Will Dropbox's (DBX) Profit Growth Amid Revenue Decline Shift Its Investment Narrative?

- Dropbox recently outperformed the broader market as investors shifted focus to its upcoming earnings report, which is scheduled for August 7, 2025, with analyst consensus projecting a 5% year-over-year increase in EPS despite a slight revenue decline.

- This heightened anticipation highlights the significance of Dropbox's profitability improvements, even as revenue headwinds persist and expectations for operational efficiency gains are in focus.

- We'll explore how investor attention to Dropbox's projected earnings growth, despite expected revenue contraction, influences the company's overall investment narrative.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Dropbox Investment Narrative Recap

For someone to be a shareholder in Dropbox, believing in the company’s ability to balance cost controls with profitable growth amid shifting market trends is crucial. The latest news of Dropbox’s market outperformance may slightly boost optimism around its August 7 earnings, but the underlying short-term catalyst remains the company’s efficiency in driving EPS growth while managing through revenue headwinds; the most pressing risk is ongoing churn and pricing sensitivity within Teams and core file storage customers, which remains unchanged following this recent price movement.

The recent April release of new AI search and productivity tools in Dropbox Dash is particularly relevant here, this innovation aims to strengthen Dropbox’s competitive edge, directly supporting the focus on operational efficiency and future growth prospects as earnings approach.

By contrast, investors should also be aware that elevated churn risks from Teams users may still impact Dropbox’s story if customer downsell trends continue...

Read the full narrative on Dropbox (it's free!)

Dropbox's outlook expects $2.5 billion in revenue and $501.3 million in earnings by 2028. This reflects a 1.2% annual revenue decline and a $31 million increase in earnings from $470.3 million today.

Uncover how Dropbox's forecasts yield a $27.36 fair value, a 3% downside to its current price.

Exploring Other Perspectives

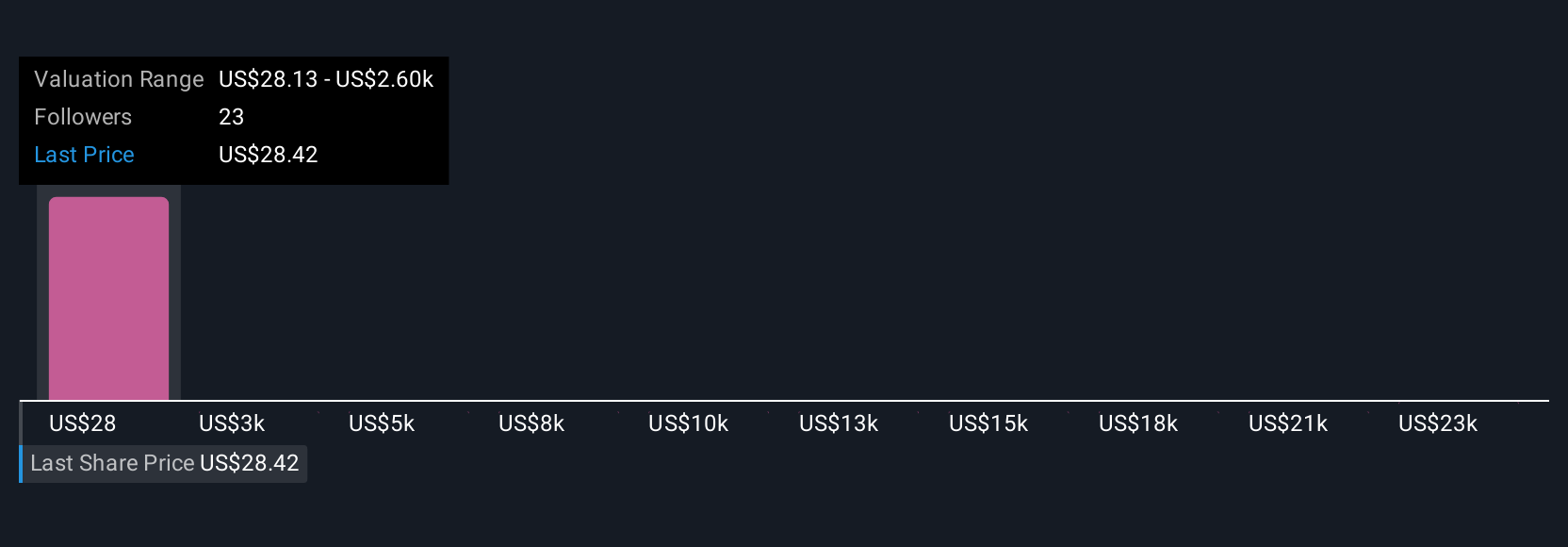

Four members of the Simply Wall St Community placed fair value estimates for Dropbox ranging from US$27.36 to a striking US$25,709.96. While investor opinions are split, ongoing concerns around revenue retention and user churn highlight why keeping an eye on both risks and new initiatives is essential when considering Dropbox’s future.

Explore 4 other fair value estimates on Dropbox - why the stock might be a potential multi-bagger!

Build Your Own Dropbox Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dropbox research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Dropbox research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dropbox's overall financial health at a glance.

No Opportunity In Dropbox?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal