Will Enova International's (ENVA) Leadership Transition Shape Its Long-Term Competitive Edge?

- Enova International recently reported robust second quarter results, with revenue rising to US$441.46 million and net income increasing to US$76.15 million, alongside leadership succession plans to appoint current CFO Steve Cunningham as CEO in 2026.

- The company’s coordinated leadership transition highlights a focus on long-term continuity, which may support operational performance and investor confidence through a period of significant industry and company change.

- Now, we'll explore how Enova’s strong earnings growth and planned executive transitions impact its overall investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Enova International Investment Narrative Recap

To be a shareholder in Enova International, you have to believe in the continued growth of digital lending, Enova’s technology-driven underwriting, and its strong position in the small business and nonprime segments. The company’s latest robust earnings report and well-planned executive transition do not materially alter the central near-term catalyst, rising demand for digital credit, nor do they eliminate the primary risk of increased regulatory scrutiny impacting lending operations and product offerings.

The recent update on Enova’s sizeable share repurchase program stands out, with nearly 7.4% of shares having been bought back since August 2024. This move, in the context of strong earnings and leadership changes, aligns with an ongoing effort to deliver value to shareholders during a time marked by both opportunity and heightened industry risk.

However, investors should be aware that, in contrast, persistent regulatory pressures could significantly affect future revenue if...

Read the full narrative on Enova International (it's free!)

Enova International's outlook anticipates $5.7 billion in revenue and $426.8 million in earnings by 2028. This is based on a forecasted annual revenue growth rate of 60.7% and an earnings increase of $170.6 million from current earnings of $256.2 million.

Uncover how Enova International's forecasts yield a $131.12 fair value, a 25% upside to its current price.

Exploring Other Perspectives

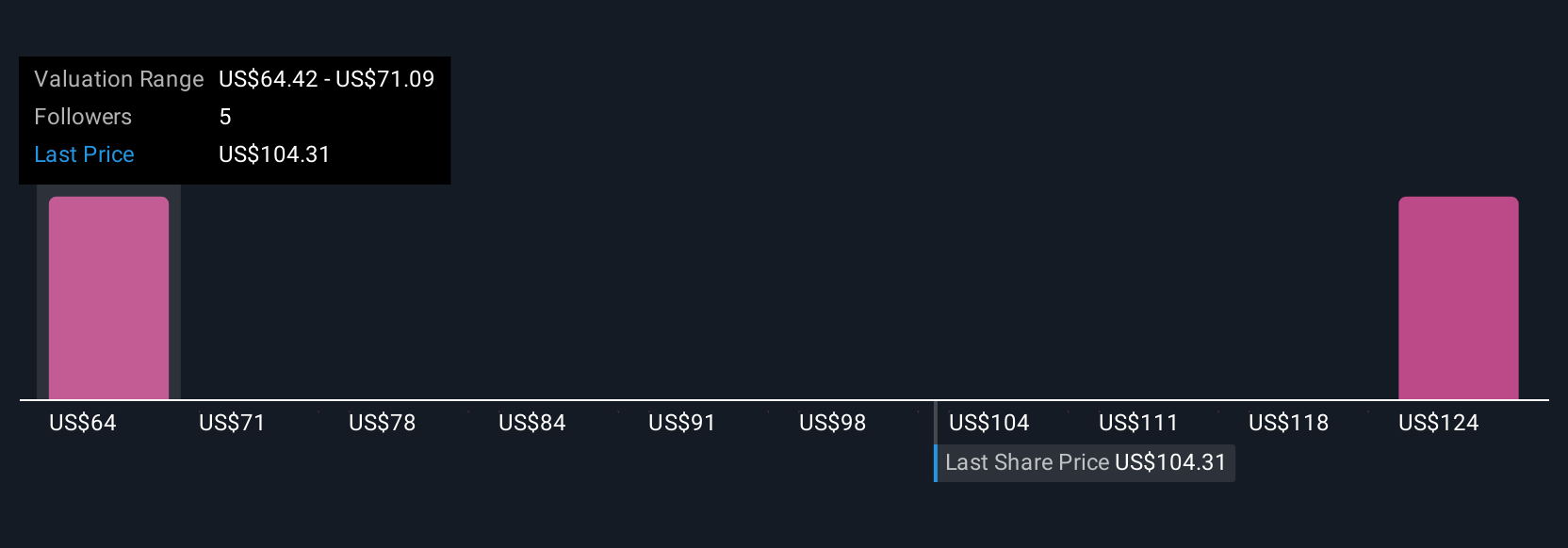

Fair value estimates from three Simply Wall St Community contributors span from US$64.42 to US$131.13, reflecting wide variability in opinions. Some highlight strong digital lending catalysts, while others caution about the potential revenue impact of regulatory changes, illustrating how your outlook may differ sharply from other market participants.

Explore 3 other fair value estimates on Enova International - why the stock might be worth as much as 25% more than the current price!

Build Your Own Enova International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Enova International research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Enova International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Enova International's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal