US Market's Undiscovered Gems for August 2025

As the United States market navigates a complex landscape of fluctuating indices and economic indicators, small-cap stocks are drawing attention amid broader market sentiment shifts. With major indexes like the S&P 500 experiencing both gains and losses, investors are keen to identify promising opportunities that may have been overlooked. In this environment, discovering stocks with strong fundamentals and growth potential becomes crucial for those seeking to capitalize on the evolving dynamics of today's market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Southern Michigan Bancorp | 117.38% | 8.87% | 4.89% | ★★★★★★ |

| Oakworth Capital | 87.50% | 15.82% | 9.79% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 12.79% | -0.59% | ★★★★★★ |

| Sound Financial Bancorp | 34.70% | 2.11% | -11.08% | ★★★★★★ |

| Wilson Bank Holding | 0.00% | 7.88% | 8.09% | ★★★★★★ |

| FineMark Holdings | 115.14% | 2.22% | -28.34% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Rich Sparkle Holdings | 26.73% | -6.13% | 1.75% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Spok Holdings (SPOK)

Simply Wall St Value Rating: ★★★★★★

Overview: Spok Holdings, Inc., through its subsidiary Spok, Inc., offers healthcare communication solutions across various regions including the United States, Europe, Canada, Australia, Asia, and the Middle East with a market capitalization of $350.54 million.

Operations: Spok Holdings generates revenue primarily from healthcare communication solutions. The company has a market capitalization of $350.54 million.

Spok Holdings, a nimble player in the telecom space, has seen its earnings grow by 53% annually over the past five years, though it trails behind industry growth. The company is debt-free and trades at a significant discount of 56.9% below estimated fair value. Recent results show revenue of US$35.69 million for Q2 2025, up from US$33.98 million last year, with net income rising to US$4.55 million from US$3.43 million previously. Despite insider selling and reliance on software growth amid declining pager services, Spok's focus on enhancing software revenue and expanding sales teams could bolster future prospects.

World Acceptance (WRLD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: World Acceptance Corporation operates in the consumer finance sector in the United States with a market cap of $834.28 million.

Operations: World Acceptance generates revenue primarily through its consumer finance segment, which reported $567.71 million. The company's financial performance can be analyzed through its net profit margin trends over recent periods.

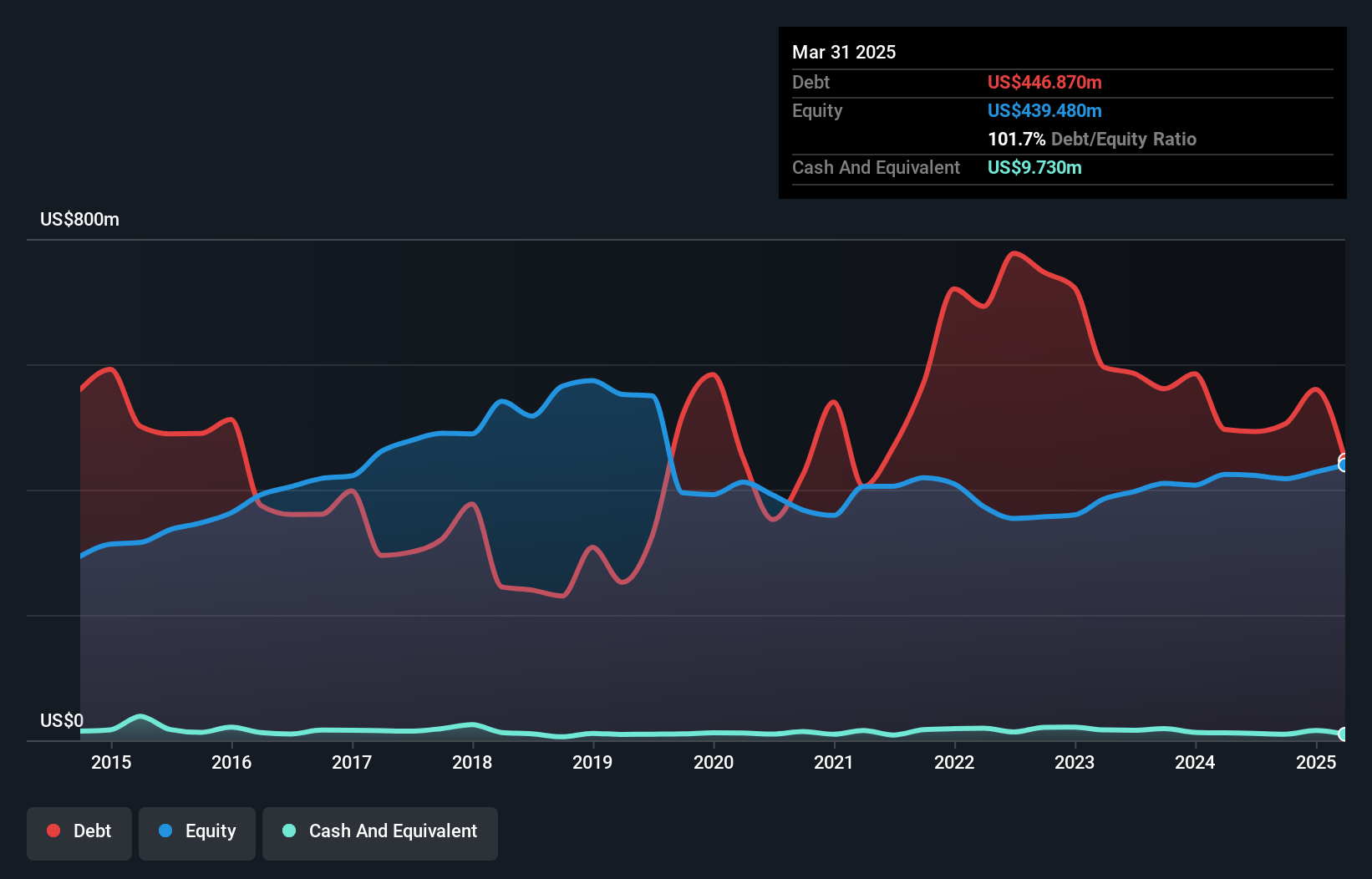

World Acceptance, a player in the consumer finance sector, faces challenges with high debt levels and increased regulatory scrutiny. Its net debt to equity ratio stands at 108.4%, which is considered high, yet its interest payments are well covered by EBIT at 3.4x coverage. Recent earnings show a dip in net income to US$1.34 million from US$9.95 million last year, while revenue slightly rose to US$132.45 million from US$129.53 million. Despite these hurdles, the company is actively managing its financial structure through share buybacks and new credit facilities totaling up to $790 million with an accordion feature for flexibility in operations and potential growth avenues like the Smile credit card initiative.

Insteel Industries (IIIN)

Simply Wall St Value Rating: ★★★★★★

Overview: Insteel Industries, Inc., along with its subsidiaries, specializes in the manufacturing and marketing of steel wire reinforcing products for concrete construction applications, with a market cap of approximately $706.91 million.

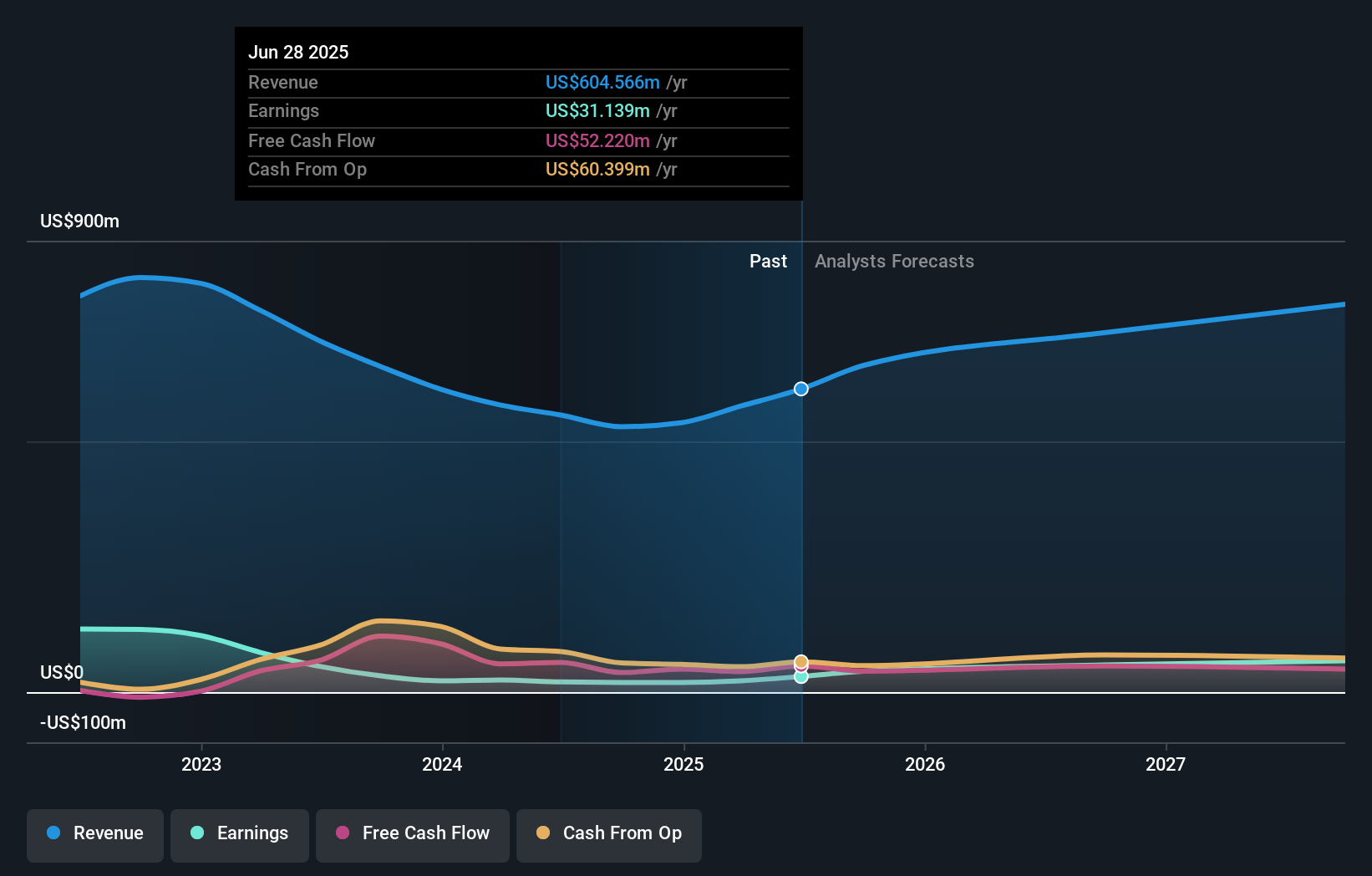

Operations: Insteel Industries generates revenue primarily from its concrete reinforcing products, totaling $604.57 million. The company's financial performance can be assessed through its gross profit margin, which provides insight into profitability relative to production costs.

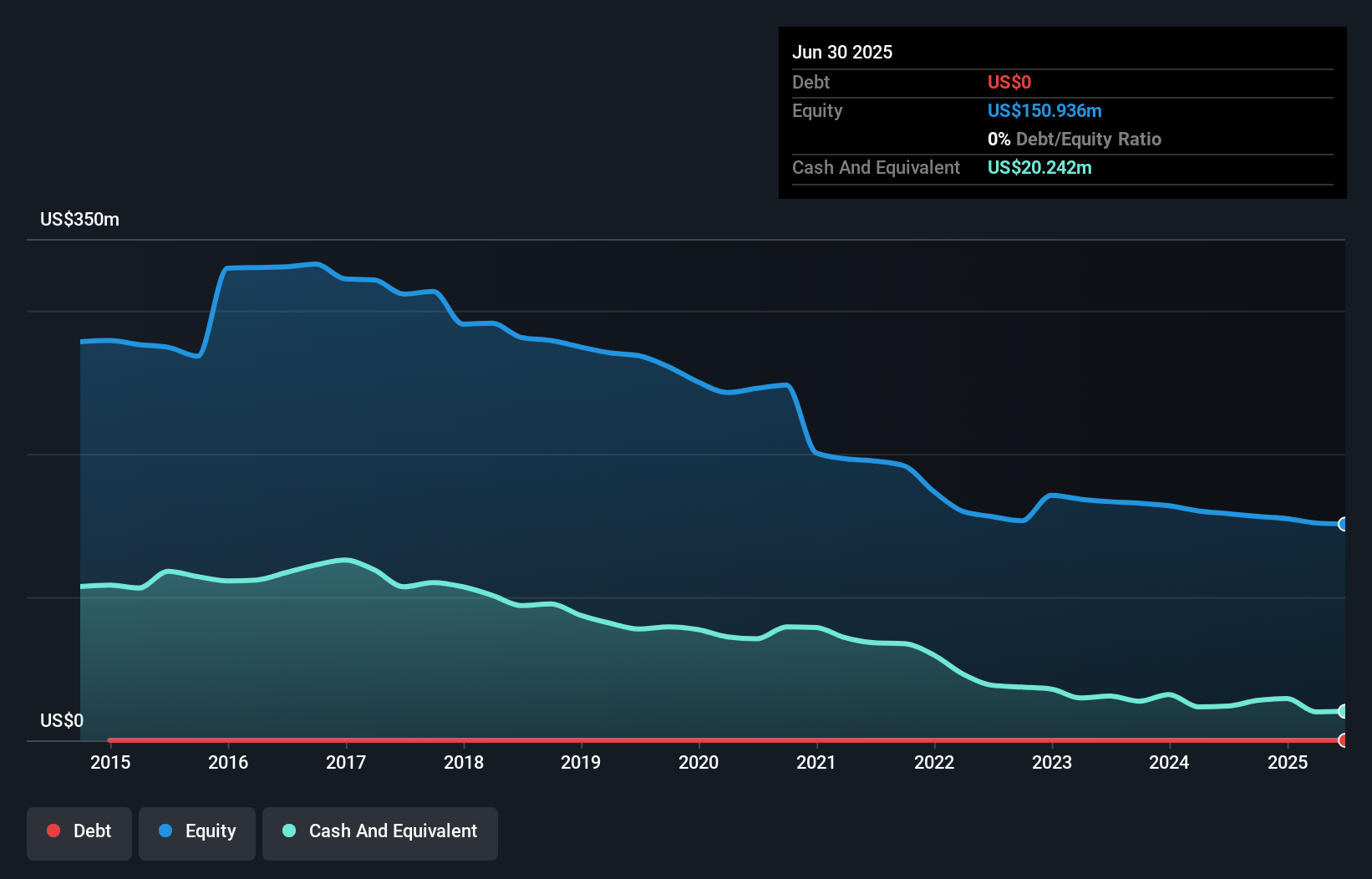

Insteel Industries, a nimble player in the construction materials sector, has been making waves with its robust financial performance. Over the past year, earnings surged by 53.3%, outpacing the building industry's -0.5% growth rate. The company reported Q3 sales of US$179.89 million, up from US$145.78 million last year, while net income climbed to US$15.16 million from US$6.57 million previously. With no debt on its books and trading at 5% below estimated fair value, Insteel is well-positioned for future growth despite challenges like tariff policies and reliance on imports impacting costs and production efficiency.

Make It Happen

- Delve into our full catalog of 297 US Undiscovered Gems With Strong Fundamentals here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal