General Dynamics (GD) Is Up 5.7% After Reporting Higher Q2 Revenue and Earnings

- On July 23, 2025, General Dynamics Corporation reported second quarter results showing revenue of US$13.04 billion and net income of US$1.01 billion, both higher than the same period last year, with basic earnings per share rising to US$3.78 from US$3.30.

- This performance marks sustained growth for the company, with six-month net income reaching US$2.01 billion and earnings advances reflected across both basic and diluted measures.

- We'll examine how General Dynamics' strong revenue and earnings growth this quarter impacts its long-term investment outlook amid sector trends.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

General Dynamics Investment Narrative Recap

Anyone considering General Dynamics as an investment needs to believe in the long-term durability of defense demand and the company’s ability to turn a record backlog into sustainable growth. The latest quarterly results underscore solid revenue and earnings gains, but do not materially shift the near-term focus from supply chain reliability, which remains the biggest risk, or from the company’s drive to capitalize on strong global defense orders, a key catalyst for future performance.

The buyback announcement is less relevant this quarter, as there were no new share repurchases reported, emphasizing a pause in capital returns during a period when operational execution and meeting delivery targets likely matter more to investors monitoring catalysts in the sector.

Yet, in contrast to upbeat earnings, investors should also be mindful of persistent supply chain pressures that could...

Read the full narrative on General Dynamics (it's free!)

General Dynamics is expected to reach $54.5 billion in revenue and $4.9 billion in earnings by 2028. This scenario assumes a 3.4% annual revenue growth rate and a $0.9 billion increase in earnings from the current $4.0 billion.

Uncover how General Dynamics' forecasts yield a $305.31 fair value, a 3% downside to its current price.

Exploring Other Perspectives

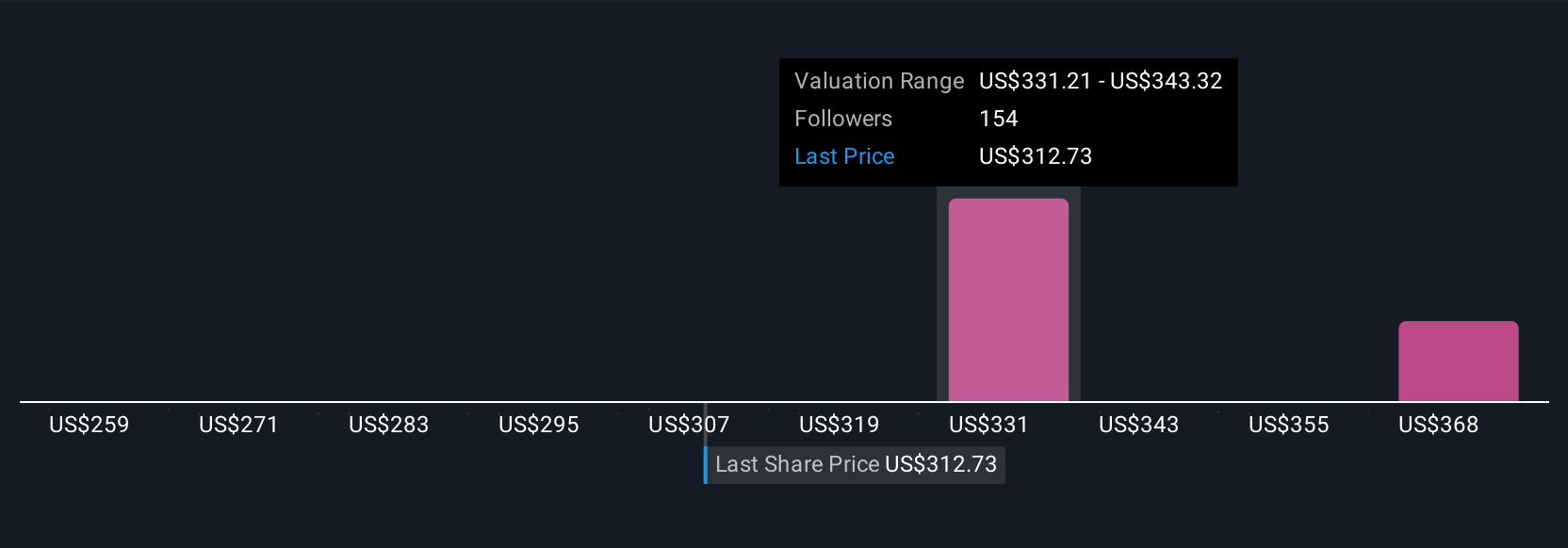

Fair value estimates among 9 Simply Wall St Community members range from US$258.57 to US$418.59 per share. Many highlight the company's record backlog as crucial for potential performance, while others stress ongoing supply chain risk as a key consideration. Explore these perspectives to see how your view compares.

Explore 9 other fair value estimates on General Dynamics - why the stock might be worth as much as 33% more than the current price!

Build Your Own General Dynamics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your General Dynamics research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free General Dynamics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate General Dynamics' overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal