Hawkins (HWKN) Is Up 5.4% After Dividend Hike and Earnings Beat – What's Changed

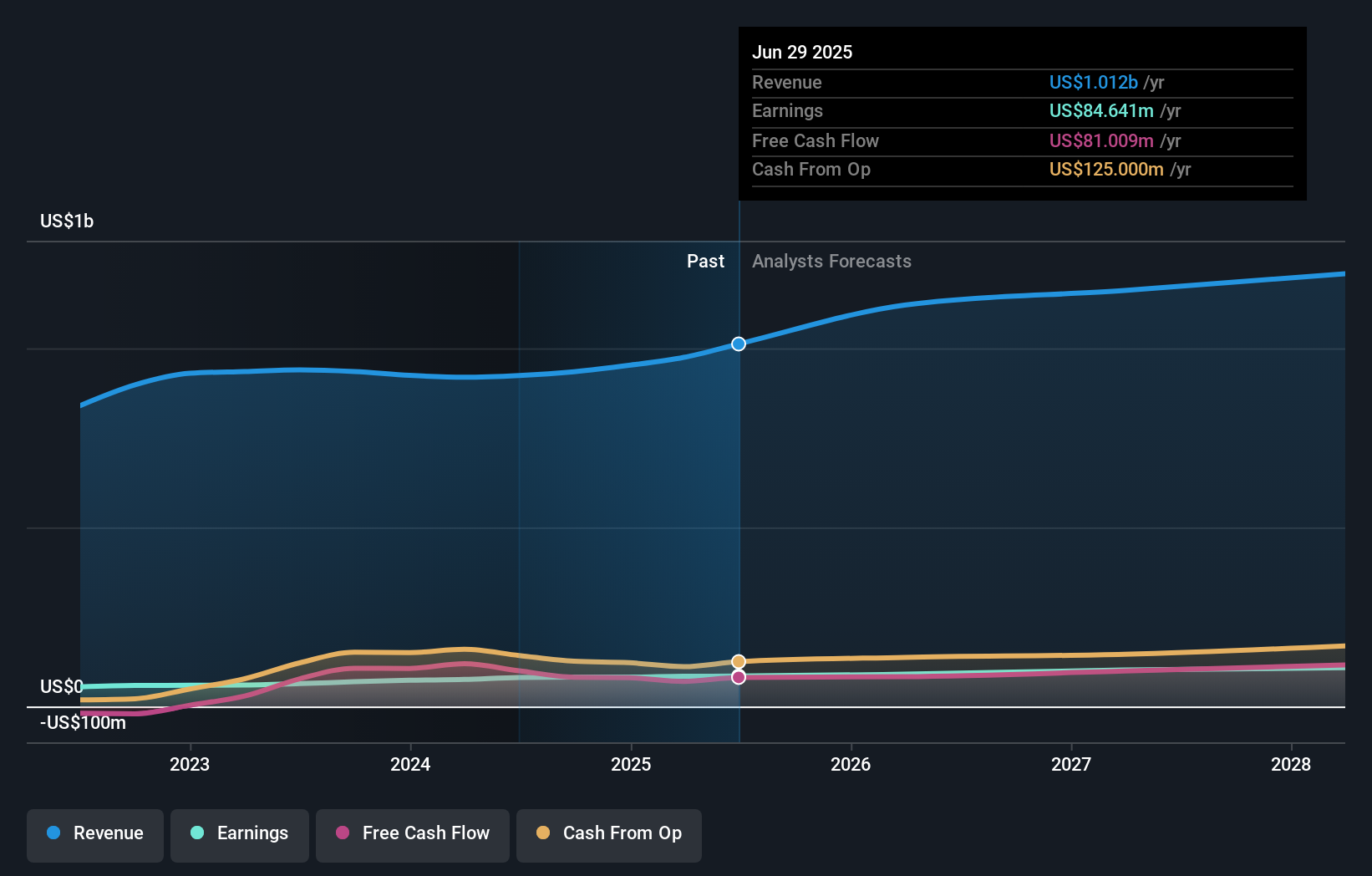

- Hawkins, Inc. recently posted first quarter earnings showing revenue of US$293.27 million and net income of US$29.18 million, both up from the prior year, alongside a 6% quarterly dividend increase to US$0.19 per share.

- This combination of financial growth and increased shareholder returns follows fresh analyst coverage that has drawn new attention to the company.

- We'll explore how Hawkins' decision to raise its dividend reinforces its investment narrative and shareholder appeal.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Hawkins' Investment Narrative?

To see Hawkins as a long-term holding, investors typically focus on its ability to combine steady growth with consistent shareholder returns. The recent jump in revenue and higher net income, topped off by a 6% rise in the quarterly dividend, seems to strengthen this appeal. These improvements are supported by new analyst coverage, which has piqued interest and contributed to a recent share price rally. With quarterly numbers up and management signaling confidence by boosting the dividend, the immediate risk profile shifts: near-term catalysts, such as further buybacks or strategic acquisitions, may see increased investor optimism. However, given Hawkins’ elevated price-to-earnings ratio, modest profit margin compression, and slower growth forecasts compared to the broader market, new gains could be harder to come by. The latest results may dampen short-term downside risks somewhat, but the biggest issue, valuation, remains front and center.

In contrast, the company’s high valuation is a key risk you should review in detail.

Exploring Other Perspectives

Explore another fair value estimate on Hawkins - why the stock might be worth 5% less than the current price!

Build Your Own Hawkins Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hawkins research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Hawkins research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hawkins' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal