What Lam Research (LRCX)'s Strong Earnings Growth Signals for Shareholders

- Lam Research recently reported its earnings for the full year and fourth quarter ended June 29, 2025, with annual sales rising to US$18.44 billion and net income reaching US$5.36 billion, both increasing from the previous year.

- The company’s new guidance for the upcoming quarter points to continued strong performance, highlighting ongoing customer demand and operational momentum.

- We’ll examine how Lam Research’s significant improvement in quarterly net income could shape its future investment outlook and ongoing business narrative.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Lam Research Investment Narrative Recap

To believe in Lam Research as a shareholder, you'd need to trust in ongoing demand for semiconductor equipment and the company's ability to gain market share through product innovation and operational efficiency. The latest earnings news, showing robust revenue and net income growth, reinforces confidence in the near-term catalyst of technology adoption, while the biggest current risk, exposure to tariffs and trade restrictions, remains; the impact from recent results doesn’t materially change this risk profile.

The newly issued earnings guidance for the upcoming quarter, which projects revenue of US$5.20 billion plus or minus US$300 million and net income per diluted share around US$1.20, is directly relevant. This outlook highlights confidence in sustained customer activity, a key short-term catalyst underpinning Lam’s momentum, even as investors continue to watch for shifts in the broader economic or regulatory environment.

Yet, investors should not overlook...

Read the full narrative on Lam Research (it's free!)

Lam Research's outlook projects $21.9 billion in revenue and $6.2 billion in earnings by 2028. To reach these levels, analysts expect annual revenue growth of 8.5% and an earnings increase of $1.5 billion from the current $4.7 billion.

Uncover how Lam Research's forecasts yield a $100.45 fair value, a 4% upside to its current price.

Exploring Other Perspectives

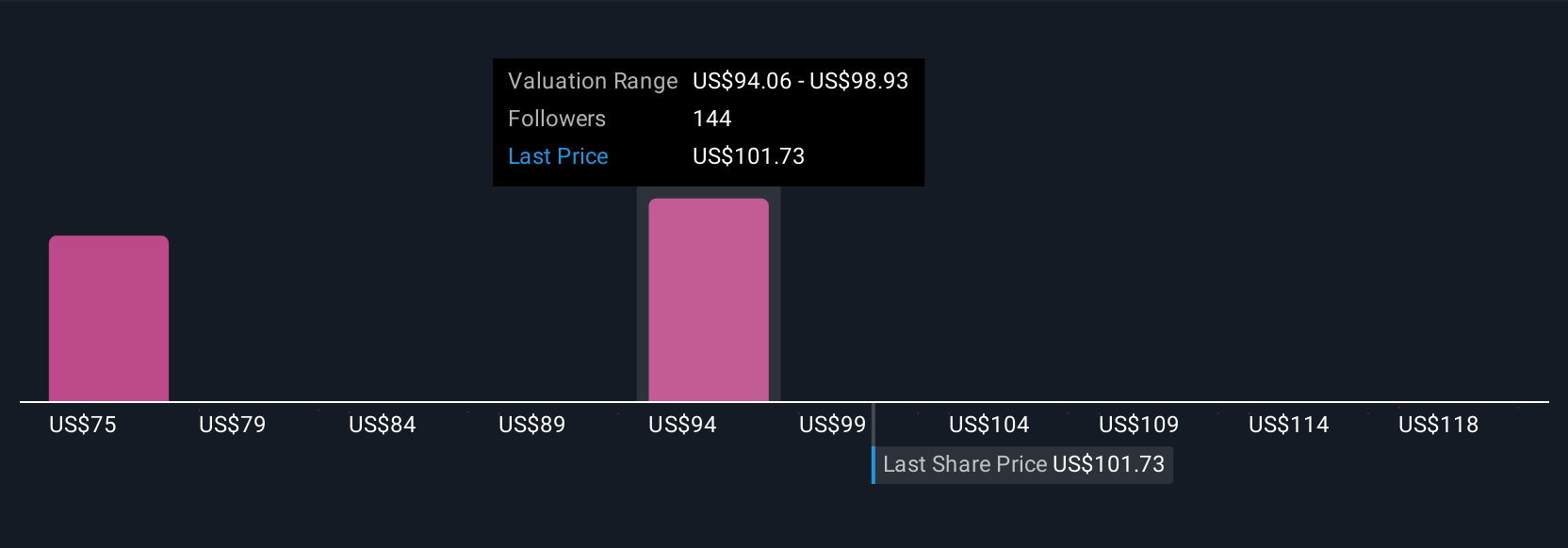

Sixteen private investors in the Simply Wall St Community have fair value estimates for Lam Research ranging from US$58.97 to US$125 per share. Amid this wide spread, many are considering the catalyst of accelerating customer demand and the risks of tariff exposure when evaluating Lam’s future.

Explore 16 other fair value estimates on Lam Research - why the stock might be worth as much as 30% more than the current price!

Build Your Own Lam Research Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lam Research research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Lam Research research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lam Research's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 21 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 25 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal