Does Board Refresh and Dividend Raise at Royalty Pharma (RPRX) Signal a Shift in Strategy?

- Royalty Pharma’s board approved a third quarter 2025 dividend of US$0.22 per Class A share, payable September 10 to holders of record as of August 15, while also announcing the addition of Carole Ho and Bess Weatherman to its board of directors on July 17.

- The appointment of two board members with deep expertise in biopharmaceutical development and healthcare investing introduces new experience and insights at a time of significant business transformation for Royalty Pharma.

- We'll explore how the infusion of biopharma leadership on the board could reinforce Royalty Pharma's evolving investment story and growth prospects.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Royalty Pharma Investment Narrative Recap

To be a shareholder in Royalty Pharma, you need to believe in the company's ability to generate sustainable returns through acquiring and managing royalties on innovative therapies. The recent board appointments add significant healthcare and investment expertise, but do not materially alter the most pressing short-term catalyst, the execution of the internalization transaction, or the largest risk, which remains overdependence on lumpy, one-time milestone payments that can affect earnings predictability. Of the recent developments, the consistent third quarter dividend of US$0.22 stands out. While it signals ongoing commitment to shareholder returns, it does not address questions around future large-scale royalty acquisitions and how these might affect revenue guidance, especially as new board members bring fresh perspective to growth initiatives. Yet, against this backdrop, it is important for investors to remember that, despite new leadership, the reliance on onetime milestone payments remains a critical point to watch...

Read the full narrative on Royalty Pharma (it's free!)

Royalty Pharma's outlook anticipates $3.7 billion in revenue and $1.4 billion in earnings by 2028. Achieving this requires an 18.3% annual revenue growth rate and a $0.3 billion increase in earnings from the current $1.1 billion.

Uncover how Royalty Pharma's forecasts yield a $42.15 fair value, a 14% upside to its current price.

Exploring Other Perspectives

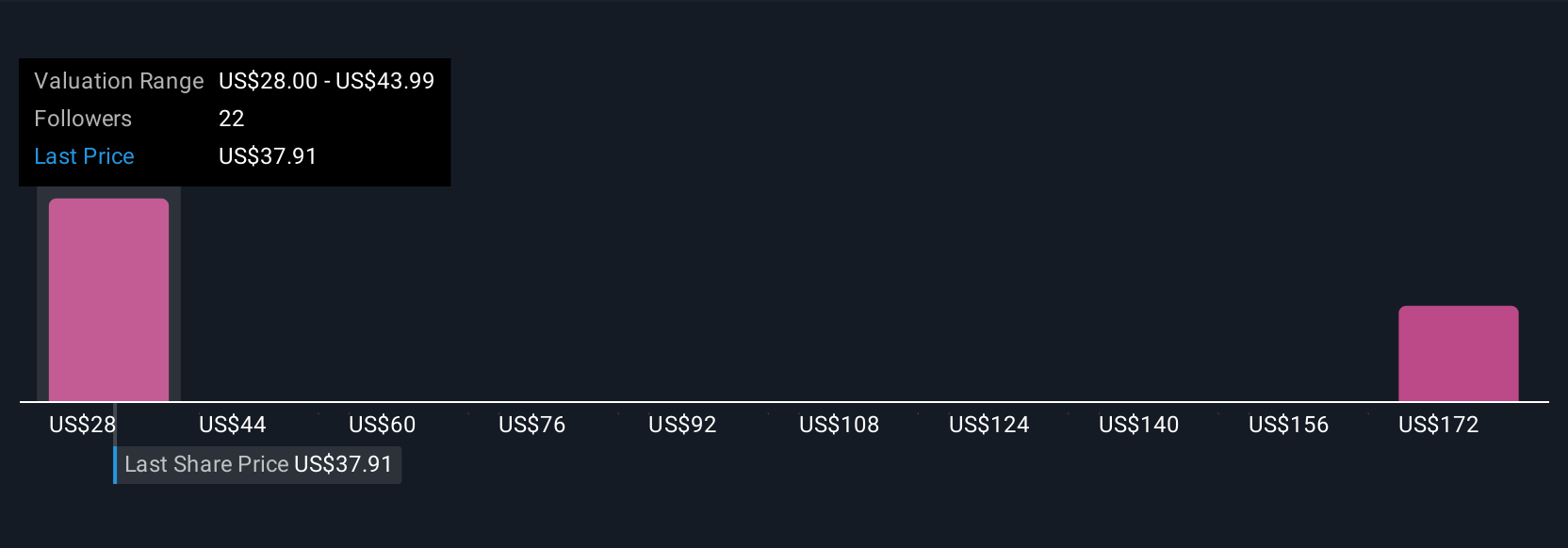

Four Simply Wall St Community members estimate Royalty Pharma’s fair value between US$28 and US$201.90 per share. As you compare these diverse expectations, keep in mind that revenue consistency remains a prime concern for many and may influence long-term confidence in the company.

Explore 4 other fair value estimates on Royalty Pharma - why the stock might be worth 24% less than the current price!

Build Your Own Royalty Pharma Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Royalty Pharma research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Royalty Pharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Royalty Pharma's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal