Will Royalty Pharma’s (RPRX) New Board Appointments Reshape Its Approach to Value Creation?

- Royalty Pharma recently appointed Carole Ho, Chief Medical Officer at Denali Therapeutics, and Elizabeth (Bess) Weatherman, Special Limited Partner at Warburg Pincus, to its Board of Directors, while also affirming a US$0.22 per share third-quarter dividend payable in September 2025 to shareholders of record in August.

- The addition of executive leaders with expertise in both biopharmaceutical development and healthcare investing is seen as a move to enhance the company’s leadership and capital allocation expertise.

- We'll now examine how these Board appointments could influence Royalty Pharma's investment narrative and prospects for future value creation.

Find companies with promising cash flow potential yet trading below their fair value.

Royalty Pharma Investment Narrative Recap

Investors in Royalty Pharma generally look for steady royalty revenues, disciplined capital allocation, and exposure to biopharmaceutical innovation. The recent appointments of Carole Ho and Elizabeth Weatherman to the Board add medical and investment expertise, but they are unlikely to materially change the near-term focus on integrating management, delivering on synthetic royalty deals, or addressing the primary risk of achieving organic growth without one-off payments like those from Biohaven in 2024.

Of the latest announcements, the affirmation of Royalty Pharma’s US$0.22 per share dividend for Q3 2025 stands out. Consistent dividends can reassure investors about the company’s cash generation and capital return policies, adding context to catalysts such as the large-scale internalization transaction and ongoing share repurchases that are shaping shareholder returns.

However, the biggest risk that could catch investors off guard remains Royalty Pharma’s ability to sustain long-term growth absent major milestone payments, especially if...

Read the full narrative on Royalty Pharma (it's free!)

Royalty Pharma's outlook anticipates $3.7 billion in revenue and $1.4 billion in earnings by 2028. This is based on a projected 18.3% annual revenue growth rate and a $0.3 billion increase in earnings from the current $1.1 billion.

Uncover how Royalty Pharma's forecasts yield a $42.15 fair value, a 14% upside to its current price.

Exploring Other Perspectives

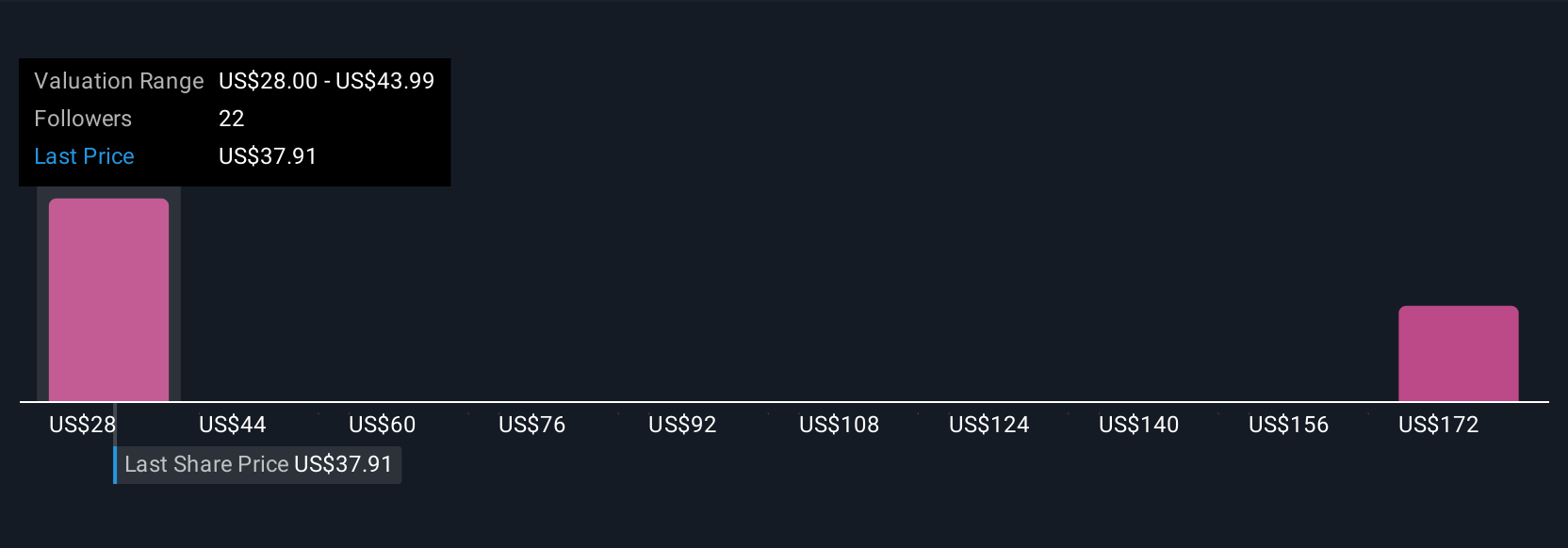

Simply Wall St Community members assigned fair value estimates for Royalty Pharma ranging from US$28 to US$201.90, with four distinct perspectives. These wide differences highlight how expectations about organic revenue growth, and the need for repeat milestone successes, can shape interpretations of the company’s outlook.

Explore 4 other fair value estimates on Royalty Pharma - why the stock might be worth over 5x more than the current price!

Build Your Own Royalty Pharma Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Royalty Pharma research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Royalty Pharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Royalty Pharma's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal