Wall St Community estimate AngloGold Ashanti's fair value between US$17.84 and US$124.44 per share, showing broad differences in outlook. While forecasts reflect strong operating trends, views on future cost control shape diverse expectations for earnings consistency, encouraging you to compare multiple perspectives.

Explore 11 other fair value estimates on AngloGold Ashanti - why the stock might be worth over 2x more than the current price!

Build Your Own AngloGold Ashanti Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AngloGold Ashanti research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free AngloGold Ashanti research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AngloGold Ashanti's overall financial health at a glance.

No Opportunity In AngloGold Ashanti?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal