KLA (KLAC) Announces Q4 Earnings Growth With Revenue Surpassing US$3 Billion

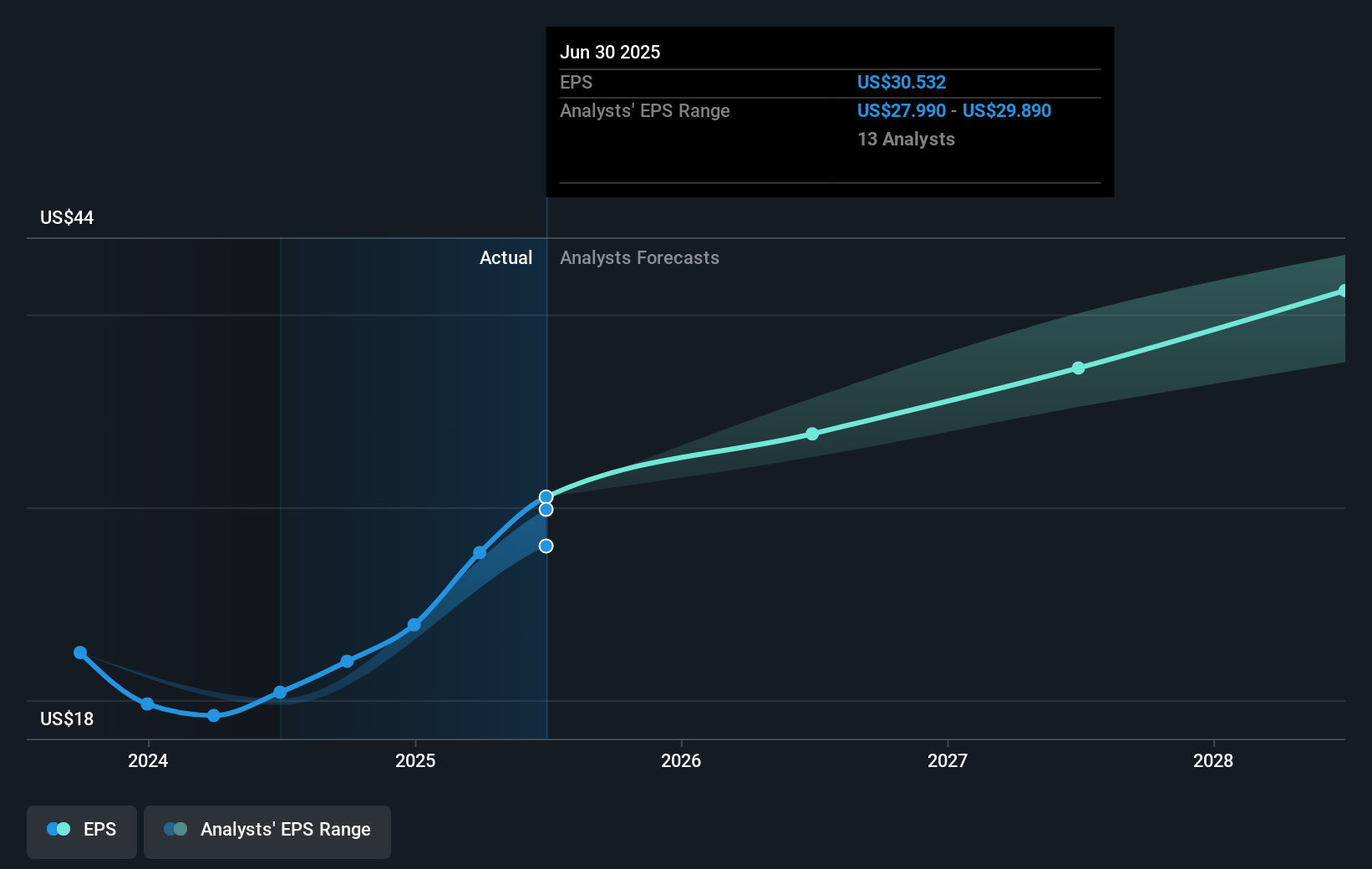

KLA (KLAC) recently reported strong financial results for the fourth quarter, with revenue reaching $3.2 billion and net income improving to $1.2 billion, up notably from the previous year. The company's positive earnings trends, highlighted by a significant increase in both basic and diluted EPS, likely contributed to its stock price surge of 26% over the last quarter. Indeed, the broader market had posted solid gains, buoyed by optimism about strong corporate earnings, which KLA's results would have supported. Additionally, KLA's confident guidance for fiscal year 2026 could have bolstered investor sentiment against the backdrop of tariff concerns and market fluctuations.

You should learn about the 1 possible red flag we've spotted with KLA.

Rare earth metals are the new gold rush. Find out which 24 stocks are leading the charge.

KLA's robust financial results for the fourth quarter have further strengthened its narrative of capitalizing on advanced packaging and AI tools. The reported revenue of $3.2 billion and net income of $1.2 billion underline the company's capacity to enhance revenue and margin growth, driven by strong demand in AI infrastructure and e-beam technologies. Over the last five years, KLA's total return, including share price and dividends, was a very large 357.64%. This long-term performance highlights the company's ability to generate significant shareholder value, providing a solid context to its recent 26% share price surge in the last quarter.

When considering its performance over the past year, KLAC's growth of 41.6% in earnings surpassed the Semiconductor industry's decline of 0.6%, although the company's share price underperformed the broader US Semiconductor industry, which returned 45.6%. This context emphasizes KLAC's relative strength in earnings growth while still facing competitive pressures. The company's revenue and earnings forecasts could be positively reinforced by its successful tariff mitigation strategies and innovation in wafer-level packaging. Nonetheless, geopolitical uncertainties pose risks that could affect earnings stability. Currently, KLAC is trading slightly above consensus analyst price targets, with a minor 0.98% difference from the target of $870.38, suggesting general confidence in its valuation but a close alignment with expected earnings trajectories.

Evaluate KLA's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal