State Street (STT) Launches Innovative Sector-Based Premium Income ETFs

State Street (STT) recently introduced eleven new Select Sector SPDR® Premium Income Funds, a noteworthy development for the company, which may have bolstered its stock performance. Over the last quarter, State Street's stock rose 29%, aligning with the broader market trends that saw a general upturn, with the DNA of optimism driven by robust corporate earnings and easing tariff concerns. Additionally, State Street's efforts in boosting dividends and share buybacks, as well as positive developments in strategic partnerships and sector innovations, added appreciable weight to its upward momentum amidst favorable market conditions.

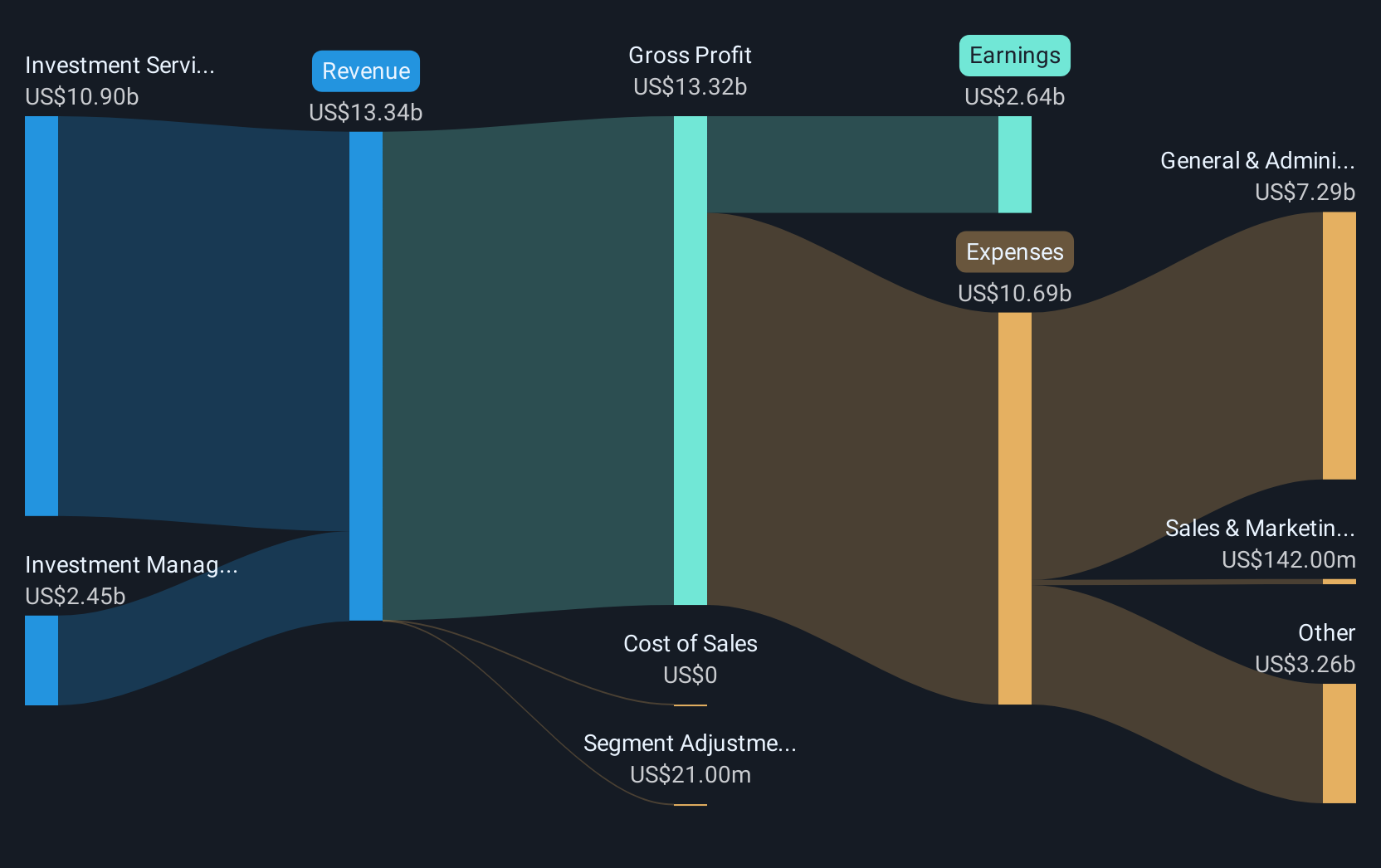

The introduction of State Street's Select Sector SPDR® Premium Income Funds reflects a strategic shift towards enhancing its ETF franchise, potentially boosting revenue streams through increased fee income in the passive investment sector. This development ties into the narrative of State Street capturing wealth and retirement flows, underlying its capability to leverage ETF growth for sustained revenue expansion. Over a five-year period, State Street delivered a total shareholder return of 104.99%, highlighting its capacity to generate long-term value despite recent market fluctuations. Over the past year, State Street's return fell short of the US Capital Markets industry, indicating room for improvement in aligning short-term gains with industry performance.

While the company's recent initiative potentially increases fee revenue, its impact on earnings forecasts remains moderated by ongoing pressure from fee compression and fintech competition. Analysts project earnings of US$3.4 billion by 2028, with anticipated margin improvement from 19.8% to 23.2%, suggesting robust profit potential. Current share movements indicate a marginal discount from the consensus price target of US$113.37, reinforcing the idea that State Street is perceived as approximately fairly valued. As the company continues to navigate these strategic changes, it will be critical to monitor how effectively it matches its initiatives with evolving market dynamics to sustain shareholder returns.

Examine State Street's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal