Does 3M’s (MMM) Big Buyback Amid Lower Profits Signal a Shift in Capital Allocation Strategy?

- 3M recently reported its second quarter 2025 results, updated its full-year organic revenue growth guidance to approximately 2%, and disclosed that it repurchased over 6.5 million shares for US$921.91 million in the latest quarter.

- The company's share repurchase activity coincided with steady sales but a marked reduction in net income compared to the prior year, highlighting both capital allocation priorities and ongoing earnings challenges.

- We'll explore how 3M's updated revenue growth outlook and substantial buybacks may influence its long-term investment case.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

3M Investment Narrative Recap

To believe in 3M as a shareholder, you'd need confidence in its ability to keep innovating and driving operational efficiencies despite ongoing earnings pressure and macro headwinds. The latest results reaffirm steady organic revenue guidance and ongoing share buybacks, but do not ease the most pressing short-term risk: PFAS litigation and related liabilities. If this overhang persists or worsens, it could dampen any near-term benefit from improved sales or cost control initiatives.

Of the recent announcements, the Q2 2025 earnings release stands out: while sales increased year-over-year to US$6,344 million, net income dropped to US$723 million from US$1,145 million. This highlights the challenge 3M faces in converting revenue gains into stronger bottom-line results, especially as operational improvements compete with legacy costs and legal uncertainties for investor attention.

Yet, buried beneath higher sales, the contrast between revenue trends and those unresolved legal costs is something investors should...

Read the full narrative on 3M (it's free!)

3M's outlook projects $26.2 billion in revenue and $4.7 billion in earnings by 2028. This is based on a 2.1% annual revenue growth rate and an $0.8 billion increase in earnings from the current $3.9 billion.

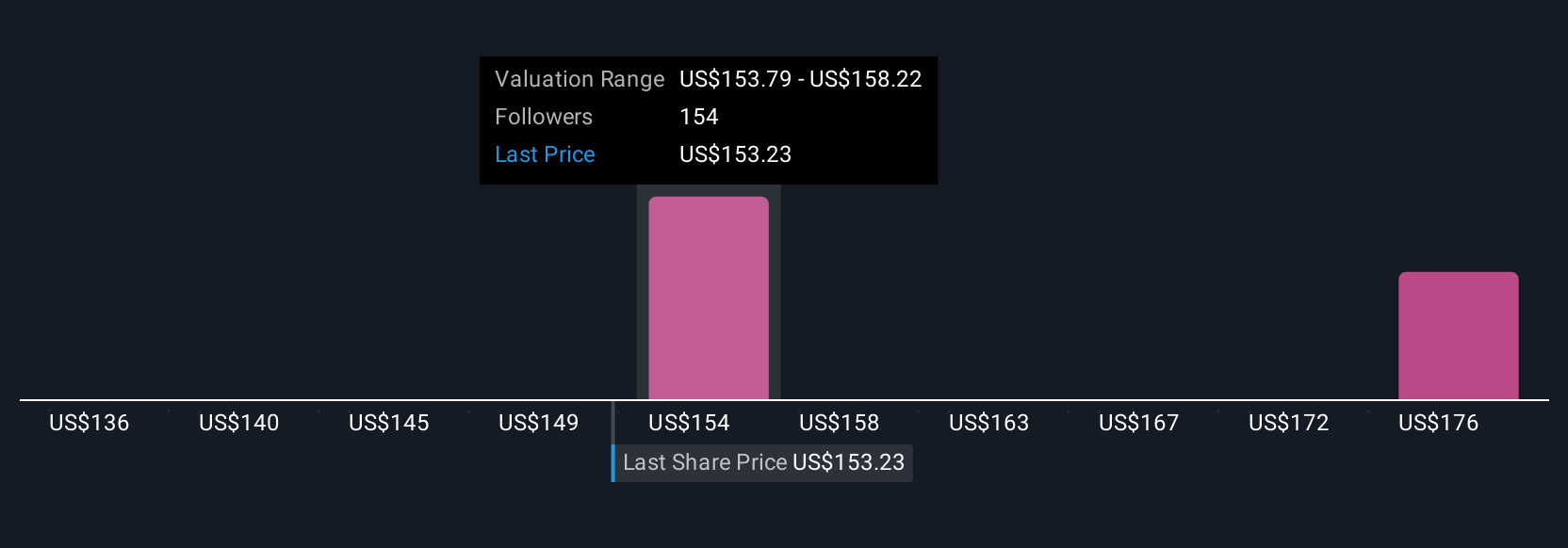

Uncover how 3M's forecasts yield a $161.15 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community contributors have published fair value estimates for 3M ranging from US$127.78 to US$180.84 across four analyses. Given persistent PFAS litigation risks, these different outlooks underline how views on the company's future prospects can sharply diverge, so be sure to review multiple perspectives when evaluating your own investment thesis.

Explore 4 other fair value estimates on 3M - why the stock might be worth 14% less than the current price!

Build Your Own 3M Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your 3M research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free 3M research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate 3M's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal