Should Illinois Tool Works’ Raised Guidance and Buybacks Change the Outlook for ITW Investors?

- Illinois Tool Works Inc. recently reported its second quarter 2025 earnings, revealing sales of US$4.05 billion and net income of US$755 million, with diluted earnings per share rising slightly from a year ago.

- Alongside the earnings announcement, the company raised its full-year earnings guidance and outlined ongoing share repurchase activity, highlighting management's confidence in demand trends and operational initiatives.

- We'll explore how the updated full-year earnings guidance shapes Illinois Tool Works' investment narrative and future earnings expectations.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Illinois Tool Works Investment Narrative Recap

To be a shareholder of Illinois Tool Works, one needs to believe in the company's ability to deliver steady profit growth and margin stability despite modest revenue trends and challenges across key segments. The recent update, moderate sales growth and a slight rise in diluted EPS, paired with a raised full-year earnings guidance, strengthens short-term confidence, but does not fundamentally alter the company’s most important catalyst: ongoing innovation-driven margin expansion; nor does it change the key risk from potential weakness in core industrial and construction markets.

Among recent announcements, the decision to narrow and increase the full-year GAAP EPS guidance to a range of US$10.35 to US$10.55 per share is particularly relevant. This move signals management's outlook for modest revenue growth and appears to validate the expectation that ongoing enterprise initiatives will continue supporting margin improvement, even if revenue remains under pressure.

By contrast, some investors may overlook lingering risks tied to persistent declines in construction and electronics demand that could pressure future revenue and operating margins...

Read the full narrative on Illinois Tool Works (it's free!)

Illinois Tool Works' narrative projects $17.3 billion revenue and $3.5 billion earnings by 2028. This requires 3.1% yearly revenue growth and a $0.1 billion earnings increase from $3.4 billion today.

Uncover how Illinois Tool Works' forecasts yield a $254.09 fair value, in line with its current price.

Exploring Other Perspectives

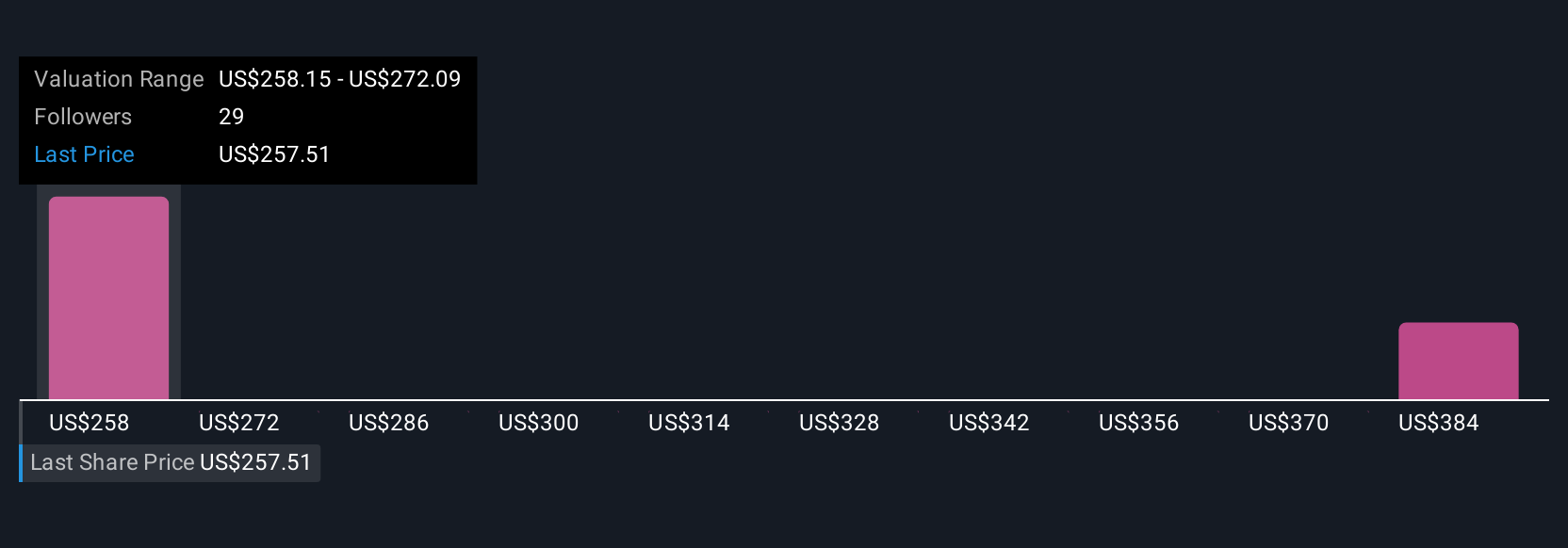

Community fair value estimates for Illinois Tool Works range from US$254 to US$429, based on two unique analyses from the Simply Wall St Community. While the company’s raised earnings outlook is encouraging, ongoing segment-specific headwinds could have a larger impact than many expect.

Explore 2 other fair value estimates on Illinois Tool Works - why the stock might be worth as much as 67% more than the current price!

Build Your Own Illinois Tool Works Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Illinois Tool Works research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Illinois Tool Works research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Illinois Tool Works' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 24 stocks are leading the charge.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal