Does Graham Holdings' Return to Profitability Mark a Turning Point for Its Investment Case (GHC)?

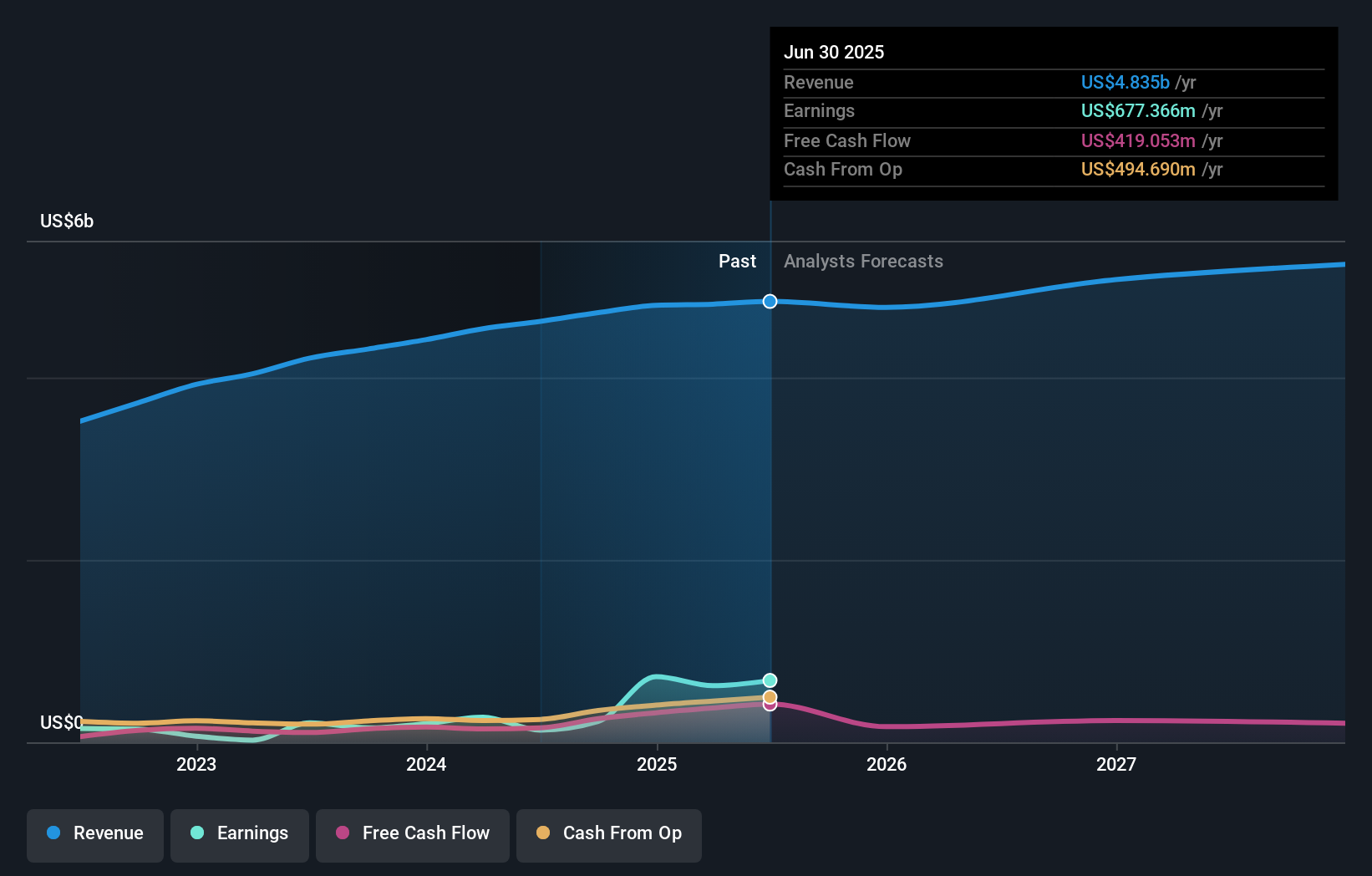

- Graham Holdings Company recently reported improved second quarter earnings, with revenue rising to US$1.22 billion and net income reversing from a US$21.04 million loss last year to a US$36.75 million profit.

- This financial turnaround follows a period where the company did not execute any share buybacks during the last quarter, despite having an active repurchase program.

- We'll explore how Graham Holdings' shift to profitability highlights operational improvements and shapes its investment narrative going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Graham Holdings' Investment Narrative?

To be a Graham Holdings shareholder, you need to believe in the company's multi-industry approach and its management's ability to drive operational improvements across a diverse portfolio. The recent return to profitability in the second quarter was key, especially after last year's net loss for the same period. This turnaround builds confidence in core operations, even though one-off profits previously impacted results. The recent news hasn't signaled any urgent shift in short-term catalysts as buybacks remained paused and revenue growth was modest, but the renewed profit and positive price move suggest improved sentiment around earnings quality and stability. Still, investors should keep an eye on the slower-than-market revenue growth and the risks tied to capital allocation decisions, particularly as management weighs acquisitions and future buybacks.

However, reliance on capital deployment strategies could introduce new uncertainties for shareholders.

Exploring Other Perspectives

Explore 2 other fair value estimates on Graham Holdings - why the stock might be worth 18% less than the current price!

Build Your Own Graham Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Graham Holdings research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Graham Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Graham Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal