July 2025 Insider-Owned Growth Leaders

As the U.S. market navigates a wave of corporate earnings reports and anticipates key economic data releases, indices like the S&P 500 and Nasdaq have recently retreated from their record highs, reflecting a cautious investor sentiment amid ongoing Federal Reserve discussions on interest rates. In this environment, growth companies with high insider ownership can be particularly appealing as they often demonstrate strong alignment between management and shareholder interests, potentially offering resilience in fluctuating markets.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Wallbox (WBX) | 24.6% | 75.8% |

| Super Micro Computer (SMCI) | 13.9% | 36.3% |

| QT Imaging Holdings (QTIH) | 26.4% | 84.5% |

| Prairie Operating (PROP) | 34.4% | 80.8% |

| OS Therapies (OSTX) | 19.5% | 16.5% |

| Niu Technologies (NIU) | 37.2% | 88.1% |

| FTC Solar (FTCI) | 23.1% | 62.5% |

| Credo Technology Group Holding (CRDO) | 11.7% | 36.4% |

| Atour Lifestyle Holdings (ATAT) | 22.9% | 23.6% |

| Astera Labs (ALAB) | 12.8% | 45.6% |

Here's a peek at a few of the choices from the screener.

Walgreens Boots Alliance (WBA)

Simply Wall St Growth Rating: ★★★★☆☆

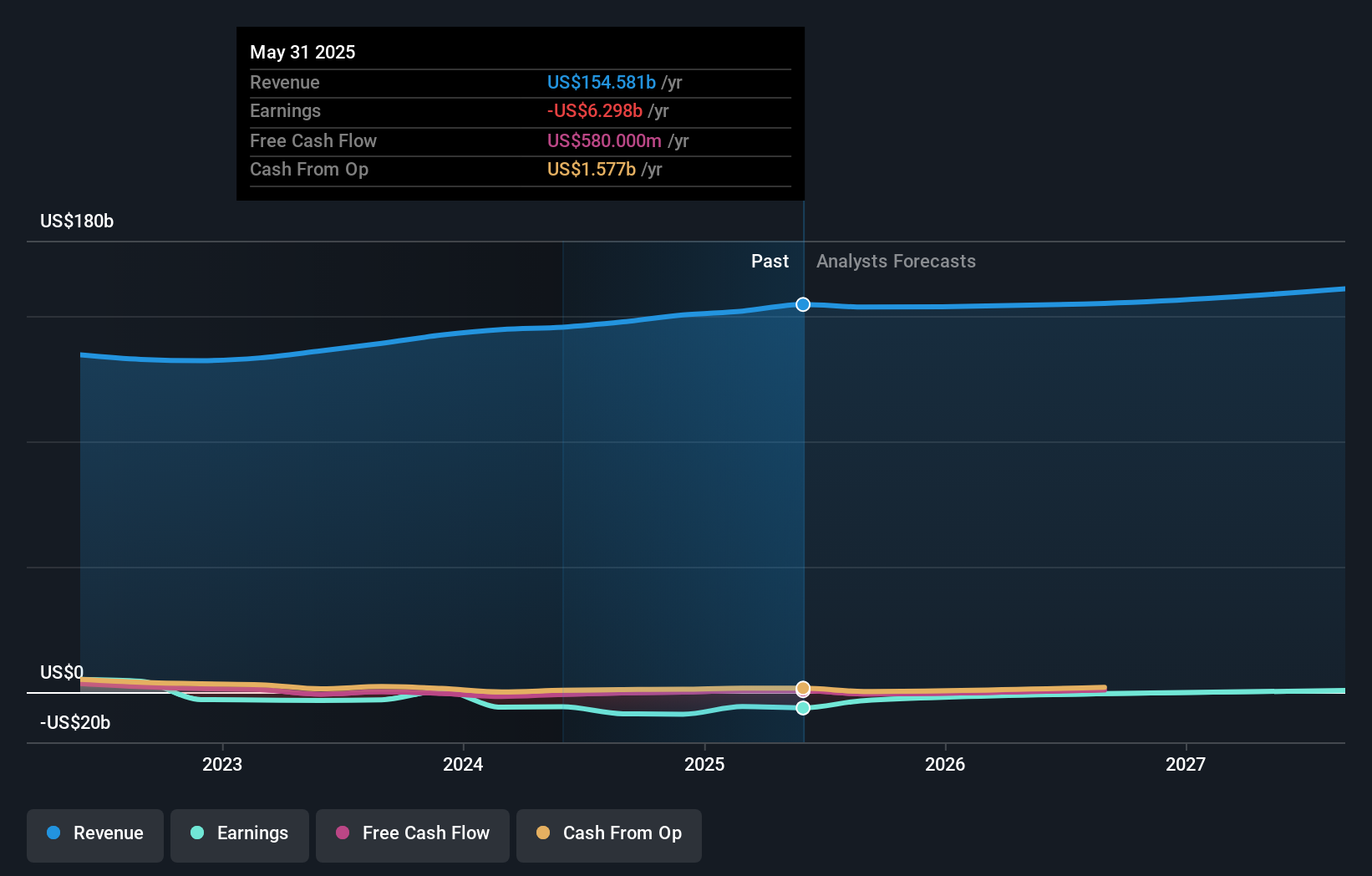

Overview: Walgreens Boots Alliance, Inc. is a healthcare, pharmacy, and retail company with operations in the United States, Germany, the United Kingdom, and internationally; it has a market cap of approximately $10.05 billion.

Operations: The company's revenue is primarily derived from its U.S. Retail Pharmacy segment at $121.43 billion, followed by the International segment at $24.63 billion, and U.S. Healthcare at $8.54 billion.

Insider Ownership: 17.2%

Earnings Growth Forecast: 81.7% p.a.

Walgreens Boots Alliance, recently added to the Russell 2500 indices, faces challenges with a net loss of US$175 million in Q3 2025 and impairment charges of US$89 million. Despite withdrawing its fiscal 2025 guidance due to an impending acquisition by Sycamore Partners, the company is forecasted to see significant profit growth over the next three years. However, revenue growth lags behind market averages and insider trading activity remains minimal.

- Delve into the full analysis future growth report here for a deeper understanding of Walgreens Boots Alliance.

- Insights from our recent valuation report point to the potential undervaluation of Walgreens Boots Alliance shares in the market.

Zscaler (ZS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zscaler, Inc. is a global cloud security company with a market cap of approximately $44.56 billion.

Operations: The company's revenue primarily comes from sales of subscription services to its cloud platform and related support services, totaling approximately $2.55 billion.

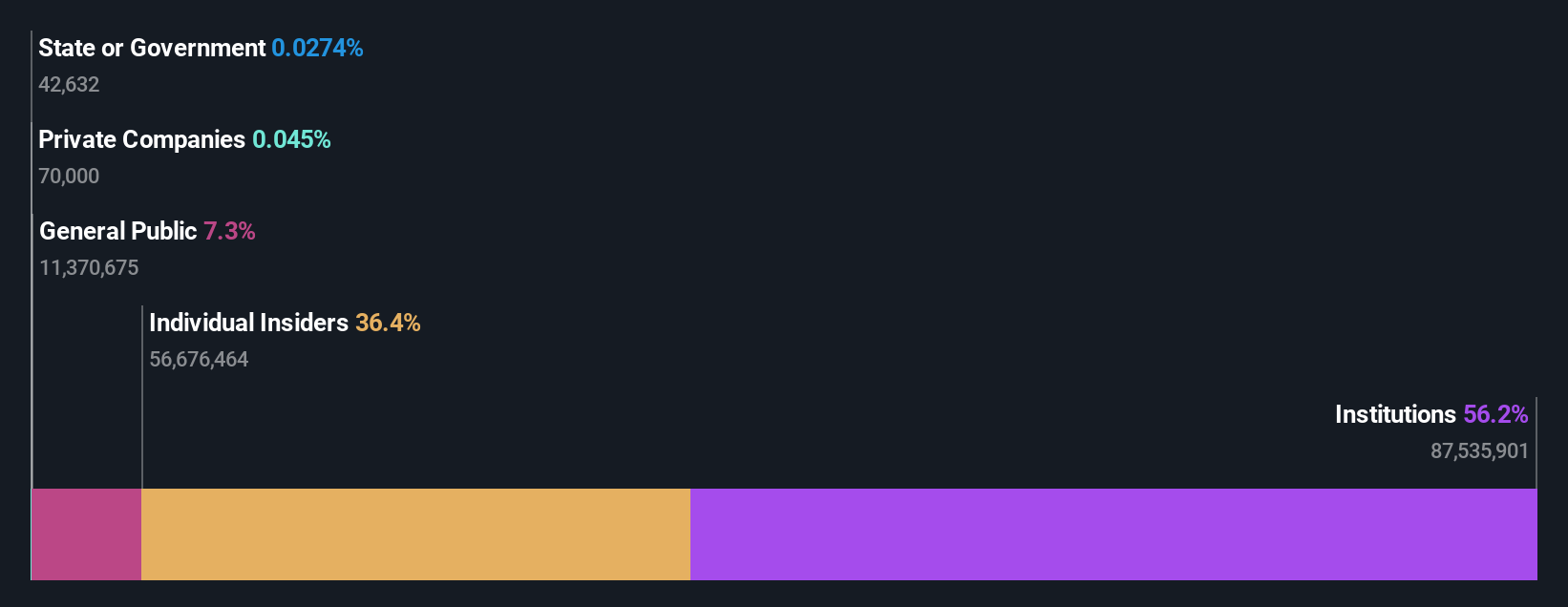

Insider Ownership: 36.4%

Earnings Growth Forecast: 48.5% p.a.

Zscaler, Inc. is poised for significant growth, with revenue projected to outpace the US market at 16.8% annually and earnings expected to rise by 48.46% per year. Despite insider selling in recent months, the company remains undervalued by 7.7% compared to its fair value estimate. Recent product launches like Zscaler Cellular and strategic partnerships enhance its Zero Trust offerings, addressing security needs for IoT/OT devices globally while positioning Zscaler as a key player in cybersecurity innovation.

- Unlock comprehensive insights into our analysis of Zscaler stock in this growth report.

- Our valuation report unveils the possibility Zscaler's shares may be trading at a premium.

Sable Offshore (SOC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sable Offshore Corp. is an independent oil and gas company operating in the United States with a market cap of $2.85 billion.

Operations: Sable Offshore Corp. generates its revenue from oil and gas operations within the United States.

Insider Ownership: 21.9%

Earnings Growth Forecast: 80.7% p.a.

Sable Offshore faces challenges with recent legal disputes and index exclusions but shows potential for growth. Despite a volatile share price, revenue is forecast to grow at 46.4% annually, outpacing the US market. Analysts anticipate a 37.4% stock price increase, and profitability is expected within three years. However, past shareholder dilution remains a concern, alongside insider ownership stability as no significant trading occurred in the last quarter.

- Click to explore a detailed breakdown of our findings in Sable Offshore's earnings growth report.

- In light of our recent valuation report, it seems possible that Sable Offshore is trading behind its estimated value.

Seize The Opportunity

- Dive into all 184 of the Fast Growing US Companies With High Insider Ownership we have identified here.

- Ready For A Different Approach? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal