Cintas’ Dividend Growth Streak and Upbeat Outlook Might Change the Case for Investing in CTAS

- Cintas Corporation recently announced a quarterly cash dividend of US$0.45 per share, payable on September 15, 2025, reflecting a 15.4% increase and extending its 42-year streak of annual dividend growth since its IPO in 1983.

- The company also reported robust fourth quarter and full year fiscal 2025 earnings, with continued revenue and net income increases, alongside new guidance projecting further earnings and revenue growth for the upcoming year.

- We'll consider how Cintas' continued dividend increases and strong annual results reinforce its investment narrative and growth outlook.

AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Cintas Investment Narrative Recap

Owning Cintas often comes down to believing in the recurring strength of its uniform rental and facility services amid evolving workplace trends. The latest news, continued dividend increases and solid annual results, reinforces the company’s story of reliable growth, but doesn’t fundamentally alter the biggest near-term catalyst: expanding outsourced service offerings. The key risk remains: any accelerated shift to remote or hybrid work could still challenge demand for physical uniforms, which this news does not materially address.

Among recent company announcements, Cintas' robust fiscal year 2025 results are especially relevant. Revenue and net income both climbed year over year, and the company raised guidance for fiscal 2026, aligning with expectations for persistent demand and effective expansion of service lines. These updates support the idea that further growth depends on Cintas capturing a greater share of outsourced business as organizations look to boost operational efficiency, but ...

Read the full narrative on Cintas (it's free!)

Cintas is projected to reach $12.8 billion in revenue and $2.4 billion in earnings by 2028. This outlook is based on a 7.2% annual revenue growth rate and an increase in earnings of $0.6 billion from the current $1.8 billion.

Uncover how Cintas' forecasts yield a $218.93 fair value, in line with its current price.

Exploring Other Perspectives

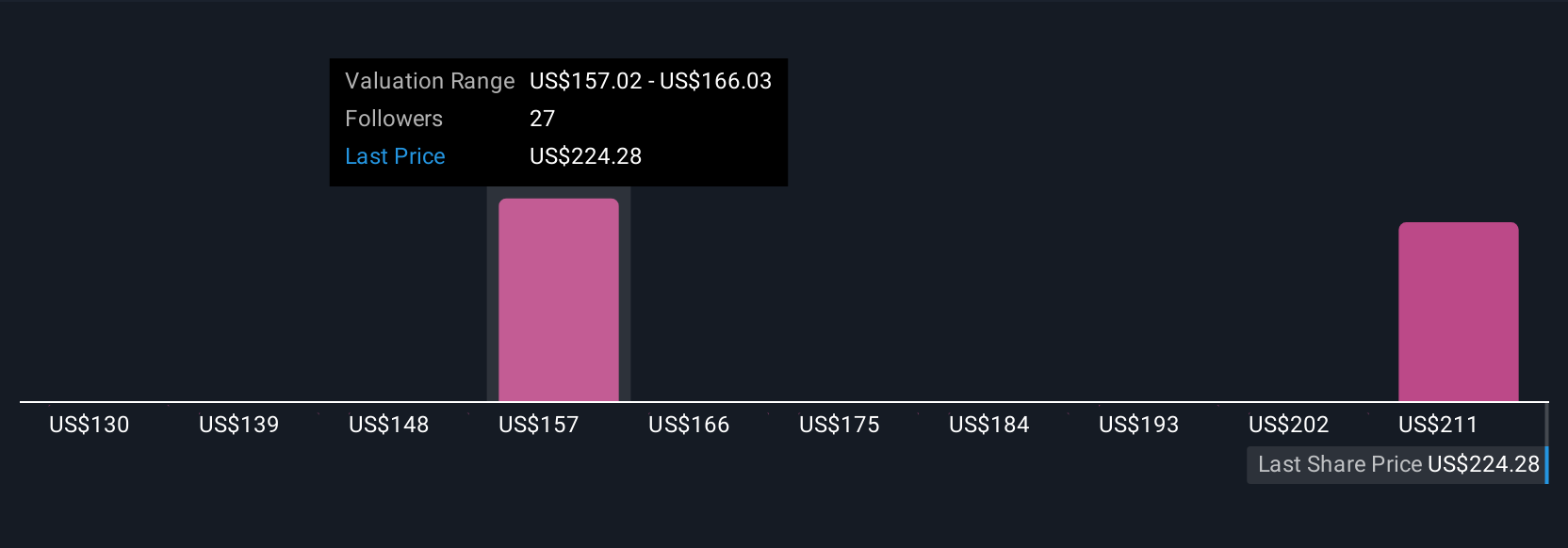

Simply Wall St Community members set fair values from US$130 up to US$218.93 across 5 opinions. While many expect growth from expanded outsourced services, some see risks in traditional business models as workplace practices evolve, making it vital to consider this wide spectrum of outlooks.

Explore 5 other fair value estimates on Cintas - why the stock might be worth as much as $218.93!

Build Your Own Cintas Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cintas research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cintas research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cintas' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal